Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

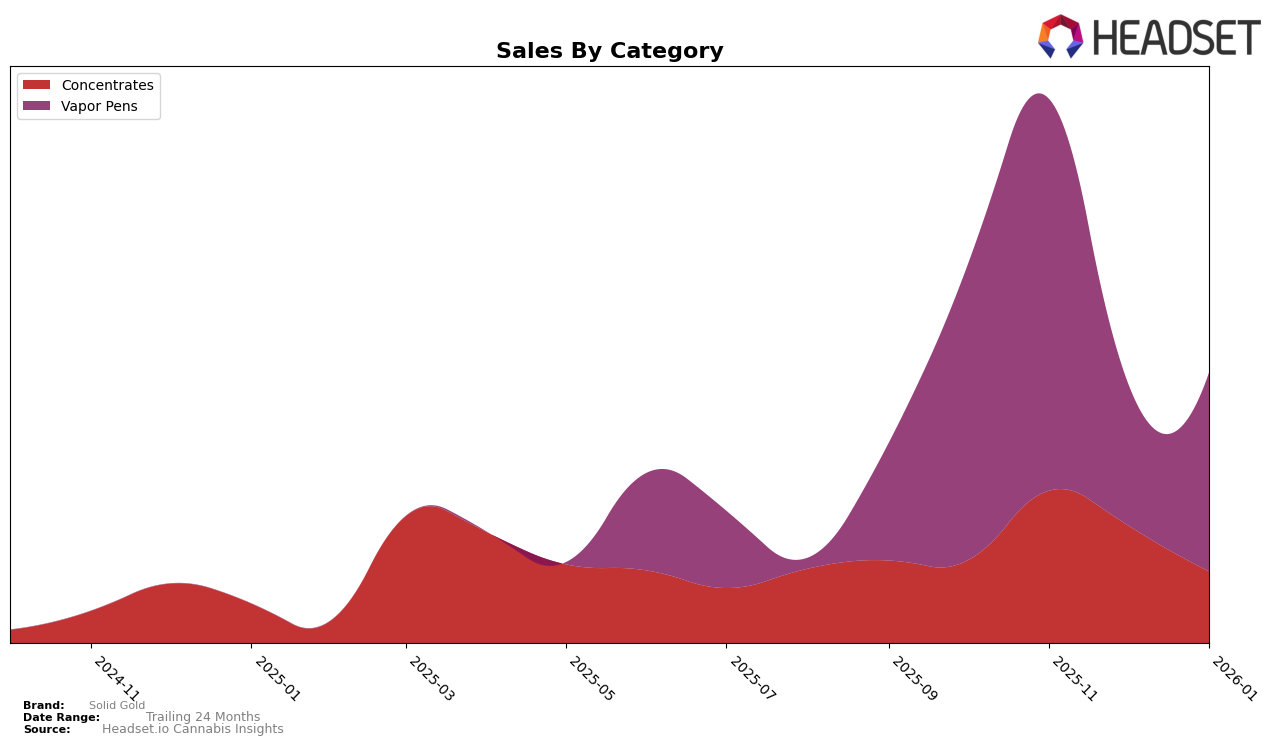

Solid Gold's performance in the Canadian cannabis market shows a varied trajectory across different provinces and product categories. In Alberta, the brand has maintained a presence in the Concentrates category, though it has slipped slightly from a rank of 30 in October 2025 to 33 by January 2026. This suggests a competitive environment where Solid Gold is struggling to maintain a top position. The Vapor Pens category in Alberta tells a similar story, with fluctuating rankings that saw the brand fall out of the top 30 in November 2025 before returning to rank 86 by January 2026, indicating challenges in sustaining consumer interest or market share. Meanwhile, in British Columbia, Solid Gold's performance in the Concentrates category started strong in November 2025 at rank 27 but declined to 35 by January 2026, a sign of increasing competition or shifting consumer preferences.

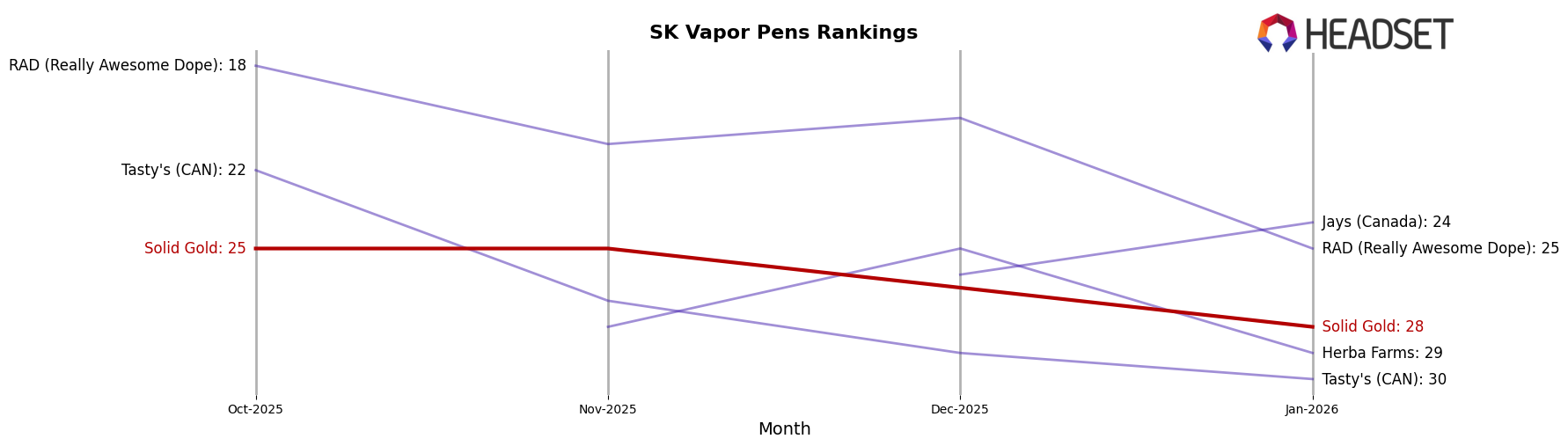

In British Columbia, the Vapor Pens category showed a significant drop in rankings, from 26 in October 2025 to 53 by January 2026. This decline could point to a need for strategic adjustments to regain consumer traction. On the other hand, in Saskatchewan, Solid Gold had a noteworthy performance in the Concentrates category, achieving a rank of 14 in November 2025, but then disappearing from the top rankings in subsequent months. This absence might be concerning for the brand's market presence and indicates potential areas for improvement. The Vapor Pens category in Saskatchewan saw a consistent presence, maintaining a rank of 25 in October and November 2025, before dropping out of the rankings in December and returning to 28 by January 2026. This pattern suggests variability in consumer demand or competitive dynamics that Solid Gold needs to navigate carefully.

Competitive Landscape

In the competitive landscape of vapor pens in Saskatchewan, Solid Gold has demonstrated a fluctuating presence, with its rank showing notable changes over the months. In October 2025, Solid Gold was ranked 25th, and it maintained this position in November before dropping out of the top 20 in December. However, by January 2026, it climbed back to 28th place. This fluctuation in rank is mirrored in its sales figures, which saw a significant increase from November to January. In contrast, RAD (Really Awesome Dope) experienced a downward trend, dropping from 18th to 25th, with sales consistently declining over the same period. Meanwhile, Herba Farms and Tasty's (CAN) also faced challenges, with both brands not ranking in the top 20 for multiple months. Jays (Canada), however, showed a promising upward trajectory, moving from outside the top 20 to 24th by January 2026. These dynamics suggest that while Solid Gold faces stiff competition, its ability to rebound in rank and sales indicates potential for growth amidst a shifting market.

Notable Products

In January 2026, the top-performing product for Solid Gold was the Purple Kush Liquid Diamond Cartridge (1g) in the Vapor Pens category, which climbed to the number one rank from fifth place in December 2025, with sales of 674 units. The Lemon Drop Remix Liquid Diamond Cartridge (1g) secured the second position, having not been ranked in the previous two months, showing a notable increase in sales to 393 units. Following closely, the Clementine Remix Liquid Diamonds Cartridge (1g) took third place, also making a remarkable entry into the rankings with 370 units sold. The MK Ultra Diamonds in Terp Sauce (1g) in the Concentrates category held steady at fourth place, maintaining its rank from November 2025. Finally, the Maui Wowie Liquid Diamonds Cartridge (1g) rounded out the top five, dropping slightly from its fourth-place position in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.