Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

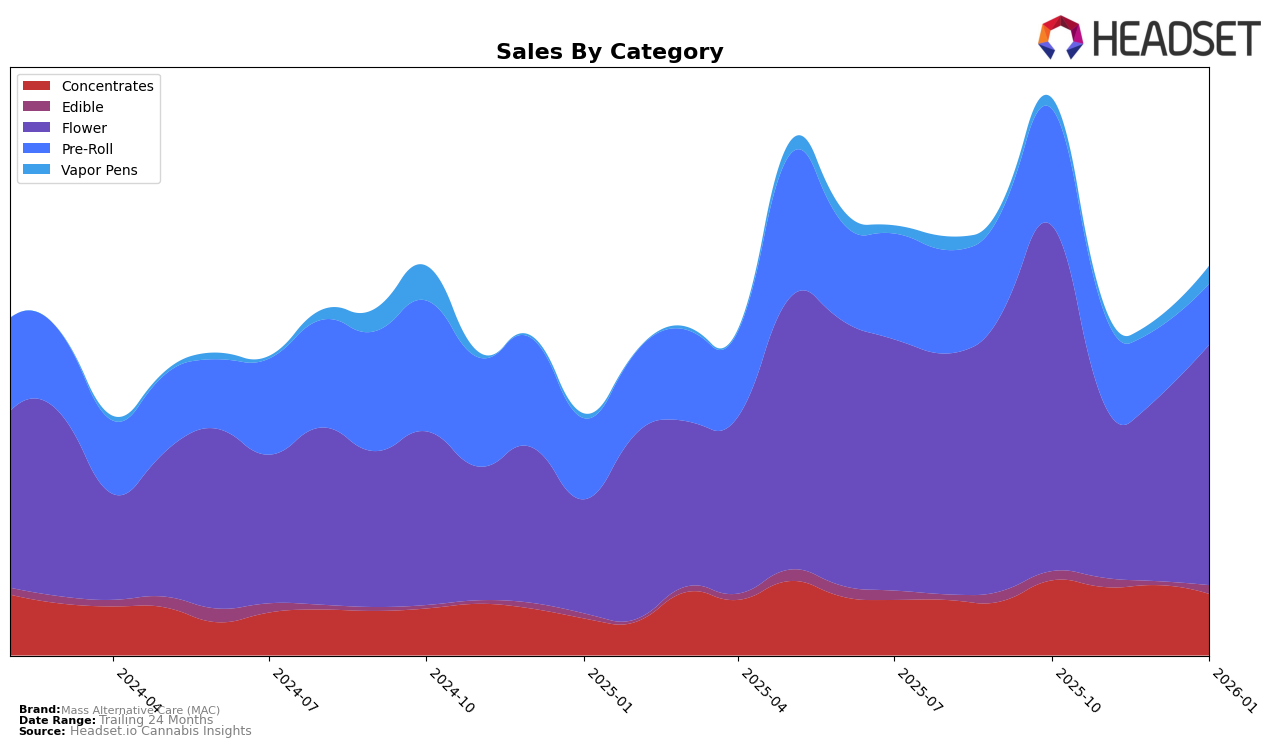

Mass Alternative Care (MAC) has demonstrated varied performance across different product categories in Massachusetts. In the Concentrates category, MAC consistently held a strong position, maintaining a rank of 9th from October to December 2025, before improving to 8th in January 2026. This stability and slight upward movement indicate a robust presence in the Concentrates market. Meanwhile, in the Edible category, MAC did not feature in the top 30 in December 2025, which might suggest a need for strategic adjustments or increased competition. However, a slight rebound to 61st in January 2026 indicates potential for recovery or realignment in this segment.

The Flower category saw a notable fluctuation in MAC's rankings, starting at 27th in October 2025 and dropping to 50th by December, before climbing back to 36th in January 2026. This pattern suggests volatility but also resilience, with the brand managing to regain some ground at the start of the new year. The Pre-Roll category presented a more challenging landscape, with MAC slipping from 45th in October 2025 to 71st by January 2026, indicating a potential area for strategic improvement. Interestingly, the Vapor Pens category saw MAC entering the rankings in January 2026 at 83rd, suggesting a new or growing presence in this space. This entry could indicate an emerging opportunity for MAC to explore further.

Competitive Landscape

In the Massachusetts flower category, Mass Alternative Care (MAC) has experienced notable fluctuations in its market position, affecting its competitive stance. From October 2025 to January 2026, MAC's rank shifted from 27th to 36th, indicating a struggle to maintain a top position amidst fierce competition. Despite a dip to 50th place in December 2025, MAC managed a recovery in January 2026, suggesting resilience in its sales strategy. Competitors like Happy Valley (MA) and Harbor House Collective consistently outperformed MAC, maintaining ranks within the top 40, with Harbor House Collective even securing a stable position at 35th in January 2026. Meanwhile, The Botanist showed a positive trend, climbing to 34th place by January 2026, while Green Gold Group closely trailed MAC, ending at 37th. These dynamics highlight the competitive pressure MAC faces, underscoring the need for strategic adjustments to regain and sustain higher market ranks.

Notable Products

In January 2026, the top-performing product for Mass Alternative Care (MAC) was Cartoons & Cereal Pre-Roll (1g), which climbed to the first rank with sales of 2203 units. Coughy Cake Pre-Roll (1g) followed closely in second place, maintaining a strong position from the previous month despite a slight decrease in sales to 2072 units. Zombie Pre-Roll (1g) improved its standing, moving up to third place from fifth in December 2025. Forbidden Spice Pre-Roll (1g) saw a decline in its ranking, dropping to fourth place, while Coughy Cake (3.5g) re-entered the top five at fifth place after being absent in the rankings for the previous months. Overall, the Pre-Roll category dominated the top positions, showing a consistent preference among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.