Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

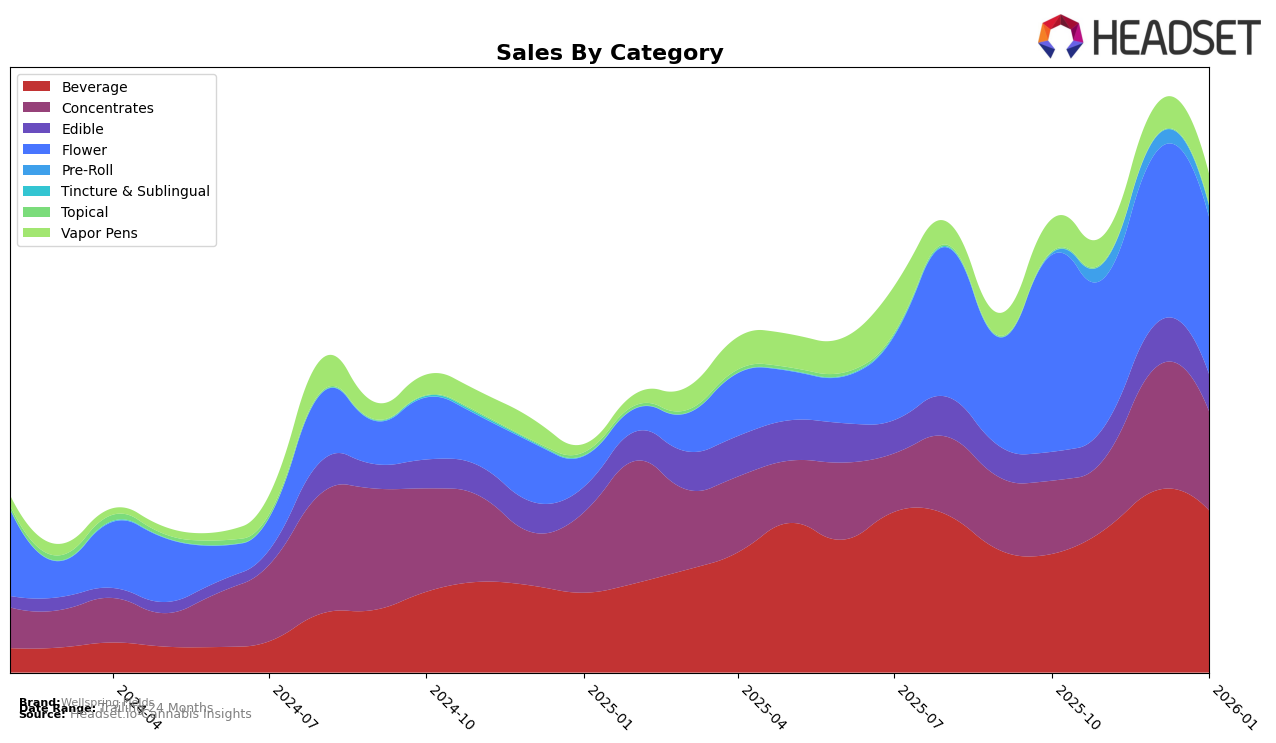

In the state of Ohio, Wellspring Fields has demonstrated strong performance in the Beverage category, securing the top rank from November 2025 through January 2026. This consistent leading position is indicative of their dominance and popularity in this segment, with a notable peak in sales during December 2025. In contrast, their presence in the Pre-Roll category has been more volatile. Despite not being in the top 30 in October 2025, they managed to enter the rankings in November and maintained a presence through January, albeit with a declining trend in their rank. Such fluctuations suggest a competitive landscape in this category that Wellspring Fields is still navigating.

Wellspring Fields' performance in the Concentrates category in Ohio has seen an upward trend, with the brand moving from the 12th position in October 2025 to achieving a higher rank of 8th in December 2025, before slightly dropping to 10th in January 2026. This indicates a positive reception and growing demand for their products in this segment. However, their performance in the Edibles and Vapor Pens categories has been less impressive, with rankings consistently outside the top 30, highlighting areas that potentially require strategic focus to improve market penetration and consumer appeal. The Flower category also shows potential for growth, as Wellspring Fields managed to improve its ranking slightly from October to December 2025, though maintaining consistency remains a challenge.

Competitive Landscape

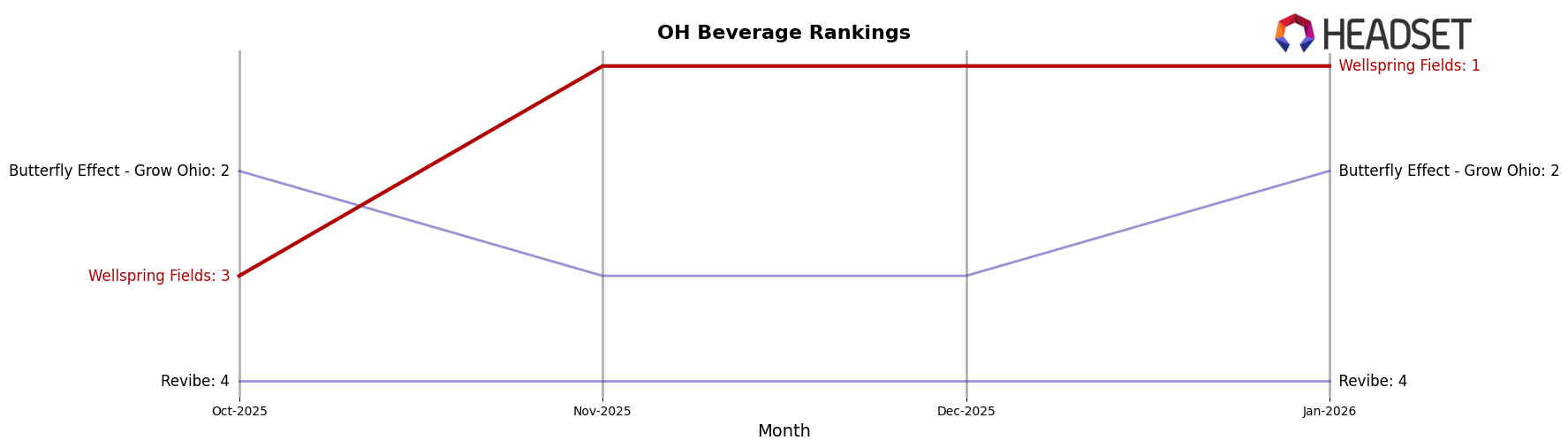

In the competitive landscape of the Ohio beverage cannabis market, Wellspring Fields has demonstrated a remarkable upward trajectory, securing the top rank from November 2025 through January 2026. This ascent is particularly notable given its initial third-place position in October 2025. The brand's strategic initiatives have evidently paid off, as reflected in its sales growth, which saw a significant increase from October to December 2025 before a slight dip in January 2026. This performance has allowed Wellspring Fields to surpass Butterfly Effect - Grow Ohio, which fluctuated between second and third place during the same period, and maintained a consistent lead over Revibe, which held steady in fourth place. The data suggests that Wellspring Fields' dominance in the Ohio market is driven by its ability to capture consumer interest and maintain strong sales momentum, positioning it as a formidable leader in the beverage category.

Notable Products

In January 2026, the top-performing product for Wellspring Fields was Platinum Neon Pre-Roll (0.35g) in the Pre-Roll category, maintaining its first-place rank from the previous two months with sales of 2441 units. Dr. Feel Better's - Root Beer Extra Strength Elixir Soda 2-Pack (220mg THC, 12oz) climbed to the second position in the Beverage category with notable sales of 872 units, marking its reappearance in the rankings after being unranked in the preceding months. Project Red Pre-Roll (0.35g) held steady in the third spot, although its sales decreased compared to December. Dr. Feel Better's - Purple Nurple Elixir Soda (50mg) in the Beverage category moved up to fourth place from fifth in December. Strawberries and Cream (2.83g) in the Flower category re-entered the rankings at fifth place, despite not being ranked in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.