Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

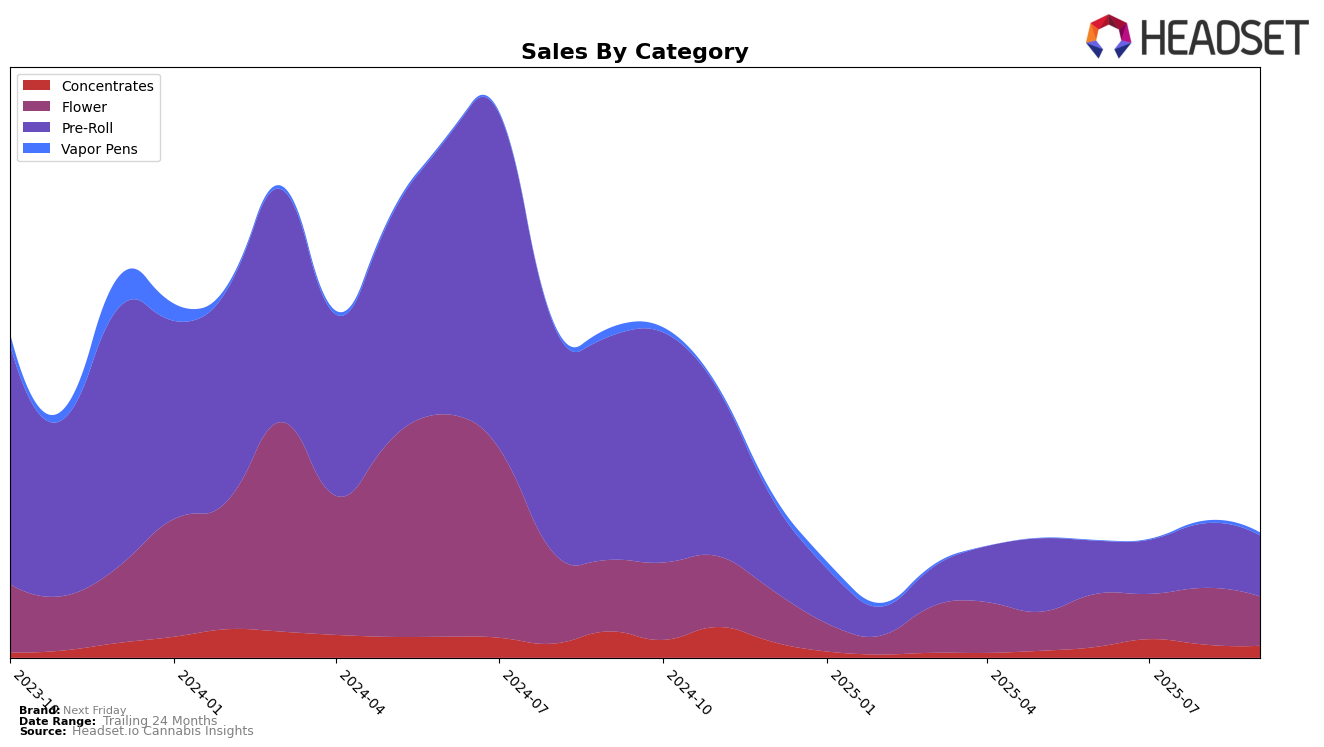

Next Friday has shown varied performance across different categories and provinces. In Alberta, the brand has seen a consistent upward trend in the Flower category, improving its rank from 73rd in June 2025 to 60th by September 2025. This positive movement is complemented by an increase in sales over the months, indicating growing consumer preference. However, the Concentrates category presents a contrasting scenario, where Next Friday was not in the top 30 brands in June and experienced a decline in rank from 26th in July to 37th in September, coupled with decreasing sales figures. This suggests potential challenges in maintaining market share in the Concentrates segment.

In Ontario, Next Friday's entry into the Flower category in August 2025 with a rank of 97th signifies a new market presence, though not yet a significant one. Meanwhile, in Saskatchewan, the Flower category saw the brand debut at 48th in July 2025, maintaining a similar position in August. The Pre-Roll category in Saskatchewan, where Next Friday ranked 65th in June, did not see any further top 30 placements in subsequent months, suggesting either a decline in sales or increased competition. These insights highlight the brand's varying performance and market penetration across different regions and product categories.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Next Friday has shown a steady improvement in rank from June to September 2025, moving from 76th to 66th. This upward trajectory is indicative of a positive trend in sales performance, as evidenced by the increase in sales figures over the same period. In contrast, MTL Cannabis re-entered the top 20 in September after being absent in June and August, suggesting volatility in their market presence. Meanwhile, Divvy has consistently improved its rank, surpassing Next Friday by September, which could indicate a stronger market strategy or product offering. Coterie, despite a significant drop from 30th in July to 63rd in September, still maintains a higher sales volume than Next Friday, highlighting the competitive pressure in the market. Additionally, XPLOR made its debut in the rankings in September, directly competing with Next Friday at 68th, which could further challenge Next Friday's market share if XPLOR's sales momentum continues.

Notable Products

In September 2025, the top-performing product for Next Friday was Mutant Tire Fire Pre-Roll (0.5g), which climbed to the first rank from fifth place in August, with a notable sales figure of 3694. Burner Phone Special Pre-Roll (0.5g) dropped to second place, despite an increase in sales from August. The Next Friday Pre-Roll (0.5g) maintained its third position consistently from August to September. The Burner Phone Special Pre-Roll 14-Pack (7g) held steady at fourth place, showing stable sales performance. Chameleon Connoisseurs Pre-Roll 5-Pack (2.5g) experienced a decline, moving from second place in August to fifth place in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.