Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

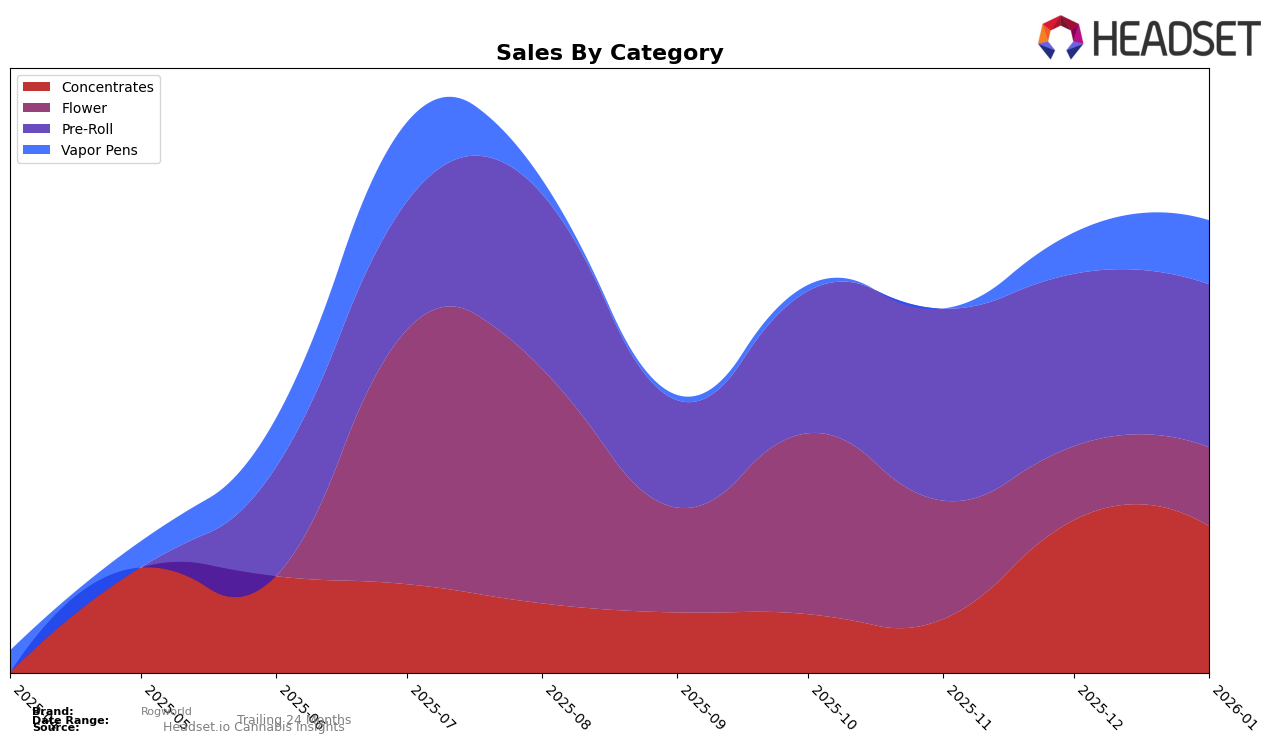

Rogworld has shown noteworthy performance in the British Columbia cannabis market, particularly in the Concentrates category. Starting from not being ranked in the top 30, Rogworld made a significant leap to secure the 32nd spot by December 2025 and further improved to 25th in January 2026. This upward trajectory suggests a growing consumer preference for their concentrates, reflecting effective market penetration and possibly enhanced product offerings. However, in the Flower and Pre-Roll categories, Rogworld did not make it to the top 30 rankings, which could indicate either a more competitive market landscape or a need for strategic adjustments in these segments.

Despite not breaking into the top 30 for Flower and Pre-Roll in British Columbia, Rogworld's sales figures in these categories still indicate a presence that should not be overlooked. Their performance in the Concentrates category, where they have shown consistent improvement, could provide insights into successful strategies that might be applied to other categories. The absence from the top 30 in Flower and Pre-Roll could be viewed as a challenge or an opportunity for growth, depending on the brand's strategic priorities and market conditions. Understanding these dynamics could offer valuable lessons for Rogworld's future positioning and expansion efforts across different product lines and regions.

Competitive Landscape

In the competitive landscape of the Concentrates category in British Columbia, Rogworld has shown a notable upward trajectory, particularly in the recent months. Despite not being in the top 20 brands in October and November 2025, Rogworld climbed to the 32nd position in December 2025 and further improved to the 25th position by January 2026. This positive momentum suggests a strengthening market presence and potentially increasing consumer preference. In contrast, RAD (Really Awesome Dope) experienced a decline, dropping from the 29th position in November 2025 to the 31st in December 2025, before slightly recovering to the 23rd position in January 2026. Meanwhile, EarthWolf Farms maintained a relatively stable rank, hovering around the mid-20s, while Happy Hour brands showed fluctuating ranks but remained outside the top 20. Rogworld's recent rank improvements could indicate an effective marketing strategy or product innovation that resonates well with consumers, positioning it as a brand to watch in the coming months.

Notable Products

In January 2026, the top-performing product for Rogworld was the Bong Guru Rockstar Pre-Roll 5-Pack (2.5g), maintaining its first-place rank consistently from October 2025 with a notable sales figure of 748 units. Strawberry OG Whipped Live Resin (1g) held the second position since its emergence in December 2025, indicating steady popularity in the Concentrates category. The Bong Guru Rockstar Pre-Roll (1g) ranked third, showing a slight dip from its peak in December 2025. Lemonade Octane Live Resin Disposable (1g) remained in fourth place since its introduction in December 2025, suggesting stable demand in the Vapor Pens category. Lastly, Cadillac Rainbow Pre-Roll (1g) debuted at fifth place, adding diversity to the Pre-Roll category offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.