Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

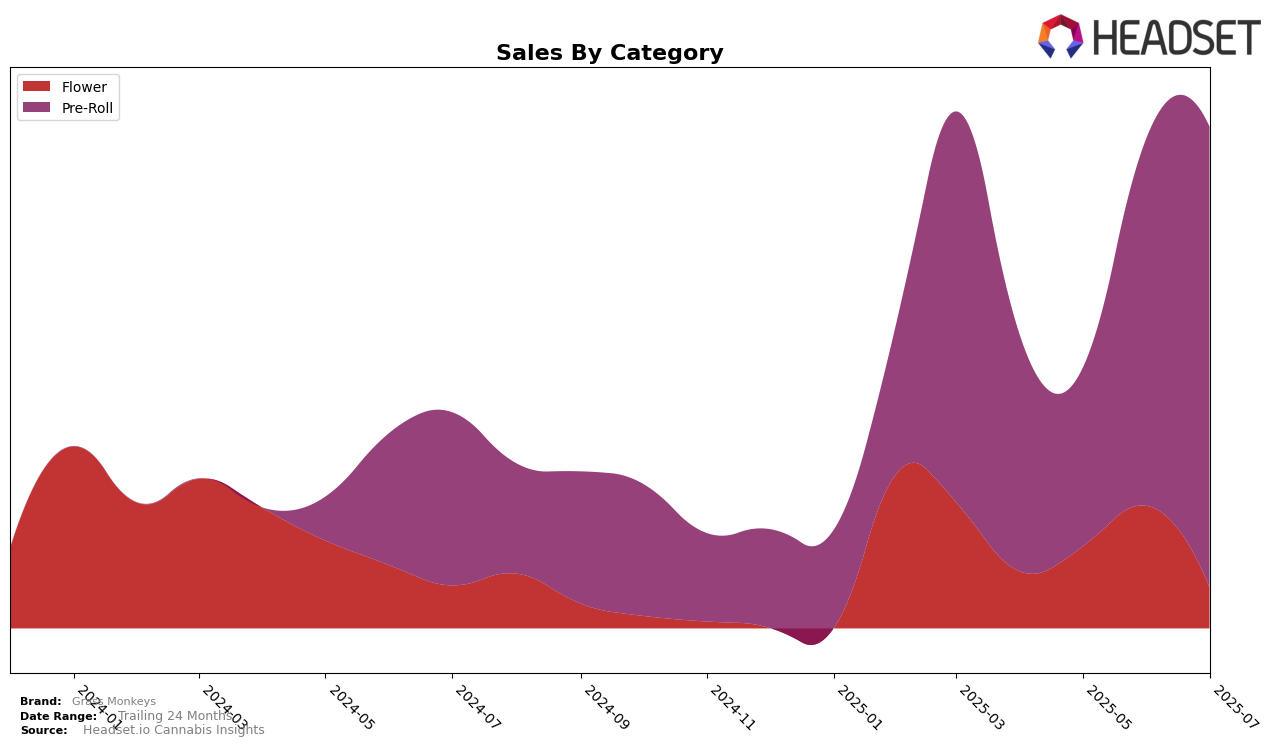

Grass Monkeys has shown a varied performance across different categories and regions over recent months. In the Alberta market, the brand's presence in the Flower category seems to have faced challenges, as it did not feature in the top 30 rankings from April to July 2025. This absence from the rankings indicates that the brand may need to reassess its strategy in Alberta's competitive Flower market. Meanwhile, the lack of sales data for certain months further suggests a potential area for growth or reevaluation for Grass Monkeys in this region.

In contrast, Grass Monkeys has demonstrated a more promising trajectory in Saskatchewan within the Pre-Roll category. Starting from a rank of 39 in April 2025, the brand improved its position significantly to 23 by July 2025. This upward movement aligns with the sales data, which shows a substantial increase from $12,020 in May to $66,890 in July. Such a trend indicates that Grass Monkeys is gaining traction and possibly increasing its market share in Saskatchewan's Pre-Roll category, suggesting a successful strategy or product offering that resonates well with consumers in this region.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Saskatchewan, Grass Monkeys has shown a notable upward trajectory in recent months. Starting from a rank of 39 in April 2025, Grass Monkeys improved significantly to rank 23 by July 2025, indicating a positive trend in market presence. This improvement is particularly impressive when compared to brands like FIGR, which entered the top 20 in June but fell out by July, and Common Ground, which did not make it into the top 20 during this period. Meanwhile, Fleur De L'ile experienced fluctuations, peaking at rank 13 in May before dropping to 25 by July. Despite these shifts, Grass Monkeys' sales have shown a steady increase, closing the gap with competitors like Rizzlers, which saw a decline in sales from April to July. This suggests that Grass Monkeys is gaining traction and could potentially continue climbing the ranks if this momentum persists.

Notable Products

In July 2025, Peanut Butter Breath Pre-Roll 5-Pack (2.5g) emerged as the top-performing product for Grass Monkeys, reclaiming its number one rank from April after a brief dip in June. Notably, this product achieved a sales figure of 672 units, highlighting its strong market presence. Super Lemon Dragon Pre-Roll 5-Pack (2.5g) closely followed, moving up to the second position, maintaining its consistent appeal with a steady sales increase since April. Lime Skunk Pre-Roll 5-Pack (2.5g) secured the third spot, showing a positive trend as it climbed from its initial appearance in June. Meanwhile, Super Lemon Dragon Pre-Roll 10-Pack (5g) and Sunset Gold Pre-Roll 10-Pack (5g) rounded out the top five, with the latter re-entering the rankings after not being listed in May and June.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.