Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

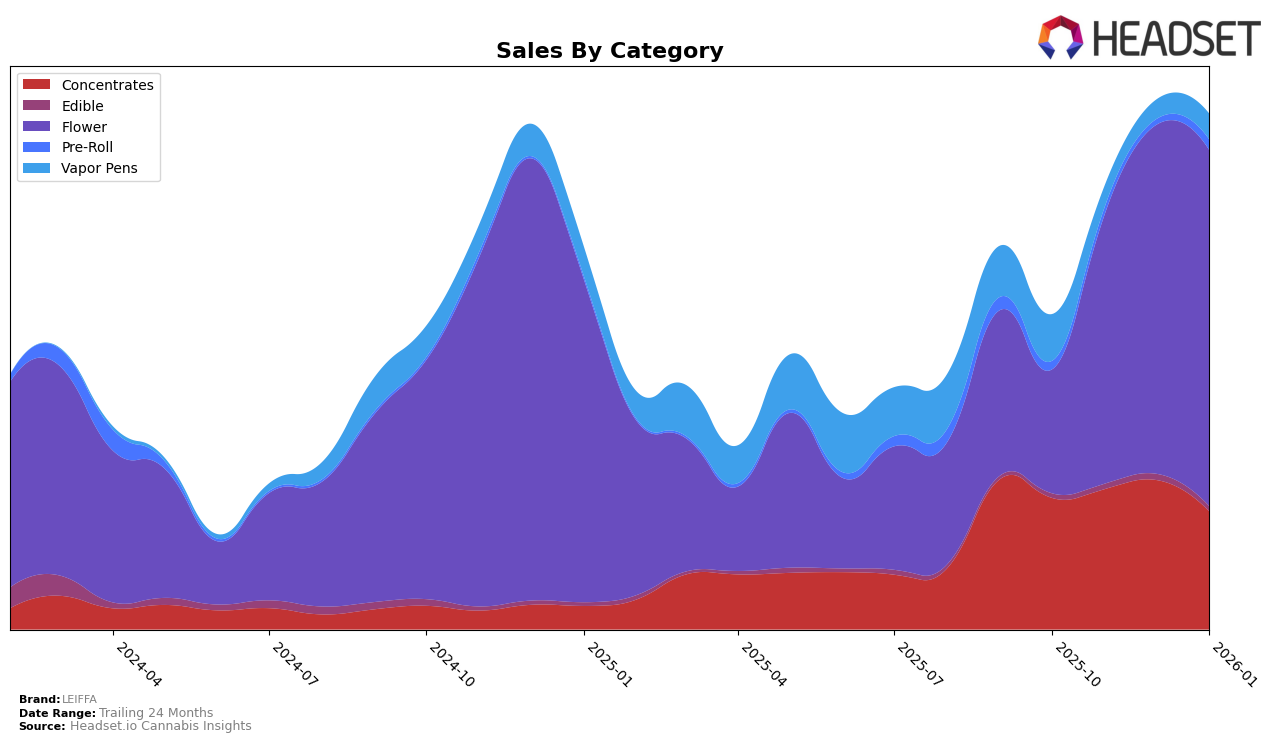

LEIFFA's performance in the Colorado market showcases a dynamic presence across multiple categories. In the Concentrates category, LEIFFA maintained a strong position, peaking at rank 7 in November 2025 before slipping to rank 12 by January 2026. This trend indicates a competitive environment, although the brand still managed to sustain respectable sales figures, with a notable increase in November and December before a dip in January. In contrast, LEIFFA's performance in the Flower category was particularly impressive, climbing from rank 40 in October 2025 to a top 10 position by December, ultimately reaching rank 7 in January 2026. This upward trajectory suggests a growing consumer preference for LEIFFA's flower products, perhaps driven by product quality or strategic market positioning.

In New Jersey, LEIFFA's introduction to the Concentrates category in January 2026 at rank 28 marks a promising entry into the market. This initial ranking places them within the competitive landscape, hinting at potential growth opportunities as they establish their foothold. However, their absence from the top 30 in the Pre-Roll and Vapor Pens categories in Colorado during the same period suggests challenges in those segments, possibly due to intense competition or consumer preferences leaning towards other brands. The Vapor Pens category, in particular, saw LEIFFA hovering in the 50s and 60s, indicating room for improvement if they aim to capture a larger market share.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, LEIFFA has shown a remarkable upward trajectory in its rankings from October 2025 to January 2026. Starting at rank 40 in October, LEIFFA climbed to rank 7 by January, indicating a significant improvement in market presence and consumer preference. This rise is particularly noteworthy when compared to competitors such as 710 Labs, which also improved its rank from 10 to 5 during the same period, and 14er Boulder, which fluctuated but ultimately ended at rank 8. Meanwhile, Equinox Gardens experienced a decline, dropping out of the top 10 in December before recovering slightly to rank 9 in January. LEIFFA's sales growth trajectory, moving from a lower base to a competitive position, suggests a strong strategic push that has resonated with consumers, contrasting with the more stable yet less dynamic performance of LIT (CO), which maintained a consistent top 10 presence but with less dramatic rank changes.

Notable Products

In January 2026, Dulce De Uva (Bulk) emerged as the top-performing product for LEIFFA, with a notable sales figure of 16,556 units, solidifying its ascent from the second rank in December 2025. Grape Cream Cake (Bulk) followed closely, dropping from the first position in December to second place in January. Guava Pie (Bulk) made a strong debut, securing the third rank without any prior ranking history. M.A.C. (Bulk) entered the rankings at fourth place, indicating growing popularity. Day Fruit (Bulk) rounded out the top five, showing consistent entry into the rankings for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.