Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

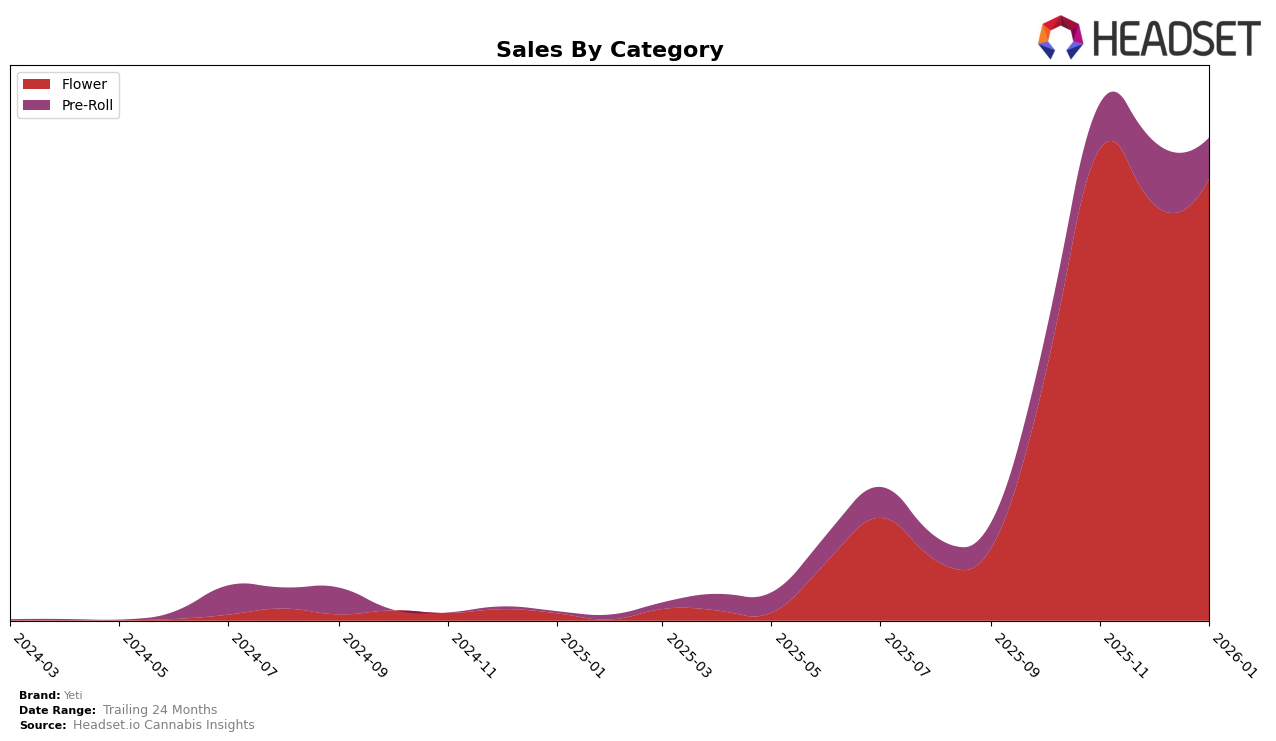

Yeti has shown a notable performance in the New Jersey market, particularly in the Flower category, where it climbed from the 25th position in October 2025 to secure the 11th spot by November 2025. This upward movement indicates a strong market penetration and growing consumer preference. However, the brand maintained its rank at 13th place in both December 2025 and January 2026, suggesting a stabilization in its market position within this category. In contrast, Yeti's performance in the Pre-Roll category in New Jersey has been more volatile, with rankings fluctuating from 51st in October 2025 to 36th in December 2025, before dropping to 42nd in January 2026. This suggests potential challenges in maintaining consistent consumer interest in this segment.

In Oregon, Yeti's presence in the Pre-Roll category appears less robust. Despite a brief improvement in November 2025, where the brand reached the 44th position, it was unable to sustain this momentum, falling to 55th in December 2025. By January 2026, Yeti did not appear in the top 30 rankings, indicating a significant struggle to capture a substantial market share in this state. This absence from the top rankings highlights a need for strategic adjustments to enhance brand visibility and consumer engagement in Oregon's competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Yeti has shown a notable upward trajectory in its market position. Starting from outside the top 20 in October 2025, Yeti surged to the 11th rank by November and maintained a steady position at 13th in December and January 2026. This rise indicates a significant improvement in market presence and consumer preference. In contrast, Seed & Strain Cannabis Co. experienced a slight decline, dropping from 8th to 12th place over the same period, which could suggest a shift in consumer loyalty or market dynamics. Meanwhile, Crops saw a gradual decline from 6th to 11th place, indicating potential challenges in maintaining their market share. Interestingly, Cookies and Good Green both improved their rankings, with Cookies climbing from 22nd to 15th and Good Green from 21st to 14th, showcasing their growing appeal. Yeti's consistent performance and strategic positioning have allowed it to capture a more significant share of the market, setting a promising outlook for future growth.

Notable Products

In January 2026, Yeti's top-performing product was Grape Goddess (3.5g) in the Flower category, securing the top rank with sales of 4,493 units. Big Mac (3.5g) followed closely in second place, demonstrating strong market presence. Blue Pineapple (3.5g) achieved the third rank, while Sweetie Pie (3.5g) and Hellcat #15 (3.5g) rounded out the top five. Notably, these products were not ranked in the previous months, indicating a significant rise in popularity or a new product launch. The consistent sales figures suggest that Yeti's Flower category is performing well in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.