Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

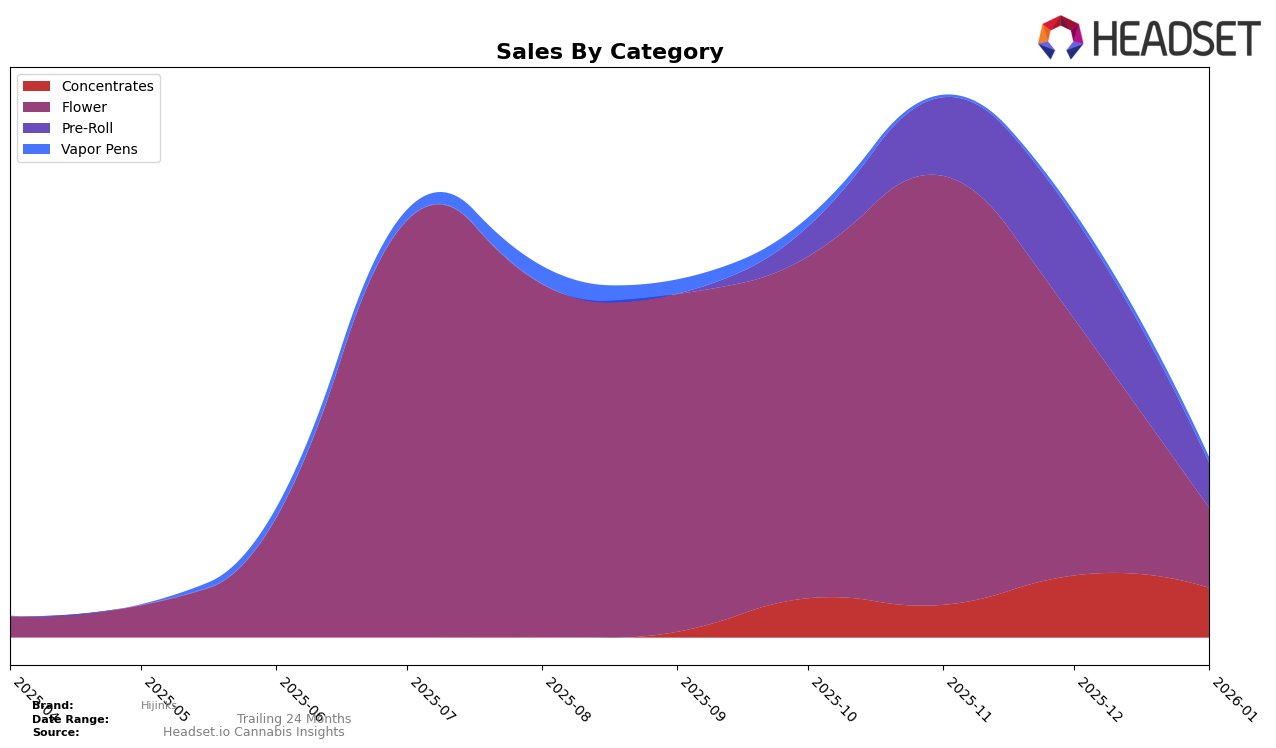

In the state of Massachusetts, Hijinks has shown a fluctuating performance in the Concentrates category. Despite not making it into the top 30 brands, there was a noticeable improvement from December 2025 to January 2026, moving from a rank of 52 to 44. This suggests some regained traction in the market, even though their sales figures have been inconsistent, with a dip in November 2025 followed by a slight recovery. In Nevada, Hijinks has experienced a similar volatility in the Flower category, where they improved their ranking significantly to 45 in November 2025, only to see a decline again by January 2026. This indicates a competitive market environment where maintaining a steady rank is challenging.

Meanwhile, in Ohio, Hijinks has shown a more stable presence across multiple categories. In the Concentrates category, they have recently entered the top 30, ranking 28 in December 2025 and maintaining a close position in January 2026. This is a positive sign of growth in a new segment for them. However, their performance in the Flower category has seen a sharp decline, dropping from 48 in December 2025 to 67 by January 2026, which could be a cause for concern. On a more positive note, their Pre-Roll category has consistently performed well, maintaining a strong presence within the top 30, though a slight dip was observed in January 2026. This suggests that while Hijinks is capable of maintaining a stronghold in certain segments, there are areas that require attention to sustain and improve their market position.

Competitive Landscape

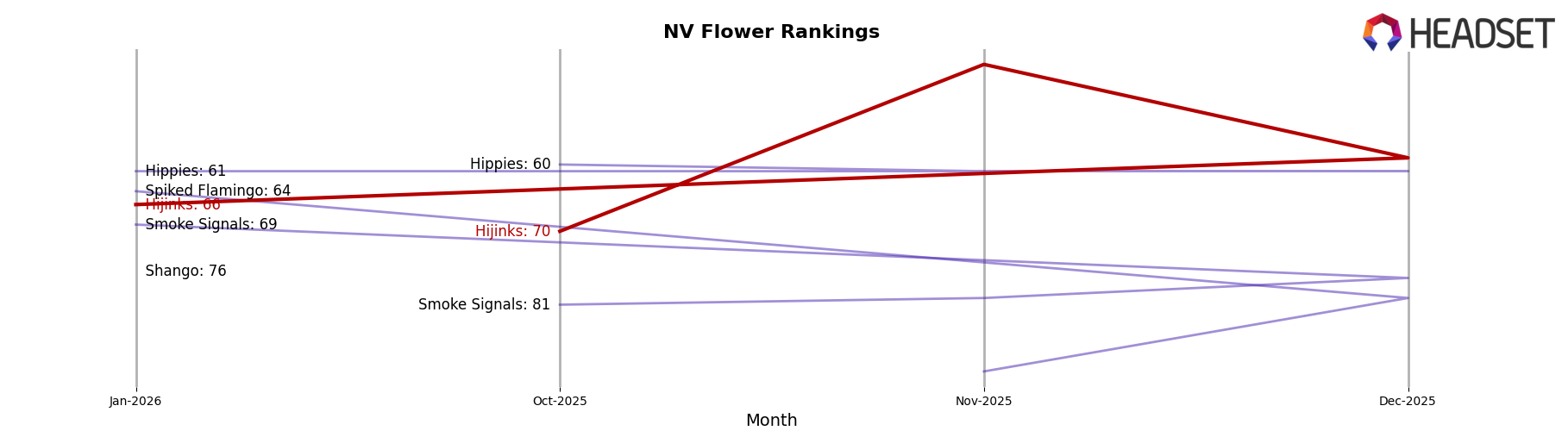

In the competitive landscape of the Nevada flower category, Hijinks has experienced notable fluctuations in rank and sales over the past few months. Starting in October 2025, Hijinks was ranked 70th, but made a significant leap to 45th in November, driven by a substantial increase in sales. However, the brand's rank slipped to 59th in December and further to 66th in January 2026. This volatility contrasts with competitors like Hippies, which maintained a steady rank of 61st throughout the same period, albeit with a gradual decline in sales. Meanwhile, Smoke Signals showed a consistent upward trend, improving from 81st in October to 69th by January, indicating a growing market presence. Spiked Flamingo also demonstrated a remarkable rise, moving from outside the top 20 in October to 64th by January, suggesting a strong growth trajectory. These dynamics highlight the competitive pressures Hijinks faces in maintaining its market position amidst fluctuating sales and the strategic maneuvers of its competitors.

Notable Products

In January 2026, Pave (3.5g) from the Flower category emerged as the top-performing product for Hijinks, climbing from its previous absence in the December rankings to secure the number one spot with sales of 615 units. Hypnotik Pre-Roll (1g), a newcomer to the rankings, achieved the second position with sales of 603 units. Lemon Fresh Pre-Roll (1g) saw a decline from its consistent first-place ranking in November and December to third place in January. Grape Bubble Pre-Roll (1g) entered the rankings at fourth, while BK OG Pre-Roll (1g) dropped from third place in December to fifth place in January. Overall, the Pre-Roll category showed dynamic changes, with new entries and shifts in rankings across the board.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.