Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

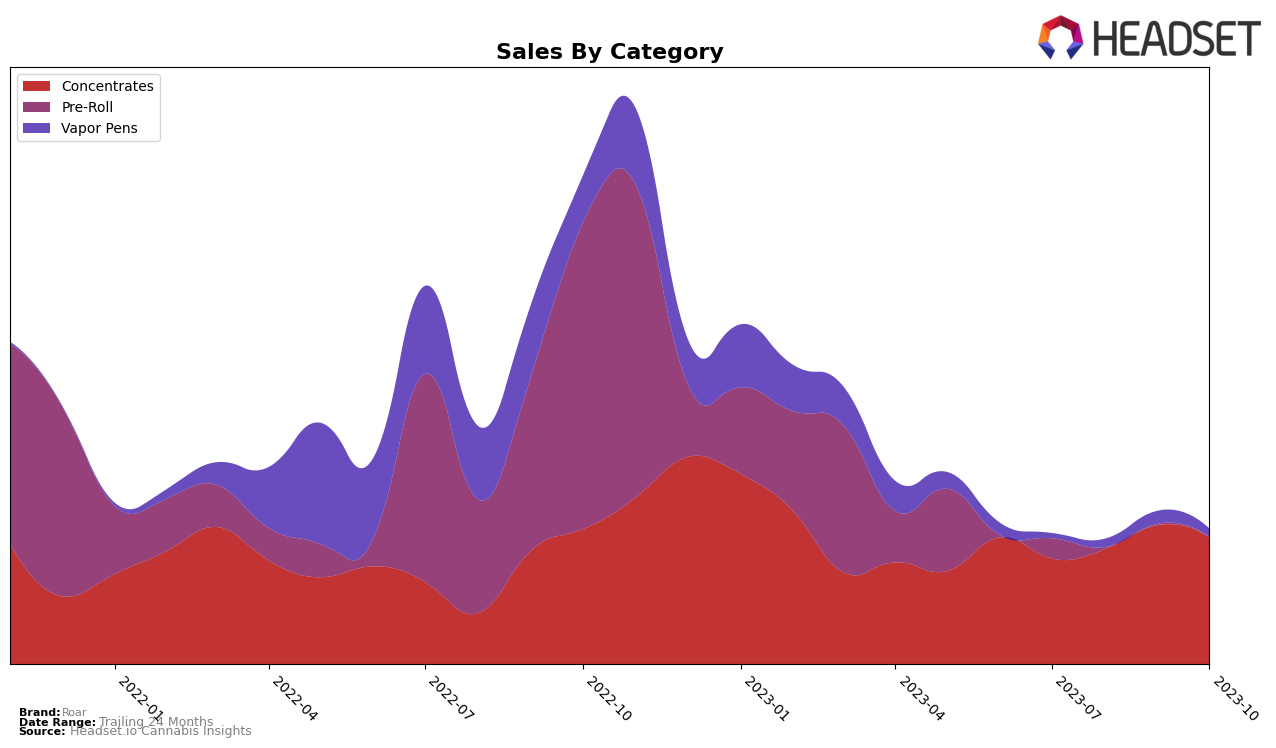

Roar, a cannabis brand in Nevada, has been consistently performing well in the Concentrates category, maintaining a rank within the top 20 for the months of July to October 2023. The brand saw a slight improvement in their ranking, moving from 16th place in July to 15th in October, which suggests a growing popularity amongst consumers. However, the brand's performance in the Pre-Roll category is not as stellar, as it did not make it to the top 20 rankings in August, September, and October. This could be an area of improvement for the brand.

On the other hand, Roar's performance in the Vapor Pens category showed some volatility. The brand's ranking fluctuated from 83rd in July to 67th in September, before settling at 72nd in October. Despite not being in the top 20, the brand did see an increase in sales over this period, hinting at some positive growth. While Roar's performance in Nevada's cannabis market has been varied, it's clear that the brand has a solid foothold in the Concentrates category, which could be a key focus for future growth.

Competitive Landscape

In the Nevada concentrates market, Roar has maintained a steady position, ranking 16th in July, August, and September of 2023, and improving slightly to 15th in October. This consistency contrasts with the fluctuating ranks of its competitors. For instance, Roots dropped from 4th to 17th place over the same period, while CAMP (NV) and Tidal, despite not being in the top 20 in July, climbed to 13th and 14th place respectively by October. Grassroots also experienced a decline, falling from 11th to 16th place. In terms of sales, while Roar's sales have shown a steady increase, its competitors have seen more significant fluctuations, with some brands experiencing higher sales peaks, but also lower troughs. This data suggests that while Roar may not be the top performer in the Nevada concentrates market, its stability could be a strength in a volatile market.

Notable Products

In October 2023, the top-performing product from Roar was 'High Roller Sugar (0.5g)', with sales reaching 1204 units. This product maintained its top rank from the previous month. The second best-selling product was 'Grape Animals Wax (Half Gram)', which also held its position from September, with significant sales growth. 'Day Dream Sugar (0.5g)' dropped to the third rank, despite an increase in sales. New entries to the top five were 'Nova Cake Sugar Wax (0.5g)' and 'Zeppelins Sour Grape Sugar Wax (0.5g)', ranking fourth and fifth respectively.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.