Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

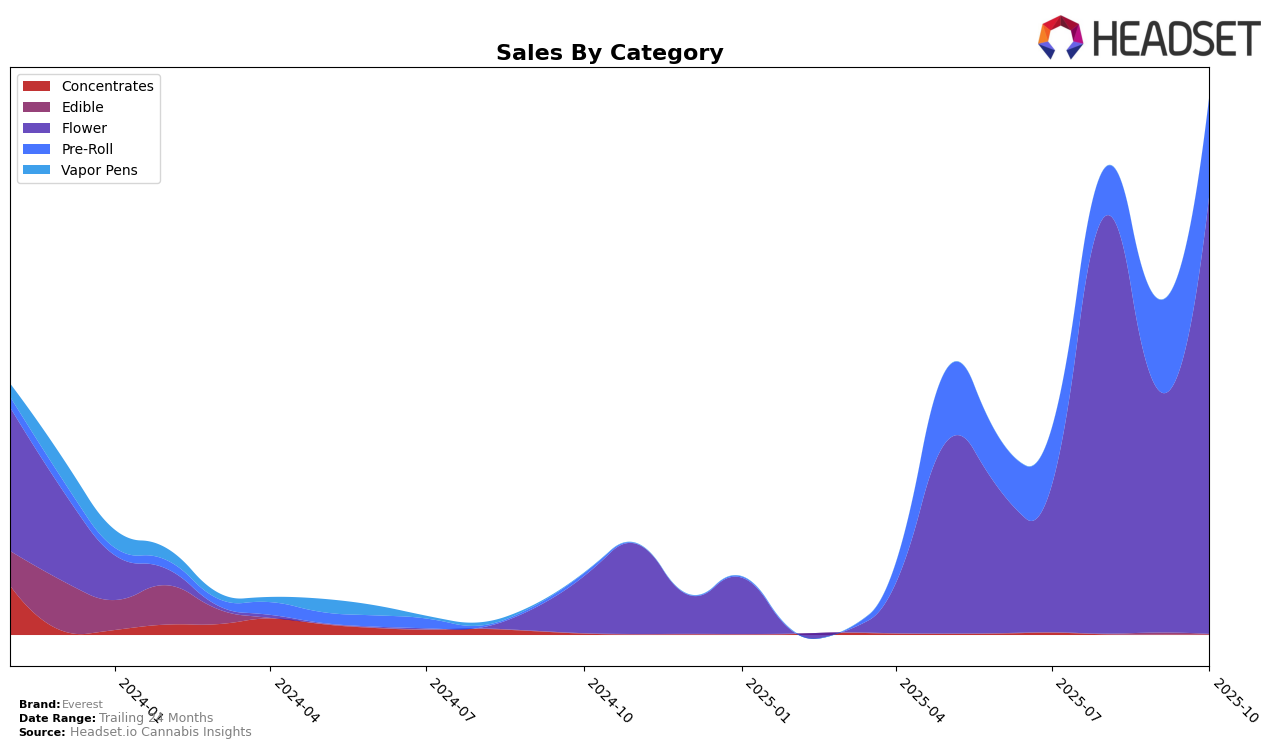

In the province of Alberta, Everest has shown a noteworthy performance in the Flower category. Starting from a rank of 54 in July 2025, Everest climbed to 29 by August, demonstrating a significant upward movement. Although there was a dip to 44 in September, the brand bounced back to an impressive 25 by October, indicating resilience and a strong market presence. This fluctuation in rankings suggests a competitive landscape but also highlights Everest's ability to regain momentum. The sales figures corroborate this trend, with a notable increase from July to October, peaking at over 229,000 in October.

Conversely, Everest's performance in the Pre-Roll category in Alberta paints a different picture. The brand did not appear in the top 30 for July through September, only emerging at rank 84 in September and slightly improving to 83 in October. This indicates that while Everest is making strides in the Flower category, it faces challenges in gaining a foothold in the Pre-Roll segment. The sales figures for Pre-Rolls reflect a gradual increase, suggesting potential for growth, but the brand remains outside the top tier in this category. This contrast between categories highlights areas of strength and opportunities for strategic improvement.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Everest has shown a remarkable fluctuation in its ranking over the past few months. Starting from a rank of 54 in July 2025, Everest made a significant leap to 29 in August, indicating a strong surge in market presence. However, this was followed by a dip to 44 in September before climbing back to an impressive rank of 25 in October. This volatility suggests that while Everest has the potential to compete with established brands, it faces challenges in maintaining consistent market performance. In comparison, brands like Freedom Cannabis and Potluck have maintained more stable positions, with Potluck consistently ranking within the top 25. The sales trajectory of Everest mirrors its ranking fluctuations, with a notable increase in October, positioning it closer to competitors like Common Ground and Partake, which have shown steady growth. This dynamic suggests that while Everest is capable of competing with top brands, strategic efforts are needed to stabilize its rank and capitalize on its potential for growth.

Notable Products

In October 2025, Everest's top-performing product was Ego Checker Pre-Roll 3-Pack (3g) in the Pre-Roll category, rising to the first position with a notable sales figure of 1212 units. Ego Checker (7g) in the Flower category, which had previously held the top spot, moved to second place. Iced Peach (7g) made its debut in October, securing the third rank in the Flower category. Iced Peach Pre-Roll 3-Pack (3g) saw a decline, dropping from the second to the fourth spot. Iced Peach (14g) remained steady in fifth place, showing a slight sales increase compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.