Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

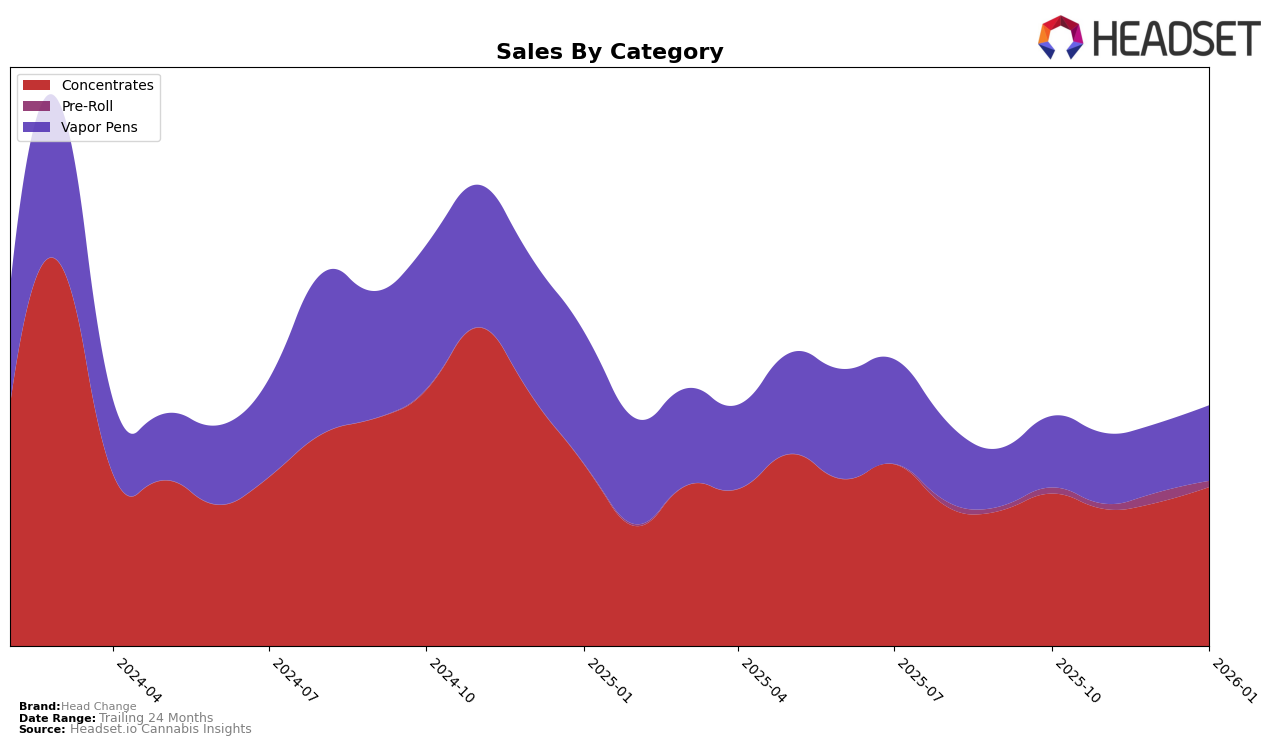

Head Change has demonstrated notable performance in the Missouri market, particularly within the Concentrates category. Over the past few months, the brand improved its ranking from seventh in October 2025 to fourth by January 2026. This upward trajectory is supported by a consistent increase in sales, culminating in a significant rise of over $14,000 from December 2025 to January 2026. In contrast, Head Change's presence in the Pre-Roll category remains less prominent, with rankings fluctuating outside the top 75, indicating a potential area for growth or strategic reevaluation within this segment.

In the Vapor Pens category, Head Change maintains a steady position, with slight fluctuations in rankings, moving from 41st in October 2025 to 38th in January 2026. While the brand does not break into the top 30, the sales figures suggest a stable customer base that could be leveraged for future growth. The consistent sales performance in this category contrasts with the more volatile Pre-Roll segment, highlighting the brand's stronger foothold in certain product lines. This data suggests a strategic focus on Concentrates and Vapor Pens could enhance Head Change's market standing in Missouri.

Competitive Landscape

In the Missouri concentrates market, Head Change has demonstrated a notable upward trajectory in its ranking, moving from 7th place in October 2025 to 4th place by January 2026. This improvement in rank is indicative of a positive trend in sales performance, particularly in January 2026, where Head Change surpassed its previous months' sales figures. Despite this progress, Head Change faces stiff competition from brands like Proper Cannabis, which consistently held the 2nd rank throughout the same period, and Infinity (MO), maintaining a strong 3rd position. Additionally, Amaze Cannabis and Vivid (MO) have shown fluctuations in their rankings, with Amaze Cannabis peaking at 3rd in November 2025 before settling at 6th by January 2026, while Vivid (MO) made a significant leap to 4th in December 2025 before dropping to 5th in January 2026. These dynamics suggest that while Head Change is gaining ground, it must continue to innovate and adapt to maintain and further its competitive edge in this evolving market landscape.

Notable Products

In January 2026, the top-performing product for Head Change was Slurp Juice Live Rosin (1g) from the Concentrates category, securing the number one rank with sales of 471 units. Following closely, Kool Aid Terp Test Live Resin Badder (1g) and Brain Maze Live Rosin (1g) held the second and third positions, respectively, both also within the Concentrates category. Funky Pajamas Live Resin Sauce Cartridge (0.5g) and Berry Blastoff Live Sauce Cartridge (0.5g) rounded out the top five, ranking fourth and fifth in the Vapor Pens category. This marks a strong debut for these products, as they were not ranked in the previous months of 2025. The shift in rankings highlights a growing consumer preference for Concentrates over Vapor Pens in January 2026.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.