Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

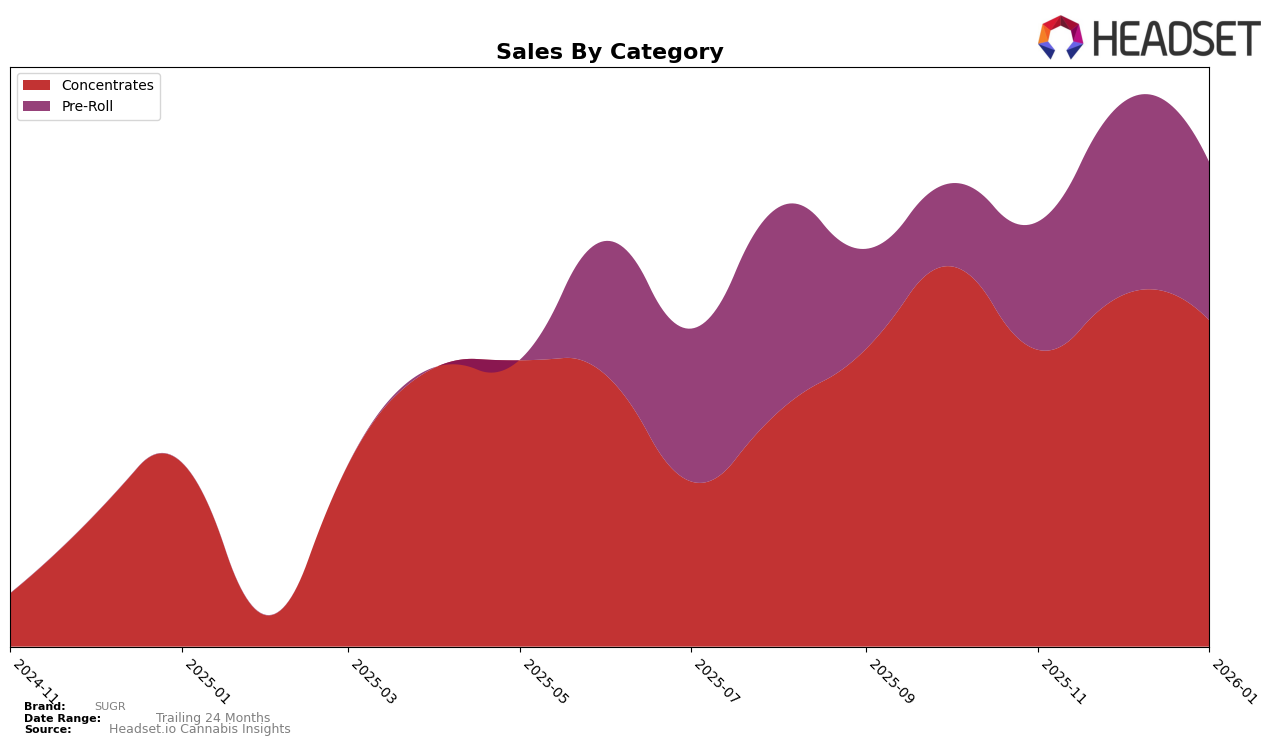

SUGR has demonstrated consistent performance in the Concentrates category within Alberta, maintaining a steady rank of 4th place from October 2025 through January 2026. This stability indicates a strong foothold in the market, although there was a noticeable dip in sales from October to November, followed by a recovery in December. Such fluctuations might suggest seasonal demand or competitive dynamics. Meanwhile, SUGR's presence in the Pre-Roll category has been more dynamic, showing a positive trajectory as it climbed from the 89th position in October to 53rd by January. This upward movement could be indicative of growing consumer interest or successful marketing strategies that have yet to be fully explored.

The lack of ranking in the top 30 for SUGR in certain categories and states outside of Alberta might be a cause for concern, or alternatively, an area ripe with potential for expansion. The brand's ability to sustain a top 5 position in Alberta's Concentrates category contrasts with its struggle to break into higher rankings in the Pre-Roll market, despite improving sales figures. This divergence suggests that while SUGR has a solid product offering in Concentrates, there may be untapped opportunities or challenges in Pre-Rolls that could be leveraged or addressed to improve their market position further. Understanding these dynamics could be crucial for stakeholders looking to capitalize on SUGR's strengths and address its weaknesses.

Competitive Landscape

In the Alberta concentrates market, SUGR consistently maintained its position at rank 4 from October 2025 to January 2026, indicating a stable performance amidst a competitive landscape. Despite a slight decline in sales from October to November, SUGR's sales figures showed a recovery in December, although they remained lower than those of its closest competitors. Dab Bods and Endgame both outperformed SUGR, consistently holding higher ranks at 2 and 3 respectively, with Dab Bods even climbing to rank 2 in December and January. Meanwhile, 3Saints maintained a steady presence at rank 5, trailing behind SUGR. Notably, Nugz (Canada) entered the top 20 in November and sustained its position at rank 6, suggesting a growing presence in the market. For SUGR, the challenge lies in increasing sales to close the gap with higher-ranked competitors while maintaining its stable rank amidst emerging brands like Nugz.

Notable Products

In January 2026, SUGR's top-performing product was the Drop Culture Sticks Pre-Roll 5-Pack (3.5g) in the Pre-Roll category, maintaining its number one rank from previous months with sales of 2,369 units. Funky Town Live Rosin (1g) climbed to the second position in the Concentrates category, showing a significant recovery with sales increasing to 1,428 units from lower figures in prior months. Sweet Tooth Live Rosin (1g) dropped to the third position in the Concentrates category, experiencing a decline in sales. Gas Leak Live Rosin (1g) remained consistent at the fourth position within the Concentrates category. Drop Culture Funky Town Live Rosin (1g) re-entered the rankings in fifth place, marking its return with a modest sales uptick.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.