Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

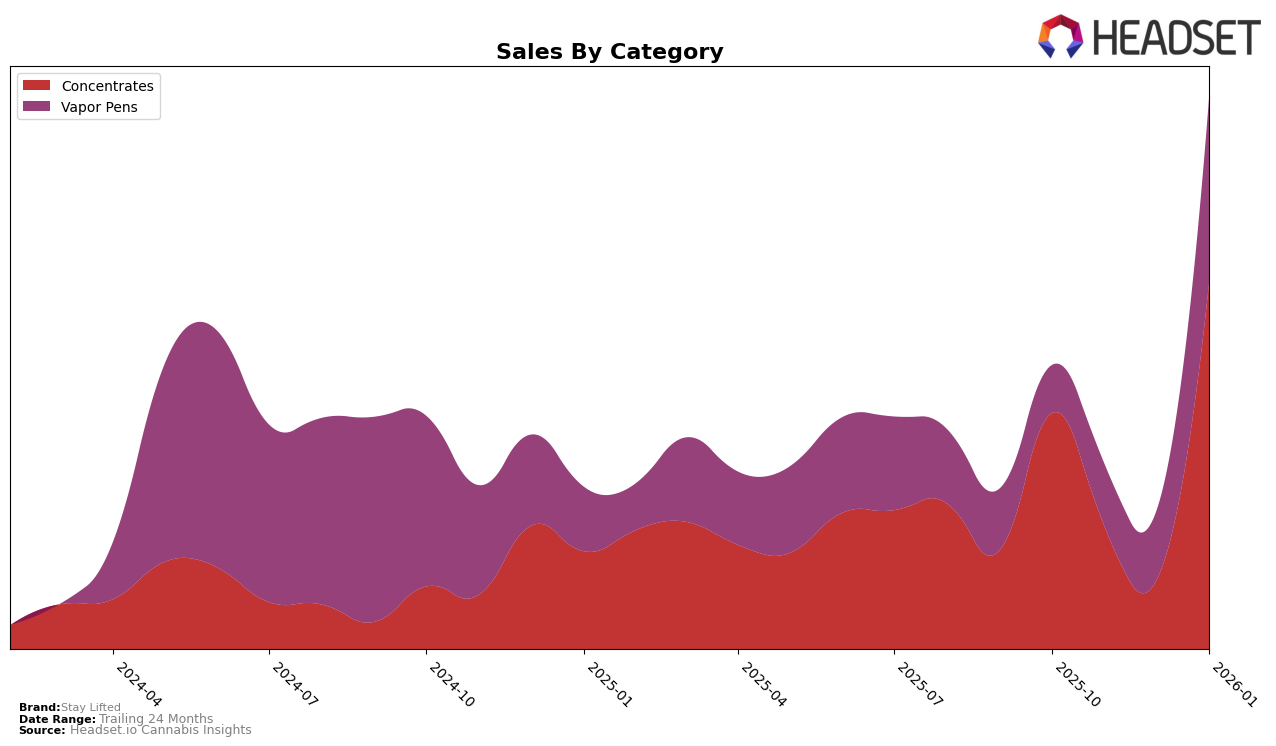

Stay Lifted has shown notable fluctuations in its performance across different categories and states. In the Concentrates category in Oregon, the brand made a remarkable comeback, climbing from not being in the top 30 in the previous months to securing the 27th rank in January 2026. This upward movement indicates a significant improvement in market presence, likely driven by strategic changes or increased consumer interest. The increase in their sales from October 2025 to January 2026 further supports this positive trend, suggesting that Stay Lifted is gaining traction in this category, potentially due to product innovation or enhanced distribution strategies.

In contrast, Stay Lifted's performance in the Vapor Pens category in Oregon has been less consistent. The brand did not make it to the top 30 ranks in October, November, or December 2025, only appearing in the rankings in January 2026 at the 63rd position. This indicates that while there is some level of market penetration, there might be challenges in achieving a stable and higher ranking within this category. The absence from the top 30 in previous months suggests potential areas for improvement, possibly in marketing or product differentiation, to better capture consumer interest and improve their standing in the Vapor Pens segment.

Competitive Landscape

In the Oregon concentrates market, Stay Lifted has experienced a notable fluctuation in its ranking and sales performance over the past few months. After not ranking in the top 20 in October, November, and December 2025, Stay Lifted made a significant comeback in January 2026, climbing to the 27th position with a corresponding increase in sales. This resurgence contrasts with competitors like Willamette Valley Alchemy and 2Far Extracts, who maintained relatively stable rankings, with 2Far Extracts consistently outperforming in sales. Meanwhile, Happy Cabbage Farms and Elysium Fields showed strong sales in November and December, though they experienced a slight dip in January. Stay Lifted's recent improvement suggests a potential upward trend, but the brand must continue to innovate and capture market share to compete with these established players.

Notable Products

In January 2026, Stay Lifted's top-performing product was Bernscotti Wax (2g) from the Concentrates category, which ascended to the number one spot with impressive sales of 1303 units. Jokerz Wax (2g), also in Concentrates, climbed to the second position, significantly increasing its rank from fifth in December 2025. Lemon Pastries Sugar Sauce (2g) made its debut in the rankings at third place, showcasing strong initial sales. In the Vapor Pens category, Guzzolene Distillate Cartridge (1g) improved its ranking to fourth, while Mac Daddy Distillate Cartridge (1g) experienced a slight drop to fifth. The changes in rankings highlight a growing consumer preference for Concentrates in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.