Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

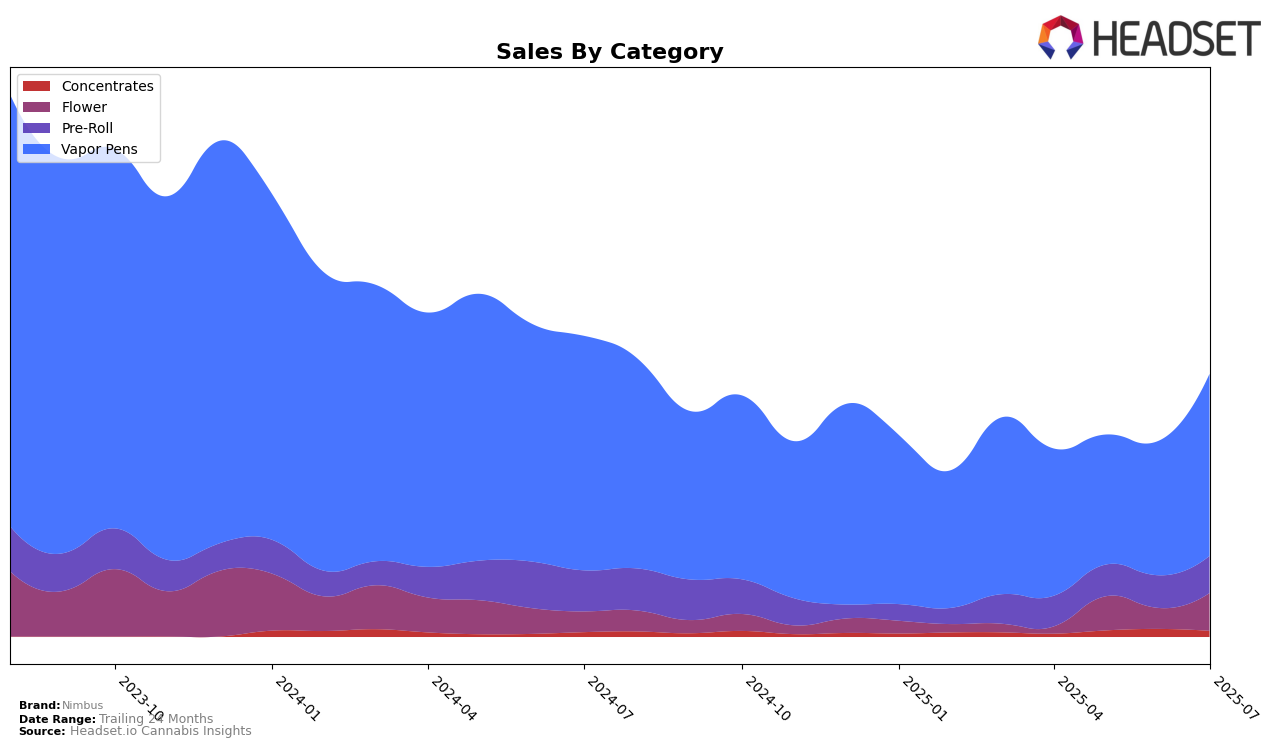

Nimbus has shown varied performance across different categories and states, with notable movements in the Massachusetts market. In the Vapor Pens category, the brand experienced a decline, moving from the 23rd position in April to the 33rd position by July. This indicates a potential challenge in maintaining market share against competitors in this category. Meanwhile, Nimbus's presence in the Concentrates category was not strong enough to secure a spot in the top 30, suggesting room for growth or a need for strategic adjustments. Interestingly, the Pre-Roll category saw a consistent performance, with rankings hovering in the 80s, culminating at 80th in July, which might reflect stable demand for their products in this segment.

In New Jersey, Nimbus demonstrated a positive trajectory in the Vapor Pens category, advancing from the 46th position in April to an impressive 28th by July. This upward trend highlights significant growth and potential increased consumer interest or successful marketing efforts in this state. However, the absence of Nimbus in other categories within New Jersey's top 30 rankings suggests that while they are gaining traction in Vapor Pens, there might be opportunities to expand their presence in other product segments. Understanding these dynamics can provide valuable insights into Nimbus's strategic priorities and market positioning across different regions.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Nimbus has shown a remarkable upward trajectory in its market ranking from April to July 2025. Starting at the 46th position in April, Nimbus climbed to the 28th spot by July, indicating a significant improvement in its market presence. This upward movement is particularly notable when compared to competitors such as Kind Tree Cannabis, which started at 24th and fell to 31st, and Jersey Sauce Boss, which improved from 54th to 29th. Meanwhile, Rosin King of Jersey and The Farmers Market (NJ) also showed positive trends, with Rosin King moving from 47th to 27th and The Farmers Market from 52nd to 26th. Despite these competitors' gains, Nimbus's rapid ascent, especially in July, suggests a strong consumer response and effective market strategies, positioning it as a formidable player in the New Jersey vapor pen market.

Notable Products

In July 2025, the top-performing product for Nimbus was the Beast Coast Berry Distillate Cartridge (1g) in the Vapor Pens category, which climbed to the number one spot with sales reaching 1,652 units. Ya Motha's Lemoncello Distillate Disposable (0.5g) secured the second position, marking its debut in the rankings. Cranberry Kush Distillate Disposable (0.5g) entered the rankings at third place. Ya Motha's Lemoncello Distillate Disposable (1g) dropped from second to fourth, while Masshole Mango Haze Distillate Disposable (1g) fell from first to fifth, reflecting a notable decline in its sales performance over the months. These shifts highlight a dynamic change in consumer preferences within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.