Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

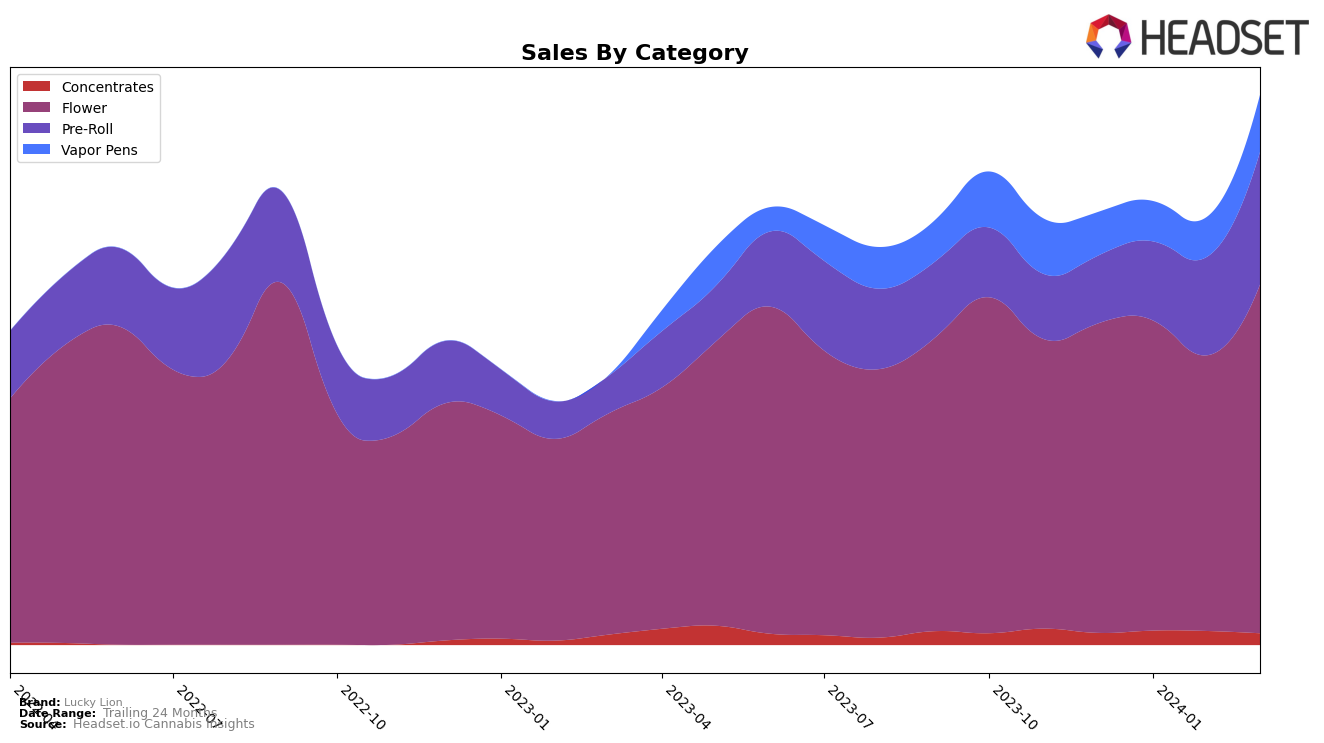

In Oregon, Lucky Lion has shown a varied performance across different cannabis categories, each telling a unique story about the brand's market presence. In the Flower category, Lucky Lion has maintained a strong position, fluctuating slightly from the 10th rank in December 2023 to the 11th in March 2024. This slight movement, coupled with an impressive increase in sales from December's $429,184 to March's $483,962, indicates a solid demand for their Flower products despite minor rank changes. Conversely, in the Concentrates category, despite a gradual improvement in rankings from 74th to 65th over the same period, the sales dipped in March to $15,967, suggesting challenges in capturing a larger market share or possible external market pressures affecting sales.

Looking at Lucky Lion's performance in Pre-Rolls and Vapor Pens within the same state, there's a noticeable positive trend in Pre-Rolls with rankings improving significantly from 31st in December 2023 to 20th by March 2024, mirrored by a substantial increase in sales reaching $183,754. This indicates a growing consumer preference for Lucky Lion's Pre-Rolls, potentially attributed to quality, marketing efforts, or changes in consumer behavior. The Vapor Pens category, however, tells a different story; despite fluctuations in rankings, there was a notable jump in sales in March to $78,896. This suggests that while Lucky Lion may not be leading in rankings within the Vapor Pens category, there's an underlying positive momentum possibly driven by strategic product improvements or promotional activities, hinting at an area where Lucky Lion could further capitalize with the right strategies.

Competitive Landscape

In the competitive landscape of the Oregon flower cannabis market, Lucky Lion has demonstrated a consistent presence among the top brands, albeit with slight fluctuations in its ranking from December 2023 to March 2024. Initially ranked 10th in December, Lucky Lion experienced a minor improvement in January 2024, moving up to 9th, maintained this position in February, but then saw a slight dip to 11th place by March 2024. This trajectory indicates a stable demand for Lucky Lion's products, though the brand faces stiff competition from peers such as Deep Creek Gardens, which climbed from 8th to 10th place by March, and Self Made Farm, which notably improved from 14th to 9th place within the same period, ending slightly ahead of Lucky Lion by March. Another notable competitor, Emerald Fields Cannabis, showed a decline from 11th to 12th place, suggesting a potential opportunity for Lucky Lion to capitalize on. The dramatic rise of Earl Baker from 36th to 13th place also highlights the dynamic nature of the market and the importance of staying competitive. These shifts underscore the competitive intensity within the Oregon flower cannabis market and suggest that Lucky Lion must continue to innovate and possibly adjust its strategies to maintain or improve its market position.

Notable Products

In March 2024, Lucky Lion saw the Hexane Pre-Roll (1g) as its top-selling product, with sales reaching 8302 units, marking its debut in the rankings. Following closely, the Super Boof Pre-Roll (1g) secured the second position after a slight dip from fourth place in February, showcasing its consistent popularity. The Super Boof (Bulk) flower, previously leading in January, dropped to the third spot, indicating a shift in consumer preferences towards pre-rolled options. Tropical Trufflez Pre-Roll (1g), despite being the top seller in February, fell to fourth place, suggesting a competitive market with fluctuating consumer interests. Lastly, the Golden Pineapple (Bulk) flower made a comeback in the rankings at fifth place, highlighting the brand's diverse appeal across different product categories.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.