Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

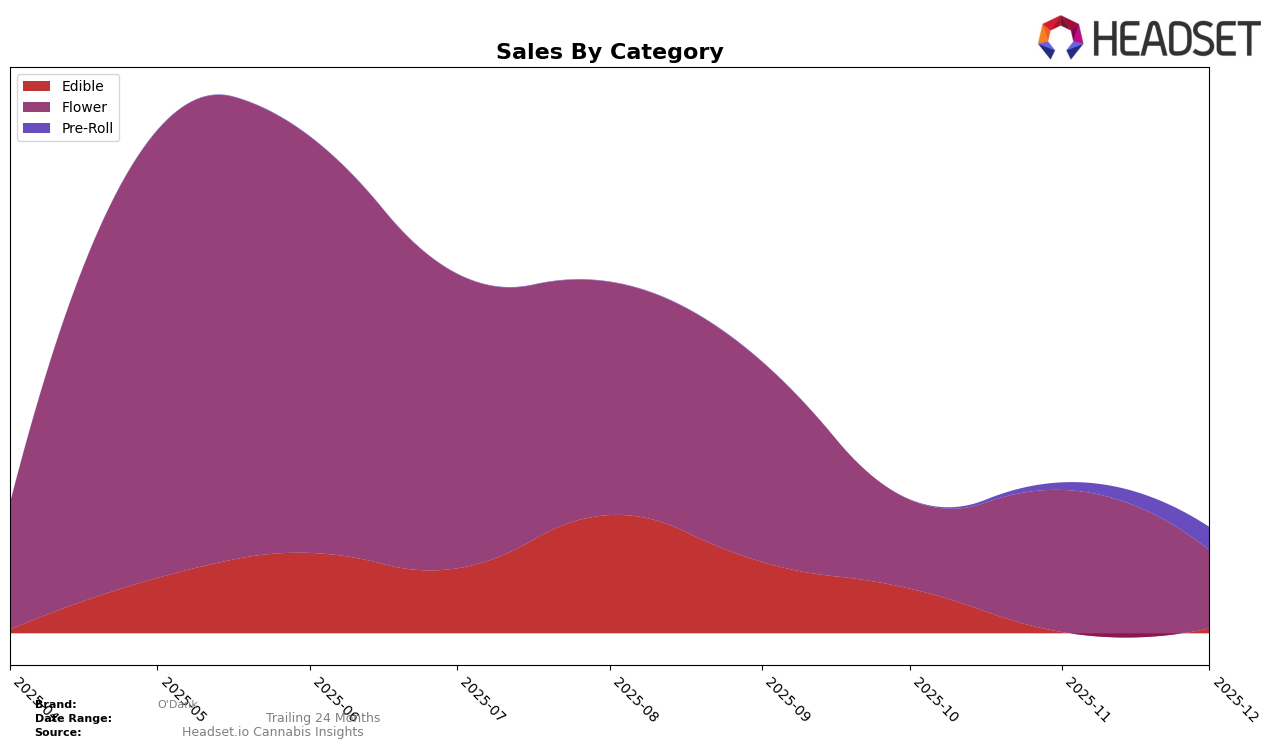

In Ohio, O'Dank's performance across different categories shows a mix of both promising and challenging trends. In the Edible category, O'Dank's ranking fell from 30th in September 2025 to outside the top 30 by October, indicating a downward trend that might be concerning for stakeholders. This drop is significant, as it suggests a loss of traction in a competitive category. Conversely, their performance in the Flower category has seen some fluctuations, with rankings moving from 44th in September to 57th in October, then improving to 47th in November, but slipping again to 55th in December. This volatility suggests that while there is interest in O'Dank's Flower products, maintaining a consistent market position remains a challenge.

Interestingly, O'Dank's entry into the Pre-Roll category in Ohio shows potential, as they achieved a 30th place ranking by December 2025, marking their debut in the top 30. This indicates a positive reception in this category, which could be a strategic area for growth. However, the absence of rankings in other months suggests that while they have made an impact, sustaining this momentum will be crucial. Despite these mixed results, the overall sales trends across categories reveal a dynamic market presence that could benefit from strategic adjustments to capitalize on emerging opportunities and address areas of decline.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, O'Dank has experienced notable fluctuations in rank and sales over the last few months of 2025. O'Dank's rank saw a decline from 44th in September to 57th in October, before slightly recovering to 47th in November, and then dropping again to 55th in December. This volatility contrasts with the more stable performance of competitors like Khalifa Kush, which improved its rank from 56th in September to 50th by December, and Wellspring Fields, which maintained a relatively consistent presence, peaking at 48th in October. Meanwhile, Kynd Cannabis Company experienced a decline in rank from 42nd in September to 53rd by December, indicating a potential opportunity for O'Dank to capitalize on its competitors' challenges. Despite these rank changes, O'Dank's sales have shown a downward trend, particularly in October and December, suggesting a need for strategic adjustments to regain market share and improve sales performance in this competitive market.

Notable Products

In December 2025, the top-performing product for O'Dank was Sour K Pre-Roll 2-Pack (1g), securing the number one rank with a notable sales figure of 1,460 units. Gelato Cookies Pre-Roll 2-Pack (1g) followed closely in the second position. Gazzurple (14.15g) maintained a strong presence in the Flower category, ranking third, despite dropping from its second position in November. Lemon Cherry Sorbet Popcorn (14.15g) ranked fourth, showing a decline in sales compared to the previous month. Pineapple Gummies 11-Pack (110mg) slipped to the fifth position, a significant drop from its consistent first place in September and October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.