Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

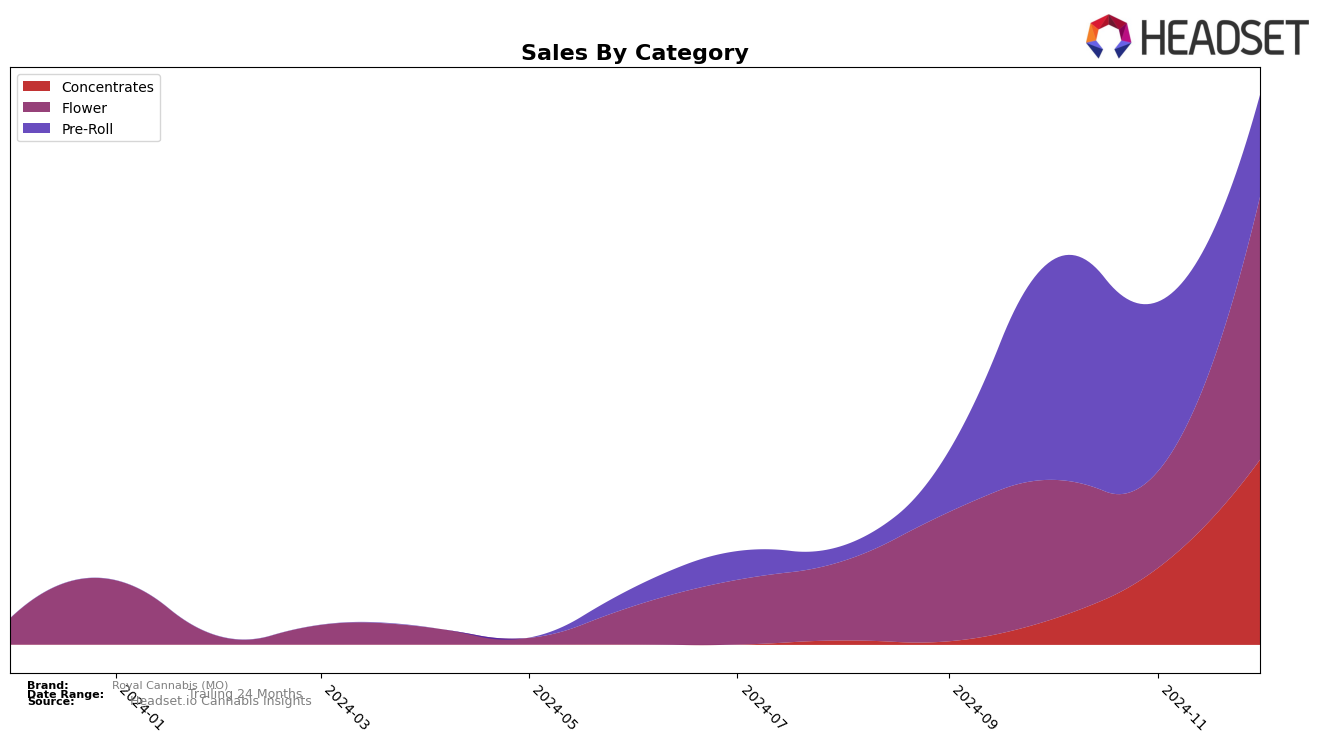

Royal Cannabis (MO) has demonstrated notable growth in the Missouri market, particularly in the Concentrates category. In December 2024, the brand climbed to the 26th position, marking a significant improvement from previous months where it was not in the top 30. This ascent highlights Royal Cannabis's increasing popularity and penetration in the Concentrates sector. Meanwhile, in the Flower category, the brand showed a steady performance, maintaining a position just outside the top 50 until December, when it moved up to rank 46. This upward trend in Flower sales suggests a growing consumer base and effective market strategies.

In the Pre-Roll category, Royal Cannabis (MO) experienced a fluctuating trajectory. The brand surged to the 33rd position in October, a remarkable rise from its 57th spot in September, before slightly declining to 39th in November and settling at 46th in December. Despite this volatility, the ability to consistently stay within the top 50 indicates resilience and potential for further growth. The brand's performance in Missouri reflects a dynamic market presence, with strengths in Concentrates and promising movements in Flower and Pre-Rolls, suggesting areas for strategic focus and potential expansion in the coming months.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Royal Cannabis (MO) has experienced fluctuating ranks over the last few months, indicating a dynamic market presence. Notably, the brand improved its position from 51st in November 2024 to 46th in December 2024, suggesting a positive trend in market performance. However, it remains behind competitors like The Standard, which consistently held higher ranks, peaking at 33rd in October 2024. Meanwhile, Willie's Reserve and Cubano have shown varying ranks, with Willie's Reserve not appearing in the top 20 for November, and Cubano maintaining a stable presence around the mid-40s. This competitive environment highlights the challenges Royal Cannabis (MO) faces in climbing the ranks, as well as the opportunities for growth by capitalizing on its recent upward trend in December.

Notable Products

In December 2024, the top-performing product for Royal Cannabis (MO) was Tropicana Cherries Live Crumble (1g) in the Concentrates category, which climbed to the number one rank with sales of 1092. Grape Bubblegum (3.5g), a Flower category product, secured the second spot, showing a strong entry in the rankings. Loma Prieta Live Budder (1g) also performed well, moving up to third place from fifth in November, indicating a significant increase in demand. Mango Mentality (3.5g) and Motor Head (3.5g), both Flower category products, took the fourth and fifth positions, respectively, marking their first appearance in the top ranks. Overall, the data reflects a noticeable shift in consumer preferences towards Concentrates, with Tropicana Cherries Live Crumble leading the charge.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.