Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

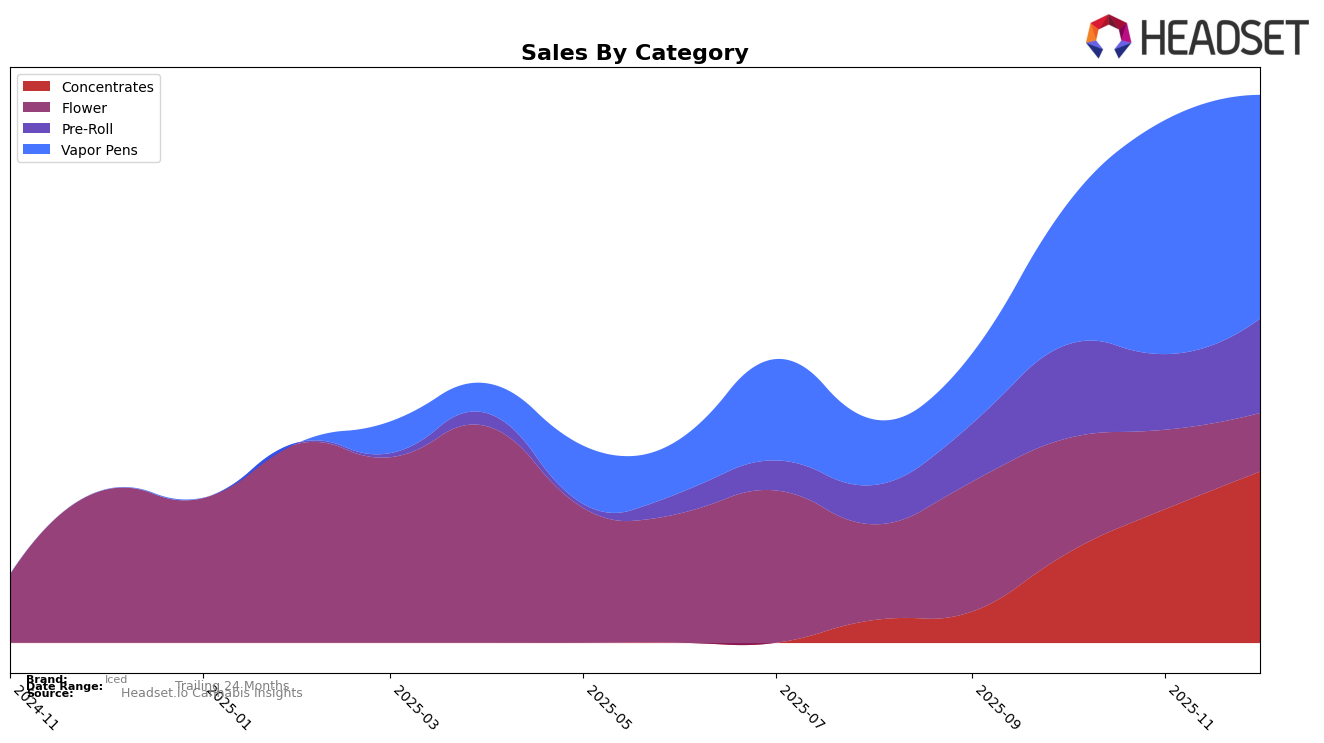

The performance of Iced in the California market has shown significant improvement in the Concentrates category. Starting from a rank of 81 in September 2025, Iced climbed to the 29th position by December 2025, indicating a strong upward trend. This movement suggests a growing consumer preference for their products in this category. The brand's sales in Concentrates also reflect this positive trajectory, with a substantial increase from September to December. This consistent improvement in ranking and sales volume highlights Iced's strengthening position in the California Concentrates market.

In contrast, Iced's performance in the Vapor Pens category within California presents a more mixed picture. The brand was not ranked in the top 30 in September 2025, but it entered the rankings at 88 in October and improved to 63 in November. However, there was a slight decline to 66 in December, indicating some volatility in this category. Despite this fluctuation, the sales figures still depict a relatively healthy demand, albeit not as pronounced as in the Concentrates category. This suggests that while Iced is making inroads into the Vapor Pens market, there is still room for growth and stabilization.

Competitive Landscape

In the competitive landscape of vapor pens in California, Iced has demonstrated a notable upward trajectory in the rankings, moving from outside the top 20 in September 2025 to securing the 63rd position by November 2025. This rise is indicative of a positive reception in the market, potentially driven by strategic marketing or product innovation. Comparatively, Eureka maintained a relatively stable position, hovering around the 60th rank, while Cream Of The Crop (COTC) experienced a decline, dropping from 54th in September to 70th by December, which may suggest a shift in consumer preference or competitive pressure. Meanwhile, CAM and Bud's Everyday by Bud's Goods showed fluctuating ranks, with Bud's Everyday improving its position significantly towards the end of the year. These dynamics highlight Iced's potential to capitalize on its momentum and possibly gain further market share if it continues to align its offerings with consumer expectations.

Notable Products

In December 2025, the top-performing product for Iced was Sugarland Liquid Diamonds Cartridge (1g) in the Vapor Pens category, which climbed to the number 1 rank from 3rd in November, with notable sales of 1659 units. Blue Zushi Sugar Diamonds (1g) maintained its 2nd position in the Concentrates category with consistent sales performance. Runtz Sugar Diamonds (1g) entered the rankings for the first time at 3rd place, indicating a strong debut. Blue Zushi Liquid Diamonds Cartridge (1g) experienced a drop from 1st in November to 4th in December. Lemon Cherry Gelato Liquid Diamonds Cartridge (1g) also saw a decline, moving from 4th to 5th place, reflecting a slight decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.