Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

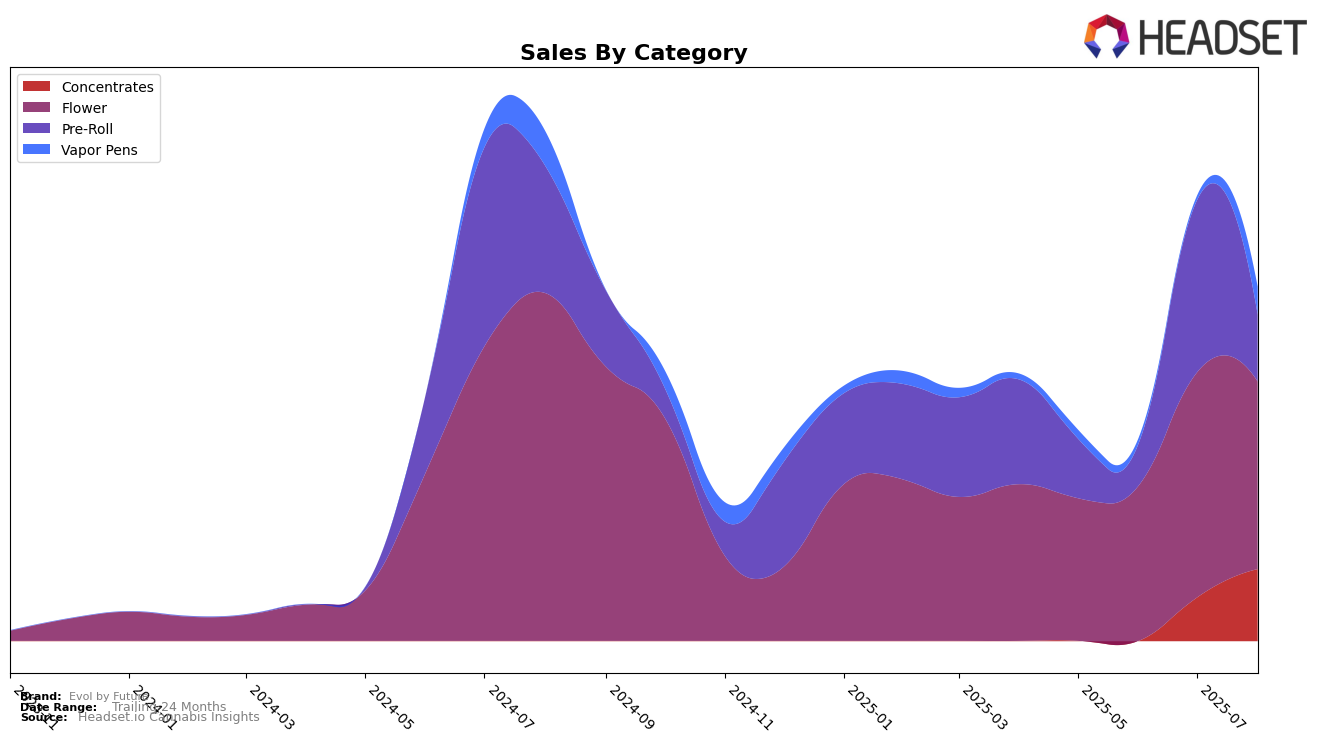

Evol by Future has demonstrated varied performance across different categories and states, with notable achievements and challenges. In Illinois, the brand has shown resilience in the Concentrates category, breaking into the top 30 by August 2025 after not ranking in the top 30 in previous months. This upward movement signals a positive trend for the brand in this category. However, in the Flower category, Evol by Future has experienced fluctuations, with rankings slightly dropping from 60th in July to 62nd in August 2025. Despite this, the brand's sales figures in the Flower category have remained robust, indicating a solid market presence.

In contrast, Evol by Future's performance in Nevada presents a different narrative. The brand's ranking in the Flower category has seen a gradual decline, moving from 78th in May to 91st by August 2025. This downward trend highlights potential challenges in maintaining competitiveness in Nevada's Flower market. The Pre-Roll category in Illinois tells an intriguing story as well, with the brand improving significantly from 67th in June to 45th in July, only to drop back to 62nd in August. These dynamics suggest that while Evol by Future has made strides in certain areas, there are still opportunities for growth and stabilization across different markets and categories.

Competitive Landscape

In the competitive Illinois flower market, Evol by Future has shown a dynamic performance over the summer months of 2025. Starting in May at rank 67, Evol by Future improved its position to 64 in June, reaching its peak at rank 60 in July before slightly declining to 62 in August. This upward trajectory in June and July indicates a positive reception and growing consumer interest, despite the brand not being in the top 20 earlier in the year. In comparison, Redemption maintained a relatively stable presence, consistently ranking higher than Evol by Future, although it experienced a dip in July. Meanwhile, TICAL saw a significant drop in sales from June to August, which may have contributed to Evol by Future's ability to gain ground in the rankings. Despite Nature's Heritage not appearing in the top 20, its sales figures suggest a competitive landscape where Evol by Future's strategic improvements in rank reflect its potential to capture a larger market share.

Notable Products

In August 2025, the top-performing product for Evol by Future was the Notorious #1 Pre-Roll (1g), which ascended to the number one rank with impressive sales of 1,251 units. Strawberry Side Piece (3.5g) maintained its strong performance, holding steady at the second rank, although its sales dipped slightly to 956 units from July. Notorious #1 (3.5g) returned to the rankings, securing the third position, while Plutoski (1g) made its debut in the top five at fourth place. Ice Attack (3.5g) rounded out the top five, climbing back to fifth position after being unranked in previous months. The shifts in rankings highlight the dynamic changes in consumer preferences, with Notorious #1 Pre-Roll (1g) experiencing a significant surge in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.