Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

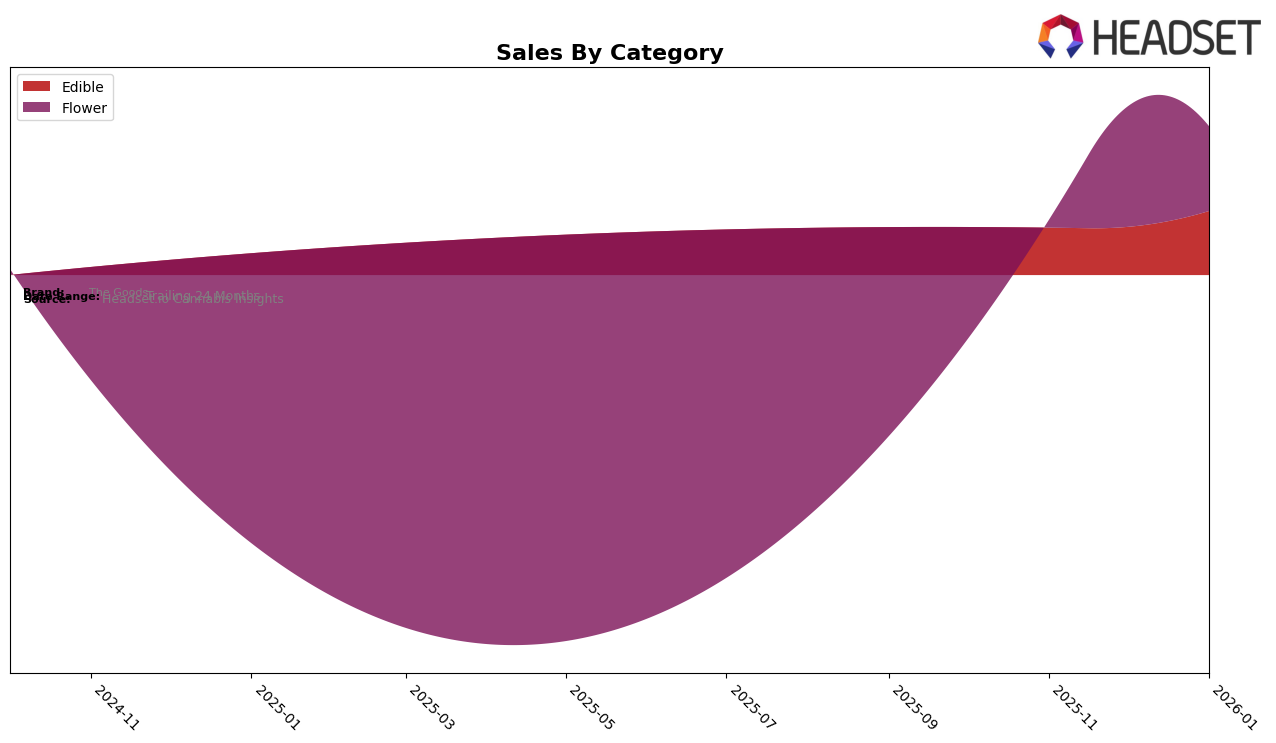

The Goods has shown varied performance across different categories and states, with notable movements in Ohio. In the Edible category, The Goods was not ranked in the top 30 in October 2025, but by December 2025, it had climbed to the 56th position, maintaining this rank into November and then improving to 48th by January 2026. This upward trajectory indicates a growing presence and potential consumer interest in their edible products. The absence from the top 30 in October suggests that they were previously underperforming, but the subsequent rise in rank highlights a positive trend, possibly due to strategic changes or increased market penetration.

In the Flower category, The Goods did not make it into the top 30 rankings until January 2026, when it debuted at 63rd position. This entry into the rankings could be seen as a positive sign, although it suggests that there is still a significant gap between The Goods and the leading brands in this category. The lack of presence in the top 30 rankings in the preceding months indicates challenges in establishing a foothold in the Flower market. The sales figures from December 2025 to January 2026 show a decrease, which could imply market saturation or increased competition. Overall, while The Goods is making strides in certain categories, there is room for improvement, particularly in the Flower segment.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, The Goods has faced challenges in maintaining a strong market presence, as evidenced by its absence from the top 20 brands from October to December 2025, only reappearing in January 2026 at rank 63. This indicates a struggle to capture significant market share compared to competitors such as PTS Farms, which consistently held a rank around 60, and Hijinks, which experienced a notable drop from rank 44 in November 2025 to 67 in January 2026, yet still managed to outperform The Goods in sales. The Goods' sales figures in January 2026 were lower than those of Ancient Roots and Firebrand Infusions, suggesting a need for strategic adjustments to enhance brand visibility and competitiveness in this market.

Notable Products

In January 2026, the top-performing product for The Goods was Spritz (2.83g) in the Flower category, maintaining its first-place ranking from December 2025 with sales of 806 units. Strawberry Lemonade Live Rosin Gummies 10-Pack (100mg) held steady in the second position across the last three months, showing a consistent increase in sales from 429 units in November 2025 to 546 units in January 2026. Mango Passion Gummies 10-Pack (100mg) remained in third place for January 2026, despite a drop from its top rank in November 2025. Elderberry Acai Live Rosin Gummies 10-Pack (100mg) climbed to fourth place, marking its first appearance in the top rankings since November. Halloweed (3.5g) maintained its fifth-place position from December to January, indicating stable performance within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.