May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

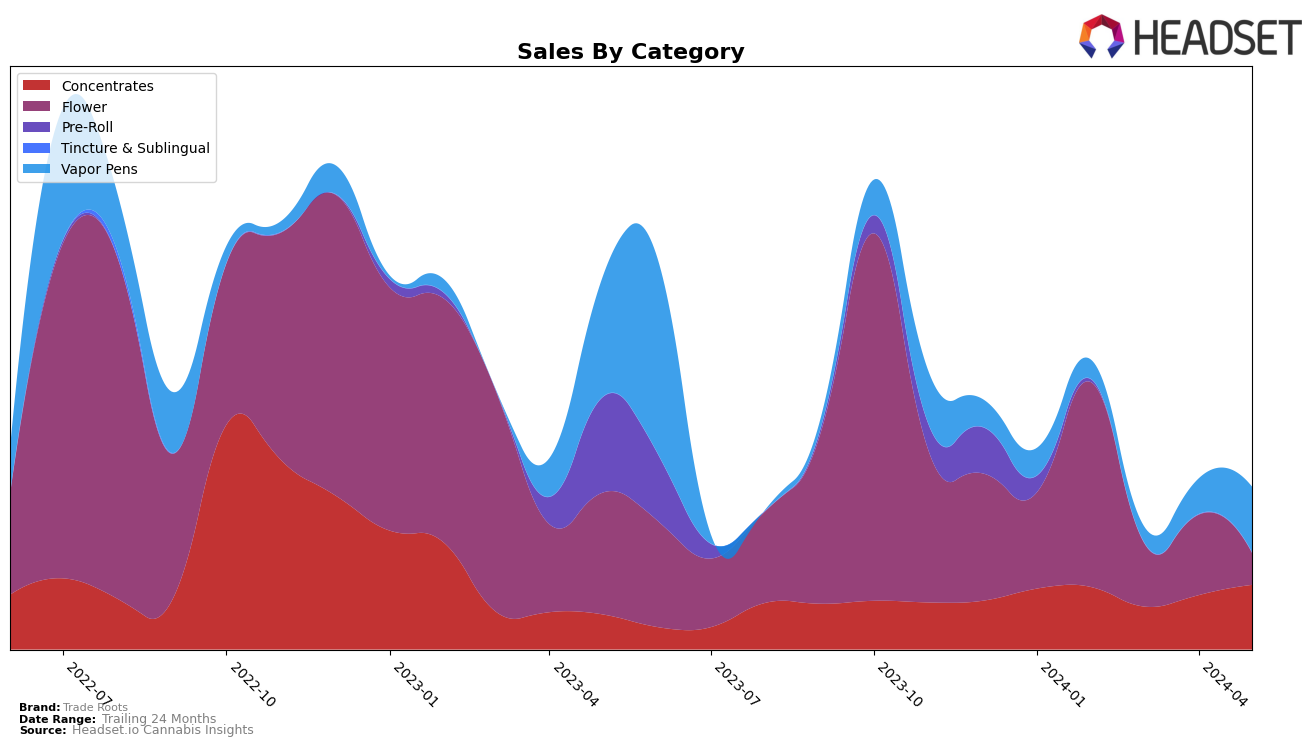

Trade Roots has shown notable movements in the Massachusetts market across several categories. In the Concentrates category, Trade Roots experienced a significant rise and fall in their rankings over the months, starting at 33rd in February 2024, dipping to 48th in March, and then rebounding to 30th by May. This fluctuation indicates a volatile but ultimately positive trend in their performance. Their sales figures also reflect this volatility, with a notable increase from $18,010 in March to $27,137 in May. In the Flower category, however, Trade Roots was ranked 88th in February but did not make it into the top 30 in subsequent months, suggesting a struggle to maintain a competitive position in this segment.

In the Vapor Pens category, Trade Roots did not rank in the top 30 initially but showed a promising upward trend by entering the rankings at 93rd in April and climbing to 75th in May. This positive movement indicates growing consumer interest and market penetration in this category. The sales figures for Vapor Pens also reflect this upward trajectory, with sales increasing from $14,909 in April to $27,505 in May. Despite some categories showing inconsistent performance, the overall upward trends in Concentrates and Vapor Pens suggest that Trade Roots is making strategic gains in the Massachusetts market.

Competitive Landscape

In the competitive landscape of vapor pens in Massachusetts, Trade Roots has shown a notable upward trend in recent months. Despite not being in the top 20 brands in February and March 2024, Trade Roots surged to rank 93 in April and further climbed to rank 75 in May. This upward movement is significant when compared to competitors like Beboe, which fluctuated around the 69-71 range, and INSA, which saw a decline from rank 64 in February to 82 in May. Root & Bloom also experienced volatility, peaking at rank 59 in April but dropping to 79 in May. Meanwhile, Neighborgoods saw a significant drop from rank 54 in February to being out of the top 20 in March, before reappearing at rank 70 in May. Trade Roots' consistent improvement in rank suggests a positive reception in the market, potentially leading to increased sales and market share in the coming months.

Notable Products

In May-2024, Coral Gabels Live Resin (1g) from Trade Roots emerged as the top-performing product, climbing from third place in April to first place with notable sales of 582 units. The Super Lemon Haze Distillate Cartridge (1g) maintained its second position from the previous month, demonstrating consistent popularity with 551 units sold. Durban Gelato Distillate Cartridge (1g) moved up from fourth place in April to third place in May, showing a significant increase in demand. The Hybrid Distillate Syringe (1g) debuted in fourth place this month, while Vortex (3.5g) entered the rankings at fifth place. These shifts highlight a dynamic market with changing consumer preferences for Trade Roots products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.