Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

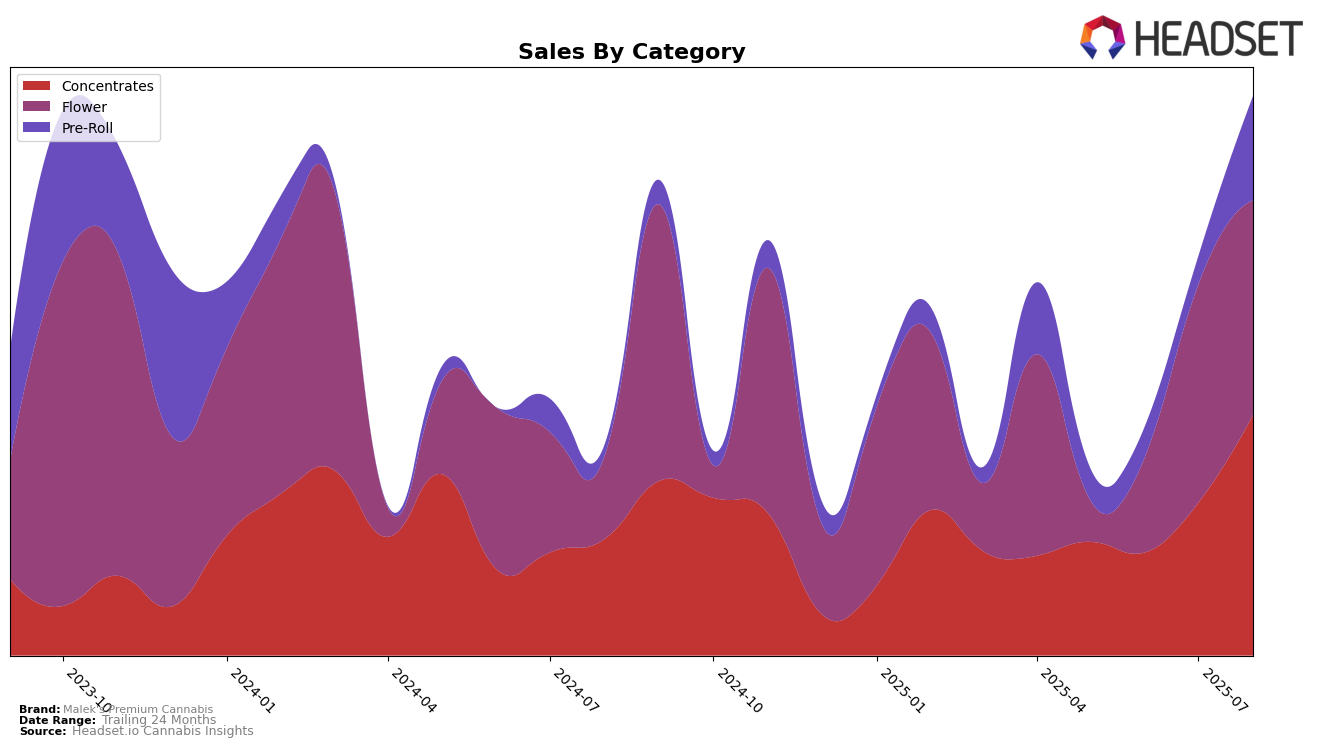

Malek's Premium Cannabis has shown notable progress in the Colorado market, especially within the Concentrates category. Over the summer months, the brand climbed from a rank of 39 in May to 27 by August, reflecting a positive trajectory. This upward movement in the rankings is backed by a significant increase in sales, which more than doubled from May to August. Such a trend indicates a growing consumer preference and potentially effective marketing strategies or product improvements. However, it is worth noting that in the Flower category, Malek's did not make it into the top 30 in May, which could point to a need for strategic adjustments to elevate their presence in this segment.

In the Pre-Roll category, Malek's Premium Cannabis has also experienced a consistent rise in rankings within the Colorado market. Starting at rank 75 in May, the brand improved its position to 53 by August. Although the sales figures for Pre-Rolls did not exhibit as dramatic an increase as seen in Concentrates, the steady climb in rankings suggests a positive reception from consumers. The Flower category, however, presents a mixed picture; while there was an improvement from rank 92 in June to 70 by August, the brand was not in the top 30 in May, indicating potential challenges in maintaining a competitive edge in this category. This mixed performance across categories highlights areas of opportunity and the need for targeted strategies to enhance market positioning.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, Malek's Premium Cannabis has shown a notable upward trajectory from May to August 2025, moving from a rank of 39 to 27. This improvement in rank is significant, especially when compared to competitors such as LEIFFA and Lazercat Cannabis, who experienced fluctuations in their rankings, with Lazercat Cannabis dropping from 11 to 29 by August. Meanwhile, Edun and RVRS have maintained more stable positions, with Edun climbing to 25 and RVRS to 26 by August. Despite the competitive pressure, Malek's Premium Cannabis has managed to increase its sales significantly, particularly in August, indicating a strong market presence and potential for continued growth. This positive trend suggests that Malek's Premium Cannabis is effectively capturing market share, positioning itself as a formidable player in the concentrates category in Colorado.

Notable Products

In August 2025, Gak Smoovie (Bulk) emerged as the top-performing product for Malek's Premium Cannabis, achieving the number one rank with notable sales of 2,532 units. The Dew (Bulk) followed closely, securing the second position, ascending from its previous fourth place in July. Mr. Suds Popcorn (1g) entered the rankings strongly, debuting at the third spot. TTRS (Bulk) made its presence known at fourth place, while SFV OG (Bulk) slipped to fifth, indicating a slight decline in popularity from June. This month marked a significant reshuffling in the rankings, showcasing dynamic changes in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.