Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

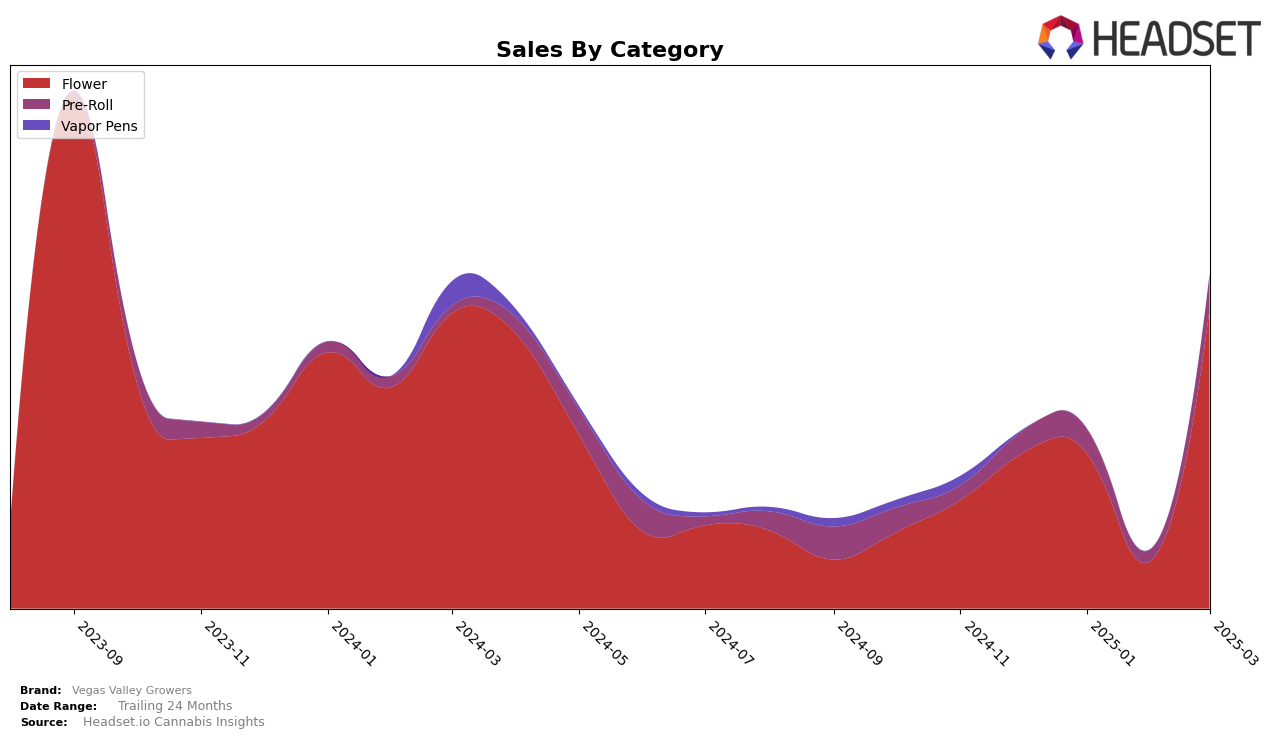

Vegas Valley Growers has shown significant fluctuations in its performance across different categories and states, with notable movements in the Nevada market. In the Flower category, the brand experienced a remarkable leap from being ranked 64th in February 2025 to 21st by March 2025, indicating a strong upward trajectory. This movement is particularly impressive given their earlier position outside the top 30 in December 2024. However, their performance in the Pre-Roll category presents a mixed picture. While they improved from 50th in December 2024 to 43rd by March 2025, they were not ranked in the top 30 during February, suggesting some volatility in their market presence.

The sales data further underscores these trends, with the Flower category seeing a significant increase in sales by March 2025, which aligns with their improved ranking. Conversely, the Pre-Roll category shows a more modest sales growth, with a noticeable absence of ranking in February 2025, which could imply challenges in maintaining a consistent market position. These patterns highlight the brand's varying success across categories, with Flower showing potential for sustained growth, while Pre-Roll may require strategic adjustments to achieve similar gains. The dynamics in Nevada reflect the competitive nature of the cannabis market, where brands must continuously adapt to consumer preferences and market conditions.

Competitive Landscape

In the competitive landscape of Nevada's flower category, Vegas Valley Growers has experienced significant fluctuations in its market position, reflecting both challenges and opportunities. Over the four-month period from December 2024 to March 2025, Vegas Valley Growers made a remarkable leap from being outside the top 20 in February to securing the 21st rank in March. This resurgence suggests a potential recovery in sales momentum, although it still trails behind competitors like Prime Cannabis, which consistently improved its rank, culminating at 19th in March. Meanwhile, CAMP (NV) demonstrated strong performance, peaking at 7th in February before a slight decline. Despite these challenges, the upward trend in March for Vegas Valley Growers indicates a positive trajectory, potentially driven by strategic adjustments or market dynamics. As the brand seeks to solidify its position, understanding the competitive strategies of top performers like Khalifa Kush and Polaris MMJ could provide valuable insights for sustaining growth in this dynamic market.

Notable Products

In March 2025, the top-performing product from Vegas Valley Growers was Chimera Pre-Roll (1g) in the Pre-Roll category, securing the number one rank with notable sales of 2916 units. Following closely in the Flower category were Moon Cat (14g) and Orange 43 (14g), ranked second and third respectively. Miracle Whip (14g) and Medulla (14g) took the fourth and fifth positions, rounding out the top five. Compared to previous months, Chimera Pre-Roll (1g) maintained a strong lead, while Moon Cat (14g) and Orange 43 (14g) showed a consistent presence in the top ranks. This stability in rankings indicates a steady consumer preference for these products from Vegas Valley Growers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.