Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

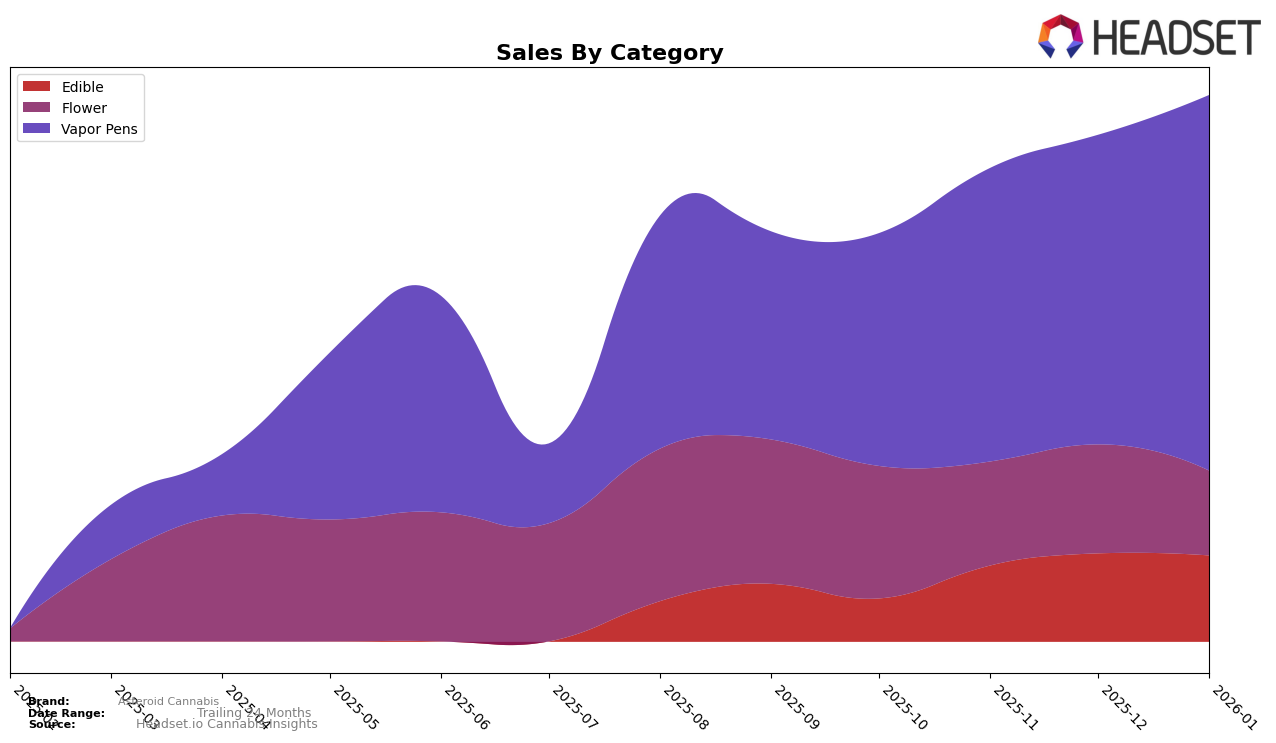

Asteroid Cannabis has shown notable performance and growth in the Connecticut market, particularly in the Edible and Vapor Pens categories. In Edibles, the brand has consistently climbed the ranks, improving from 13th place in October 2025 to 10th place by January 2026. This upward trend is reflected in their sales figures, which peaked in December 2025. In the Vapor Pens category, Asteroid Cannabis maintained a strong presence, reaching 10th place in both November 2025 and January 2026, with a significant sales increase observed in January 2026. Such performance highlights their growing appeal and market penetration in Connecticut's competitive cannabis landscape.

In contrast, Asteroid Cannabis has faced challenges in the Missouri market, particularly in the Flower and Vapor Pens categories. The brand's ranking in the Flower category remained outside the top 30, fluctuating between 49th and 54th place from October 2025 to January 2026, with a downward trend in sales. Similarly, in the Vapor Pens category, Asteroid Cannabis struggled to break into the top 30, with rankings hovering in the low 60s. These results suggest potential obstacles in brand recognition or market strategy within Missouri, indicating areas where Asteroid Cannabis might need to focus on improvement to enhance their market position.

Competitive Landscape

In the competitive landscape of vapor pens in Connecticut, Asteroid Cannabis has shown a notable upward trajectory in rankings, moving from 13th place in October 2025 to 10th by January 2026. This improvement in rank is indicative of a positive trend in sales, with a significant increase from October to January. Despite this progress, Asteroid Cannabis faces stiff competition from brands like Savvy, which consistently ranks higher, maintaining a position within the top 8 throughout the period. Meanwhile, Soundview and Affinity Grow have shown fluctuations in their rankings but remain ahead of Asteroid Cannabis, except for Affinity Grow's drop to 12th in January. The emergence of The Essence in the rankings by December further intensifies the competition, as it quickly climbed to 11th place by January. These dynamics suggest that while Asteroid Cannabis is gaining ground, it must continue to innovate and expand its market presence to compete effectively against these established brands.

Notable Products

In January 2026, Pink Lemonade Gummies 20-Pack (100mg) from Asteroid Cannabis maintained its lead as the top-performing product in the Edible category, with sales reaching 2182 units. Following closely, Piña Colada Gummies 20-Pack (100mg) climbed to the second position, showing a significant increase from its third-place rank in December 2025. Sour Z Distillate Disposable (1g) made an impressive debut, securing the third rank in the Vapor Pens category. Fruit Fritter Distillate Disposable (1g) and Purple Urkle Distillate Cartridge (1g) also entered the rankings in January, holding the fourth and fifth spots respectively. This month marked a dynamic shift in product rankings, with notable entries and movements in both Edible and Vapor Pens categories.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.