Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

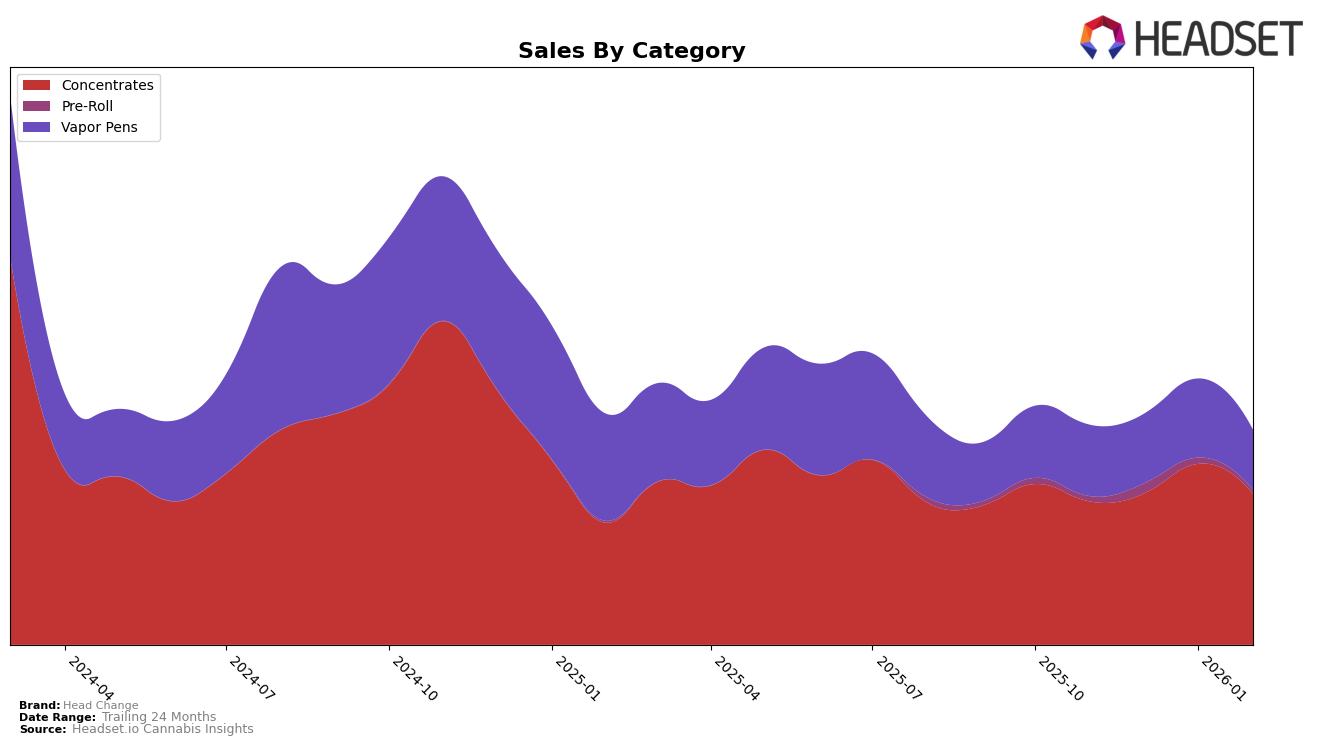

Head Change has demonstrated noteworthy performance in the Missouri cannabis market, particularly in the Concentrates category. Over the months from November 2025 to February 2026, Head Change consistently maintained a strong presence, improving its rank from 6th to 4th position. This upward movement suggests a solidifying brand reputation and increasing consumer preference in this category. However, in the Vapor Pens category, there was a slight fluctuation, with the brand moving from 41st in November to 44th in February, indicating some variability in consumer demand or competitive pressures within this segment.

In contrast, Head Change's performance in the Pre-Roll category in Missouri paints a different picture. While there was an improvement from 87th to 79th position between November and December, the brand was unable to maintain a top 30 ranking by February, indicating challenges in gaining a foothold in this competitive category. This absence from the top rankings could signal either a strategic shift away from Pre-Rolls or a need for enhanced marketing efforts to capture more market share. Such disparities across categories highlight the dynamic nature of the cannabis market and the necessity for brands like Head Change to adapt and innovate continually.

Competitive Landscape

In the Missouri concentrates market, Head Change has demonstrated a notable upward trajectory in its rankings, moving from 6th place in November and December 2025 to 4th place by January and February 2026. This improvement in rank is indicative of a positive trend in sales performance, as evidenced by a peak in January 2026. Despite the competitive landscape, Head Change has managed to outperform Sinse Cannabis, which fluctuated between 5th and 10th place, and Vivid (MO), which saw a drop from 4th to 5th place by February 2026. However, Head Change still trails behind Proper Cannabis and Infinity (MO), which consistently held the 2nd and 3rd ranks, respectively. The consistent positioning of these competitors suggests a stable consumer preference, but Head Change's recent gains indicate a growing market presence and potential for further advancement.

Notable Products

In February 2026, the top-performing product for Head Change was Fresh Produce #32 Live Rosin (1g) in the Concentrates category, achieving the highest sales with 485 units sold. Diesel Weasel Live Badder (1g) followed closely in second place, while Red Vestido Live Badder (1g) secured the third position. Blueberry Blushie Live Rosin (1g) and Sherbology 43 Live Sauce Cartridge (0.5g) rounded out the top five. Notably, Fresh Produce #32 Live Rosin (1g) jumped to the top rank for the first time, while Diesel Weasel Live Badder (1g) and Red Vestido Live Badder (1g) maintained strong positions. These shifts highlight a growing preference for Live Rosin products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.