Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

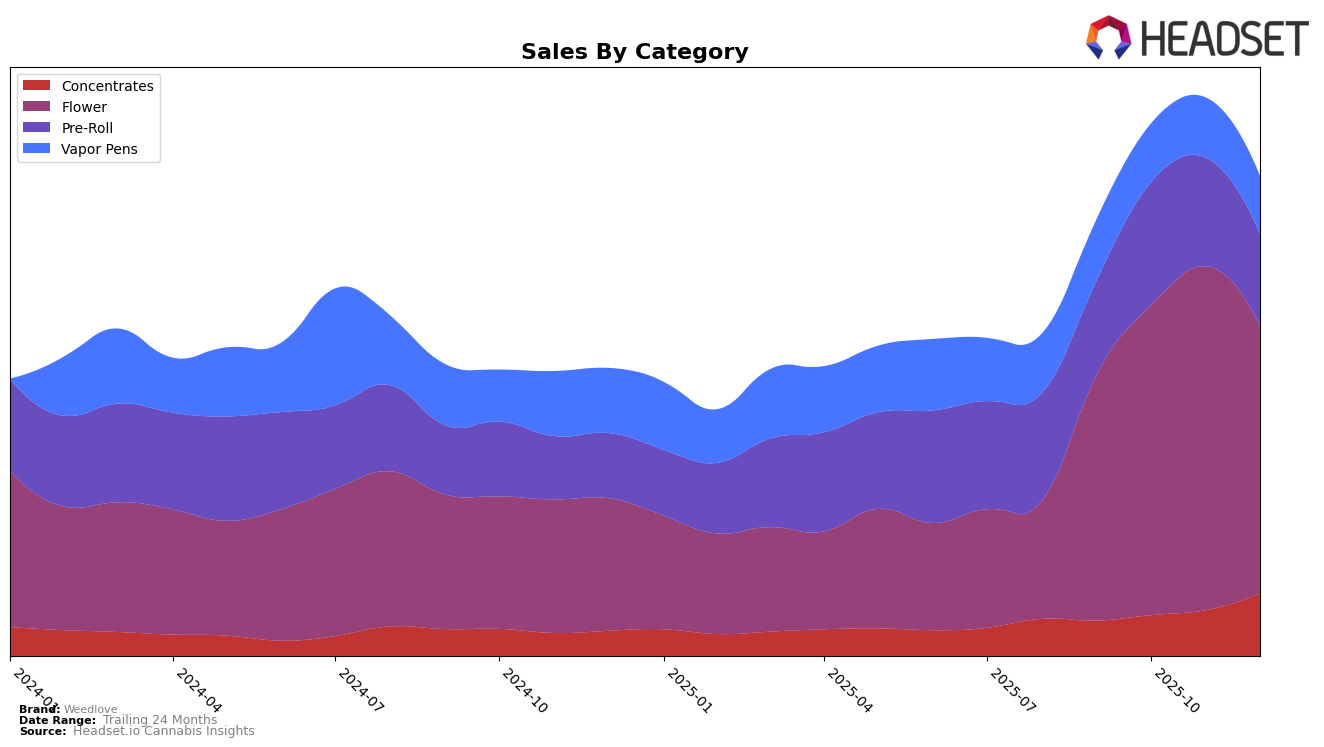

Weedlove's performance across different categories in California shows a varied trajectory as 2025 comes to a close. In the Concentrates category, Weedlove demonstrated a notable upward trend, climbing from a rank of 44 in September to breaking into the top 30 by December. This improvement is underscored by a consistent increase in sales, culminating in a significant jump in December. Conversely, the Flower category saw a fluctuating performance, with Weedlove peaking at rank 33 in November before dropping back to 44 in December, indicating potential volatility or shifts in consumer preference. Notably, the Pre-Roll and Vapor Pens categories did not manage to break into the top 30, with Pre-Rolls experiencing a decline in rank towards the end of the year, and Vapor Pens consistently remaining outside the top 70, suggesting areas where Weedlove might focus on strategic improvements.

While Weedlove's performance in California shows room for growth, particularly in the Pre-Roll and Vapor Pens categories, the Concentrates category presents a success story that could serve as a model for other segments. The sales growth in Concentrates is particularly noteworthy, indicating a strong consumer base or effective marketing strategies that could potentially be replicated. The Flower category, despite its fluctuations, remains a significant part of Weedlove's portfolio, though the December dip suggests a need for closer analysis of market conditions or competitive dynamics. Understanding these movements could provide valuable insights for Weedlove as they strategize future market engagements and aim to enhance their presence across all categories in the rapidly evolving cannabis landscape.

Competitive Landscape

In the competitive landscape of the California flower category, Weedlove experienced notable fluctuations in its ranking and sales performance from September to December 2025. Weedlove's rank improved significantly from 45th in September to 33rd in November, before dropping to 44th in December. This fluctuation indicates a dynamic market environment where Weedlove faces stiff competition. Notably, Lolo consistently outperformed Weedlove, maintaining a higher rank despite a downward trend from 27th to 38th over the same period. Meanwhile, Daze Off showed a positive trajectory, surpassing Weedlove in November and December, while Cookies and Lights Out also demonstrated competitive pressures with varying sales trends. These insights highlight the need for Weedlove to strategize effectively to maintain and improve its market position amidst evolving consumer preferences and competitive dynamics.

Notable Products

In December 2025, Bubblegum Horchata (14g) maintained its top position as the best-selling product for Weedlove, with consistent performance from November. Gasmask OG (14g) saw a significant improvement, climbing to the second position with sales reaching 1206, showing a positive trend from its fifth position in November. Cosmic Cookies Infused Flower (3.5g) entered the rankings for the first time, securing the third spot. Rainbow Biscotti (14g) followed closely in fourth place, while Rainbow Biscotti (3.5g) rounded out the top five. The rankings indicate a strong preference for flower products, with notable shifts suggesting increased consumer interest in diverse offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.