Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

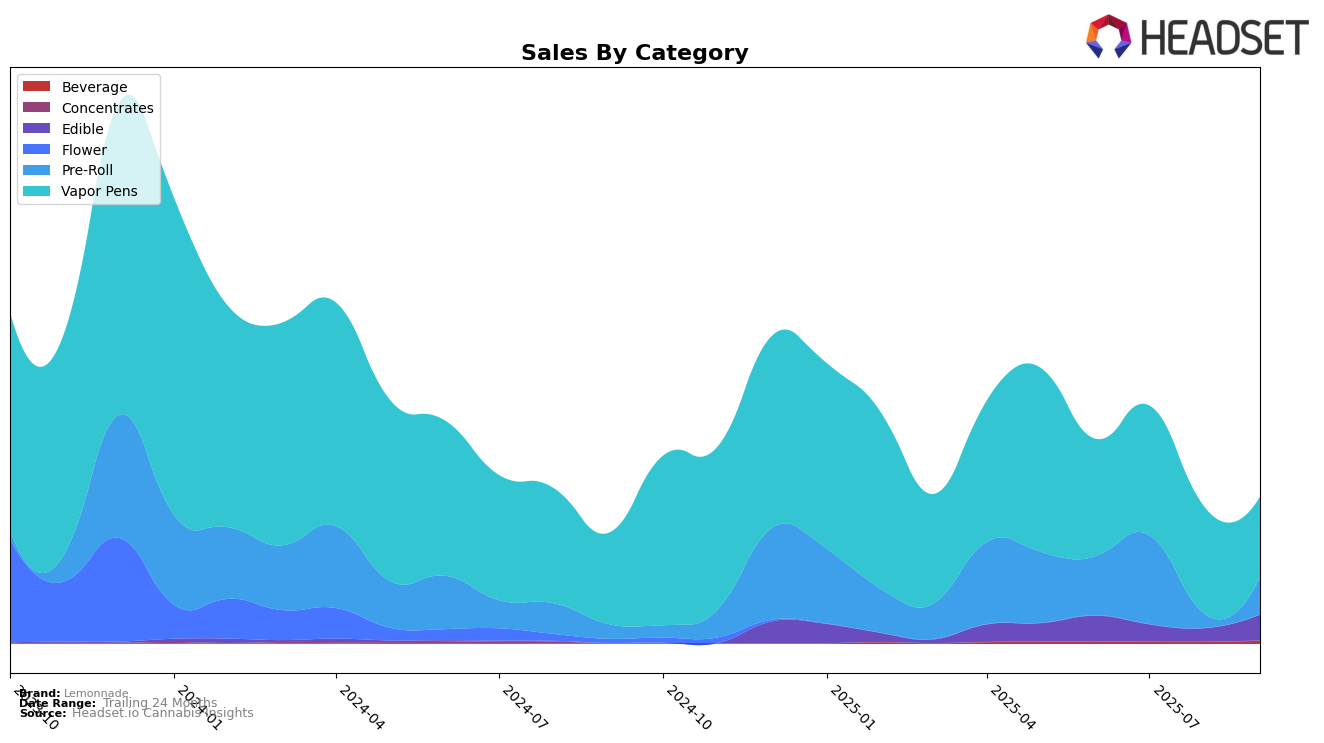

Lemonnade's performance across various categories in California shows a mixed trend over the months from June to September 2025. In the Edible category, the brand has not managed to break into the top 30, with rankings consistently declining from 54th in June to being absent from the top 30 by September. This indicates a potential struggle in maintaining a competitive edge in this segment. On the other hand, their performance in the Vapor Pens category also shows a downward trend, slipping from 76th in June to 94th by September, despite a notable increase in sales in July. The absence of Lemonnade from the top 30 in the Pre-Roll category suggests further challenges in capturing market share in this highly competitive space.

In Illinois, Lemonnade's entry into the Edible category in September with a ranking of 48th marks a significant movement, considering they were not ranked in the preceding months. This could indicate a strategic focus or an emerging opportunity in this market. However, without presence in other categories or earlier months, it remains to be seen if this momentum can be sustained or expanded. The brand's performance in Illinois compared to California highlights the varied challenges and opportunities across different state markets, emphasizing the importance of tailored strategies to address regional consumer preferences and competitive landscapes.

Competitive Landscape

In the competitive landscape of California's vapor pen market, Lemonnade has experienced notable fluctuations in its ranking and sales performance from June to September 2025. Initially positioned at rank 76 in June, Lemonnade saw a brief improvement to rank 70 in July, before experiencing a decline to rank 83 in August and further dropping to rank 94 in September. This downward trend in rank coincides with a decrease in sales, from a high in July to a significant dip by September. In comparison, Sublime Canna and Nuvata maintained relatively stable positions, with Sublime Canna consistently outperforming Lemonnade in sales, despite ranking lower in some months. Meanwhile, Treesap emerged in the rankings in August, slightly ahead of Lemonnade by September, indicating a potential new competitor gaining traction. Cure Injoy, despite a similar decline in rank, maintained higher sales than Lemonnade throughout the period. These dynamics suggest that Lemonnade faces increasing competition and may need to strategize to regain its market position amidst these shifting trends.

Notable Products

In September 2025, Madrina Preroll (1g) emerged as the top-performing product for Lemonnade, leading the sales with 1156 units sold. Guava Gelato Infused Pre-Roll (1g) followed closely in the second position, while Purple Passion Fruit Infused Pre-Roll (1g) secured the third spot. Watermelon Mojito Infused Pre-Roll (1g), which was the top seller in July, dropped to fourth place. Black Cherry Soda Infused Pre-Roll (1g) completed the top five list. Notably, Watermelon Mojito Infused Pre-Roll (1g) experienced a significant decline from its peak in July, indicating a shift in consumer preference towards other flavors.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.