Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

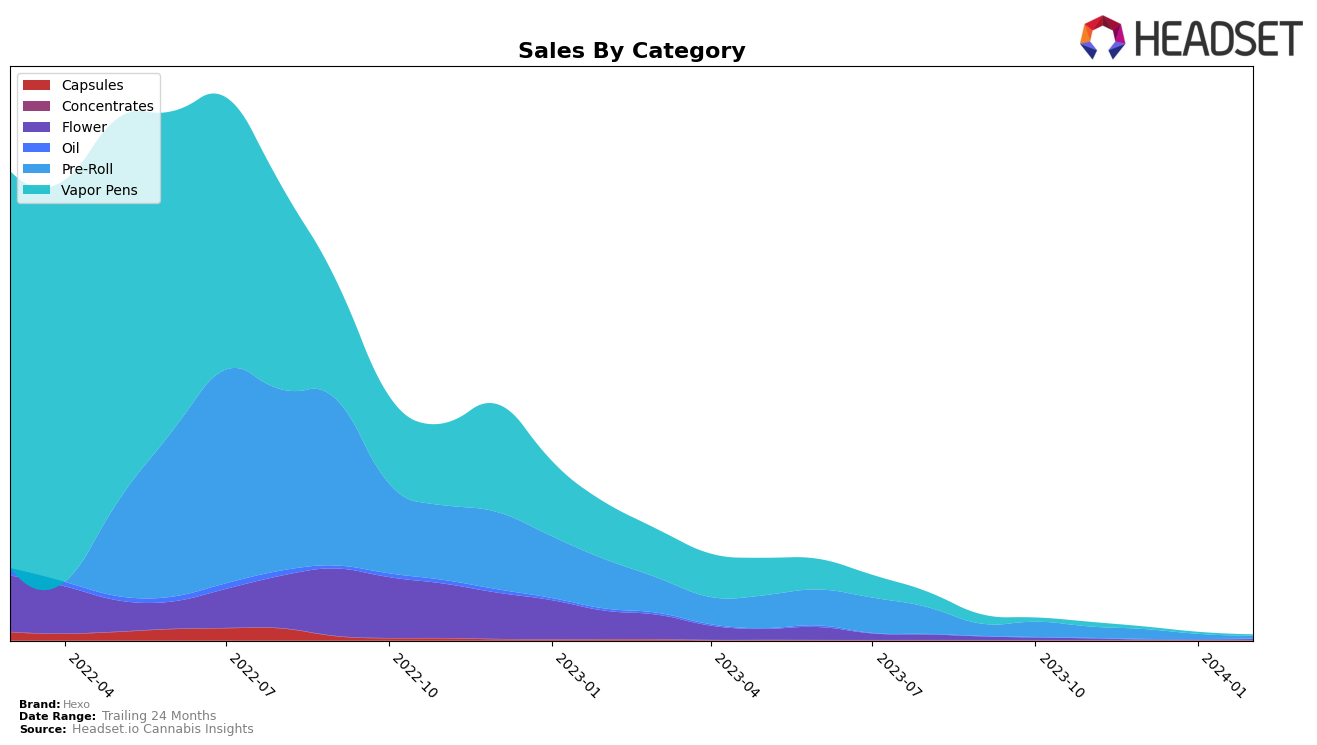

In the evolving landscape of the cannabis market, Hexo's performance across different categories and provinces shows a mixed bag of results. In Alberta, Hexo has shown a fluctuating presence in the Capsules category, not ranking in November 2023, securing the 19th position in December 2023, disappearing again in January 2024, and then barely making it into the top 20 by February 2024. This inconsistency could be a point of concern or an opportunity for growth, depending on Hexo's strategy moving forward. In contrast, their performance in the Pre-Roll and Vapor Pens categories in Alberta indicates a struggle to maintain a strong market presence, with rankings slipping significantly from November 2023 to December 2023 and no rankings at all in the subsequent months, which could be seen as a negative trend.

On a more positive note, Hexo has shown some resilience in other provinces. In British Columbia, their Oil category saw a slight improvement from November 2023 to December 2023, moving from 27th to 23rd position, albeit without further rankings in the following months. This could suggest a potential for growth or at least stability within that market. Meanwhile, in Saskatchewan, Hexo's Vapor Pens category experienced notable growth, moving from the 83rd position in November 2023 to the 73rd by February 2024, with sales peaking in January 2024 at 1,817 units. This upward trend in Saskatchewan, contrasting with their performance in Alberta, highlights the geographical nuances of Hexo's market performance and suggests that success in one province does not necessarily translate across all markets.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Saskatchewan, Hexo has shown a notable trajectory in terms of rank and sales, despite facing stiff competition. Initially ranked lower than many of its competitors in November 2023, Hexo managed to climb significantly by February 2024, surpassing brands like Ace Valley and PAX, which experienced declines in both rank and sales. Interestingly, Purefarma and Tribal remained strong contenders, with Purefarma consistently outperforming Hexo in sales, despite Hexo's upward movement in rank. Tribal's remarkable entry at rank 29 in December and its subsequent performance indicate a volatile yet competitive market. Hexo's sales growth from November 2023 to February 2024, alongside its improvement in rank, suggests a positive trajectory amidst a challenging competitive environment, highlighting its resilience and potential for growth in the Saskatchewan vapor pens market.

Notable Products

In Feb-2024, Hexo's top-performing product was the Ultra Sour Pre-Roll 10-Pack (4g) within the Pre-Roll category, maintaining its number one rank from the previous months with sales figures reaching 499 units. The second spot was taken by FLVR - Island Pineapple CO2 Disposable (0.25g) in the Vapor Pens category, moving up from its consistent third-place ranking in previous months. Following closely, FLAVR - Wild Strawberry CO2 Disposable (0.25g) also in the Vapor Pens category, showed significant progress by jumping to the third rank in Feb-2024 from its fifth position in Jan-2024. The Blue Dream CO2 Cartridge (1g), another Vapor Pens category product, held steady at fourth place. Noteworthy is the introduction of Tsunami (30g) in the Flower category, which entered the rankings directly at the fifth position, indicating a strong market entrance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.