Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

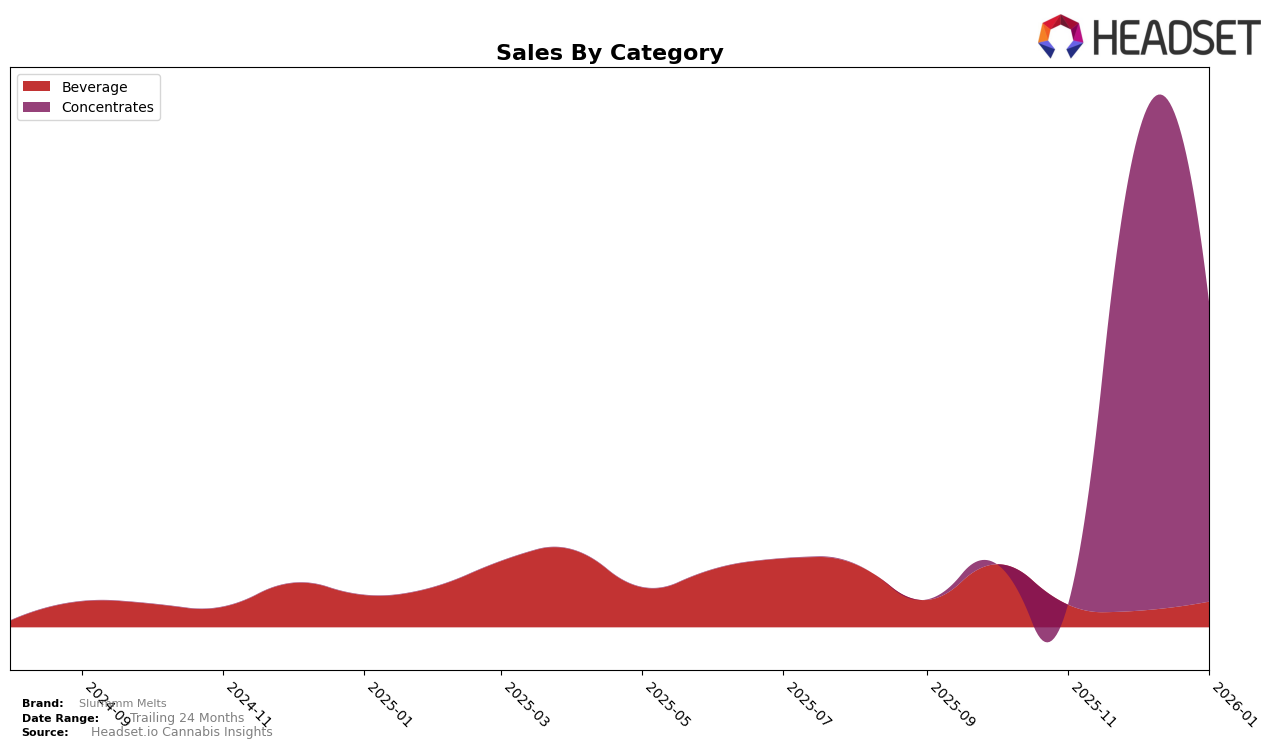

In the Canadian province of British Columbia, Slurmmm Melts has shown a notable presence in several cannabis categories. In the Beverage category, the brand achieved a rank of 13 in October 2025, but did not maintain a position within the top 30 in the subsequent months. This drop suggests a potential need for strategic adjustments or increased competition in the market. In contrast, the Concentrates category has been a more stable area for Slurmmm Melts, where it entered the top 10 by December 2025 and maintained a respectable 11th position in January 2026. This indicates a consistent demand for their concentrates products, which could be a key focus area for future growth.

Across different categories, Slurmmm Melts' performance highlights both opportunities and challenges within the British Columbia market. The absence of rankings in certain months for the Beverage category might reflect either a shift in consumer preferences or increased competition. However, the brand's ability to climb into the top 10 for Concentrates by December 2025 suggests a strong product offering in this category. This upward trend in Concentrates, coupled with a significant sales figure of 116,648 CAD in December, underscores the potential for Slurmmm Melts to capitalize on this momentum and possibly expand their market share. Further analysis would be beneficial to understand the underlying factors contributing to these trends and to identify strategic opportunities for growth.

Competitive Landscape

In the competitive landscape of concentrates in British Columbia, Slurmmm Melts has shown a dynamic shift in its market position from October 2025 to January 2026. Initially absent from the top 20 ranks, Slurmmm Melts made a notable entry in December 2025, securing the 7th position, before experiencing a slight dip to 11th in January 2026. This fluctuation highlights a competitive environment where brands like Pura Vida consistently maintained a strong presence, ranking between 7th and 9th throughout the period. Meanwhile, Dab Bods also demonstrated resilience, moving from a non-ranked position in October to 9th by January. The rise of Stigma Grow from 31st to 18th, and the fluctuating performance of Green Amber, further illustrate the competitive pressures Slurmmm Melts faces. These dynamics suggest that while Slurmmm Melts has achieved significant sales momentum, maintaining and improving its rank will require strategic efforts to outpace these established competitors.

Notable Products

In January 2026, the top-performing product for Slurmmm Melts was the Lemon Lime Live Rosin Soda in the Beverage category, maintaining its position as the leader with sales of 723 units. The Grape Peel Live Hash Rosin in the Concentrates category held steady at the second position, showing consistent performance since December 2025. The Runtz Live Hash Rosin, also in the Concentrates category, experienced a slight drop in ranking from first place in December 2025 to third in January 2026. Lemon Royale Live Hash Rosin ranked fourth in January, having declined from its third position in the previous month. Overall, the Beverage category's Lemon Lime Live Rosin Soda demonstrated strong performance, reclaiming its top spot from October 2025 after a brief dip in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.