Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

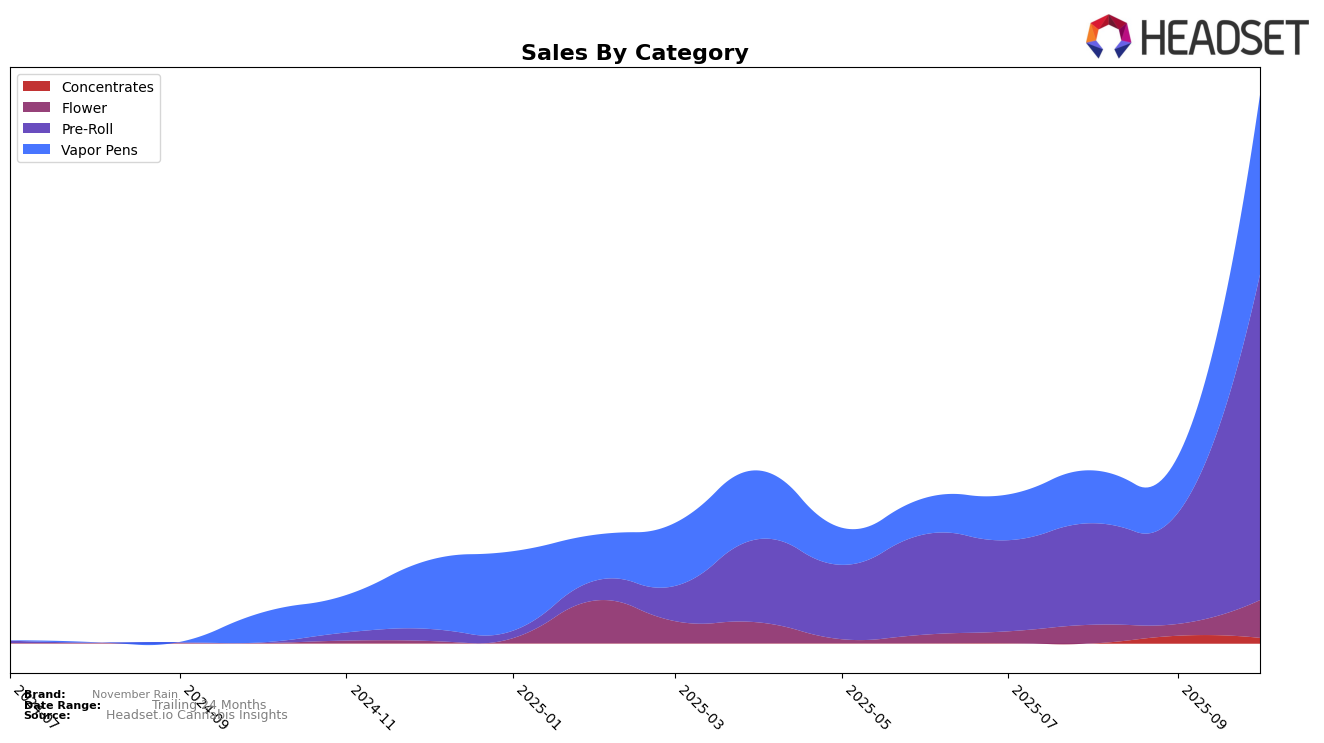

In Alberta, November Rain has shown a fluctuating performance across different cannabis categories. In the Pre-Roll category, the brand did not make it to the top 30 brands, with rankings remaining above 85 throughout the months from July to October 2025. This indicates a struggle to gain a foothold in this category within Alberta. However, in the Vapor Pens category, November Rain managed to break into the top 30 by August 2025, peaking at rank 51 in September before slightly dropping to rank 56 in October. This movement suggests a growing acceptance and potential for further growth in the Vapor Pens market in Alberta.

In British Columbia, November Rain's performance in the Pre-Roll category is noteworthy, particularly in October 2025 when it jumped to rank 29 from a consistent ranking in the 80s in previous months. This significant improvement indicates a successful strategy or product offering that has resonated well with consumers. Additionally, in the Vapor Pens category, the brand also achieved a rank of 29 in October, demonstrating a strong presence in this segment as well. However, the Flower category remains a challenge, as November Rain was not ranked in the top 30 brands until October, where it finally appeared at rank 88. This suggests potential for growth if the brand can replicate its success from other categories.

Competitive Landscape

In the British Columbia Pre-Roll category, November Rain has shown a significant improvement in its market position from July to October 2025. Initially ranked outside the top 20, November Rain made a remarkable leap to 29th place in October, indicating a strong upward trend in its market presence. This improvement in rank is mirrored by a substantial increase in sales, which surged notably in October. In contrast, Sitka Weedworks also experienced a dramatic rise in rank, moving from 97th in September to 33rd in October, but November Rain's sales growth outpaced Sitka Weedworks during this period. Meanwhile, Castle Rock Farms and Just Kush both saw fluctuations in their rankings, with Castle Rock Farms dropping to 28th in October from a consistent top 15 position, and Just Kush climbing to 27th. Happy Hour (BC) maintained a relatively stable presence, ending October at 30th. November Rain's trajectory suggests a growing consumer interest and potential for further market penetration, setting it apart from its competitors who have experienced more volatile changes in rank and sales.

Notable Products

In October 2025, November Rain's top-performing product was Dreamcatcher Pre-Roll 2-Pack (2g), ranking first with notable sales of 4,143 units. Midnight Kruntz Pre-Roll 10-Pack (5g) maintained its position at second place, consistent from August and September, with sales increasing to 3,179 units. Midnight Kruntz Pre-Roll 2-Pack (2g) secured the third spot, showing a strong debut in the rankings. Platinum Sunrise Distillate Biogradable Disposable (0.5g) and Blaster Fruity Pre-Roll 12-Pack (6g) followed in fourth and fifth positions, respectively, both entering the rankings for the first time. The rankings highlight a strong preference for pre-roll products among consumers, with Dreamcatcher Pre-Roll 2-Pack (2g) leading the way.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.