Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

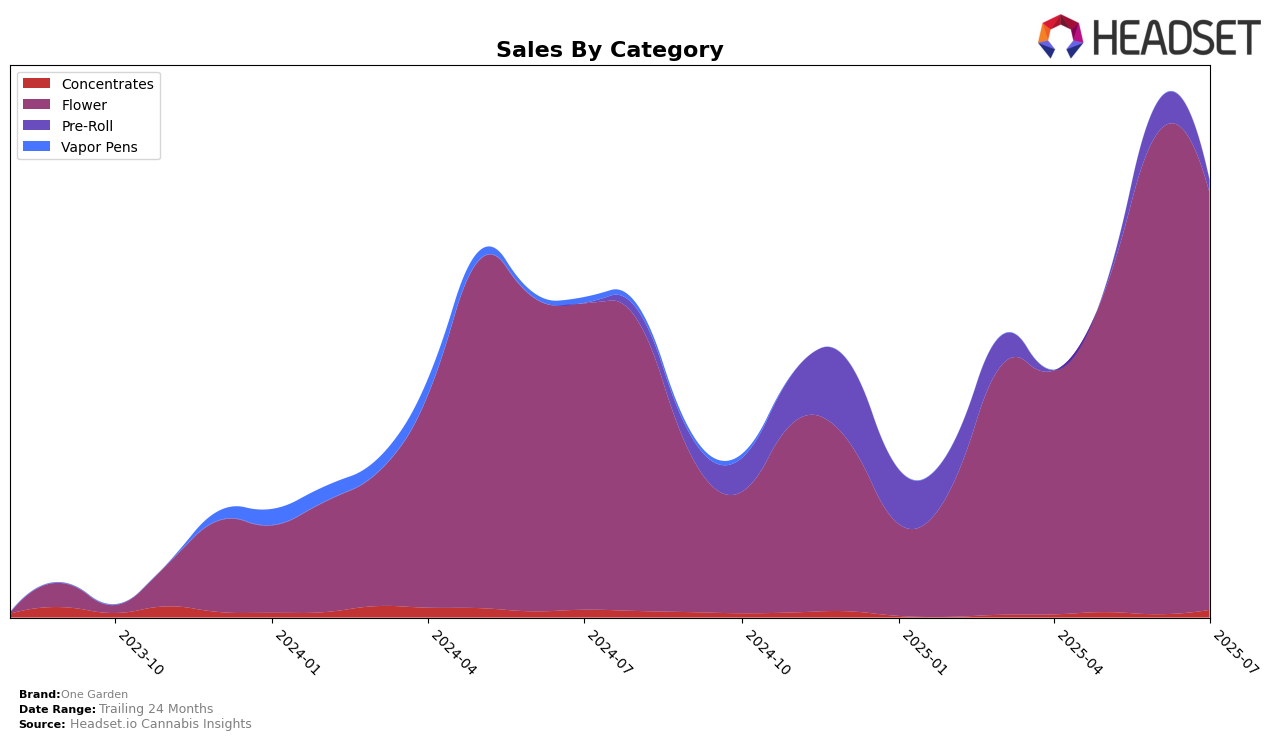

One Garden has shown a notable upward trajectory in the Michigan market, particularly in the Flower category. The brand climbed from a rank of 48 in April 2025 to 21 by June, before slightly dipping to 25 in July. This movement suggests a strong consumer response and growing market presence, as evidenced by the increase in sales from $572,144 in April to over $1.1 million in June. However, the slight decline in July indicates potential competition or market saturation challenges that the brand may need to address to maintain its momentum.

In contrast, One Garden's performance in the Pre-Roll category in Michigan has been less prominent, as they were not ranked in the top 30 until June, when they appeared at rank 99. This absence from the top rankings in earlier months highlights an area for potential growth and strategic focus, as it indicates a weaker market penetration compared to their Flower products. The lack of sales figures for May and June suggests that the brand might have been testing or slowly rolling out products in this category, or facing challenges in gaining traction among consumers. Addressing these issues could be key to expanding their overall market share in Michigan.

Competitive Landscape

In the competitive landscape of the Michigan flower category, One Garden has shown a remarkable upward trajectory in rank and sales over the past few months. Starting from a rank of 48 in April 2025, One Garden improved significantly to reach the 21st position by June 2025, before settling at 25 in July. This upward movement is indicative of a robust growth strategy, as One Garden's sales surged from April to June, nearly doubling during this period. In contrast, competitors like Grown Rogue and Hytek experienced fluctuating ranks, with Grown Rogue dropping out of the top 20 in May and July, and Hytek slipping to 28th in June. Meanwhile, Galactic and Uplyfted Cannabis Co. maintained relatively stable positions, though their sales did not exhibit the same growth momentum as One Garden. This indicates that One Garden's recent strategies may be effectively capturing market share from these established brands, positioning it as a rising player in the Michigan flower market.

Notable Products

In July 2025, the top-performing product for One Garden was Gaseous Clay (Bulk) in the Flower category, securing the number one rank with notable sales of $42,898. Kenny Flowers (Bulk) followed closely in second place, while Gastro Pop (Bulk) dropped from its previous top position in April to third place. Bob Hope (Bulk) and Melonade (Bulk) rounded out the top five, ranking fourth and fifth, respectively. The rankings indicate a shift in consumer preference from Gastro Pop (Bulk) to Gaseous Clay (Bulk) over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.