Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

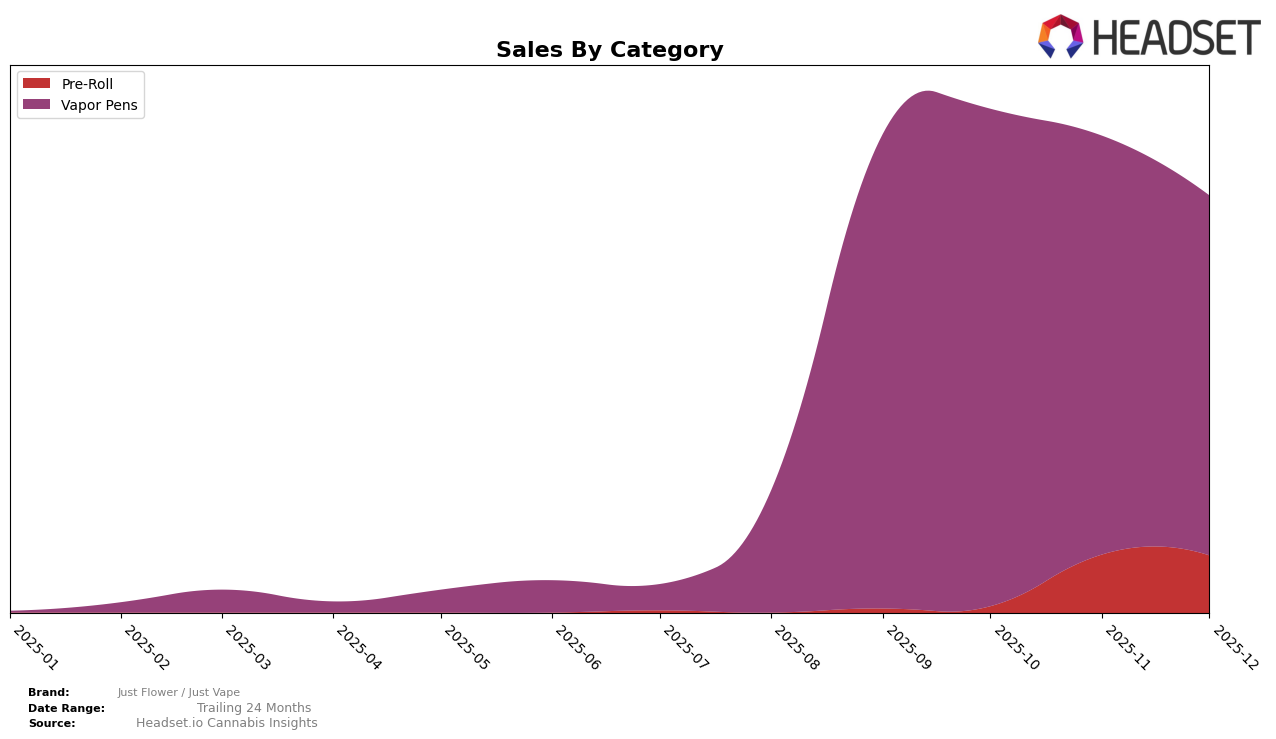

In the state of Maryland, Just Flower / Just Vape has shown varied performance across different product categories. Notably, in the Pre-Roll category, the brand was not ranked in the top 30 in September and October 2025, indicating a potential area for improvement or increased competition in this segment. However, by November and December, they made a slight advancement, achieving ranks of 46 and 45, respectively. This movement suggests a gradual increase in market presence, albeit still outside the top 30, which highlights the competitive nature of the Pre-Roll market in Maryland.

Conversely, in the Vapor Pens category, Just Flower / Just Vape maintained a stronger presence throughout the latter months of 2025. Starting at rank 25 in September, the brand saw a slight improvement to rank 24 in October and November, before dropping to rank 29 in December. Despite this decline, the brand consistently remained within the top 30, indicating a more stable foothold in this category compared to Pre-Rolls. The sales figures also reflect a downward trend from October to December, suggesting possible challenges in sustaining growth or increased competition during the holiday season. This performance reveals the importance of strategic positioning and market adaptation for Just Flower / Just Vape in Maryland's dynamic cannabis market.

Competitive Landscape

In the Maryland Vapor Pens category, Just Flower / Just Vape experienced a notable decline in rank from September to December 2025, dropping from 25th to 29th place. This downward trend in rank is accompanied by a decrease in sales, indicating potential challenges in maintaining market share. In contrast, Beboe improved its position from 42nd to 33rd, showcasing a steady rise in rank and sales, which could signify growing consumer preference or effective marketing strategies. Meanwhile, DomPen saw fluctuations in its rank, ending December in 27th place, which is still higher than Just Flower / Just Vape, but with a declining sales trend. Nature's Heritage and SunMed maintained relatively stable ranks, with Nature's Heritage holding steady at 32nd and SunMed at 28th by December. These insights suggest that while Just Flower / Just Vape faces competitive pressure, there is room for strategic adjustments to reclaim its position in the market.

Notable Products

In December 2025, the Bacio Gelato Distillate Disposable (1g) from the Vapor Pens category emerged as the top-performing product for Just Flower / Just Vape, climbing from fifth place in November to first place with sales reaching 897 units. The Asphalt Plant Pre-Roll 2-Pack (1g) maintained strong sales, although it dropped from first to second place compared to November. The Kiwi Berry Distillate Disposable (1g) entered the rankings for the first time, securing the third position. Violet Fog #1 Pre-Roll 2-Pack (1g) and Cherry Pie Pre-Roll 2-Pack (1g) also joined the rankings in December, taking fourth and fifth places respectively. This shift in rankings highlights a competitive month for Just Flower / Just Vape, with notable changes in consumer preferences towards their vapor pen offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.