Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

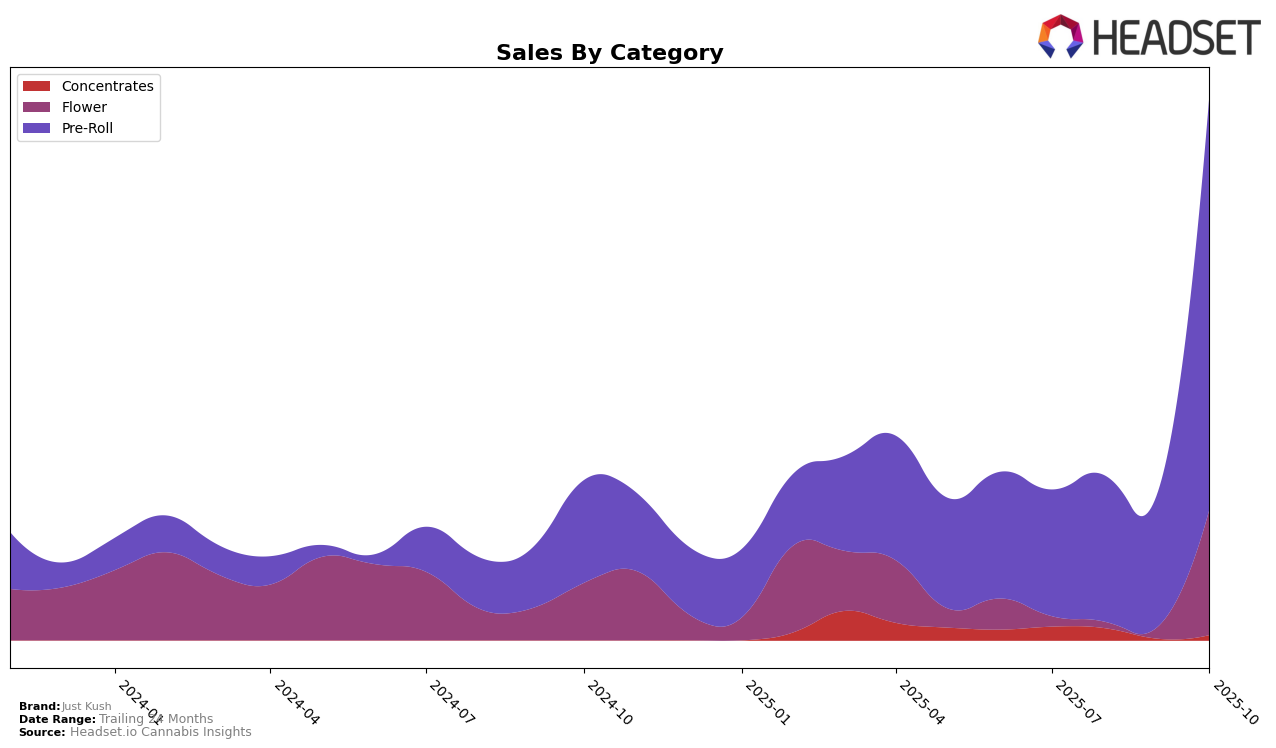

In the province of British Columbia, Just Kush has shown a dynamic performance across various product categories. Notably, in the Pre-Roll category, the brand has made a significant leap in rankings, moving from the 62nd position in July to an impressive 27th position by October. This upward trajectory is indicative of a growing consumer preference for their pre-roll offerings. However, in the Concentrates category, Just Kush did not rank in the top 30, which may suggest a need for strategic adjustments in this segment. Meanwhile, the Flower category also saw Just Kush missing from the top 30 rankings, highlighting another area where the brand could potentially focus on improving its market presence.

The sales data further illustrates the brand's performance trends. For instance, the Pre-Roll category experienced a notable increase in sales from July to October, reflecting the brand's improved ranking and possibly indicating successful marketing or product innovation strategies. On the other hand, the absence of Just Kush in the top 30 for both Concentrates and Flower categories suggests these areas might not be resonating as well with consumers, or face strong competition, potentially impacting the brand's overall market share in British Columbia. These insights into category performance and regional dynamics provide a snapshot of Just Kush's market positioning, underscoring areas of strength and opportunities for growth.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Just Kush has demonstrated a significant upward trajectory in its market presence, particularly in October 2025. Initially ranked 62nd in July, Just Kush maintained a similar position through August and September, ranking 62nd and 63rd respectively. However, by October, Just Kush surged to the 27th position, an impressive leap that coincided with a substantial increase in sales. This upward movement contrasts sharply with competitors like Dab Bods and Castle Rock Farms, both of which experienced a decline in rank, dropping to 26th and 28th respectively in October. Meanwhile, Happy Hour entered the rankings at 25th in October, while November Rain improved to 29th. The data suggests that Just Kush's strategic initiatives or product offerings have resonated well with consumers, allowing it to outpace several established brands and gain a stronger foothold in the market.

Notable Products

In October 2025, Just Kush's top-performing product was VIP Kush Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from the previous two months with impressive sales of 8235 units. Mach 1 Pre-Roll (1g) held steady at the second spot, consistently following VIP Kush since August, with notable sales growth. Five Fires Pre-Roll 5-Pack (5g) remained in third place, showing stable performance across all months. New to the rankings, Durban Lemon Poison Pre-Roll (1g) debuted at fourth place, indicating a strong market entry. Heaviez GCG Pre-Roll (2g) experienced a slight drop, moving from fourth to fifth position, despite steady sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.