Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

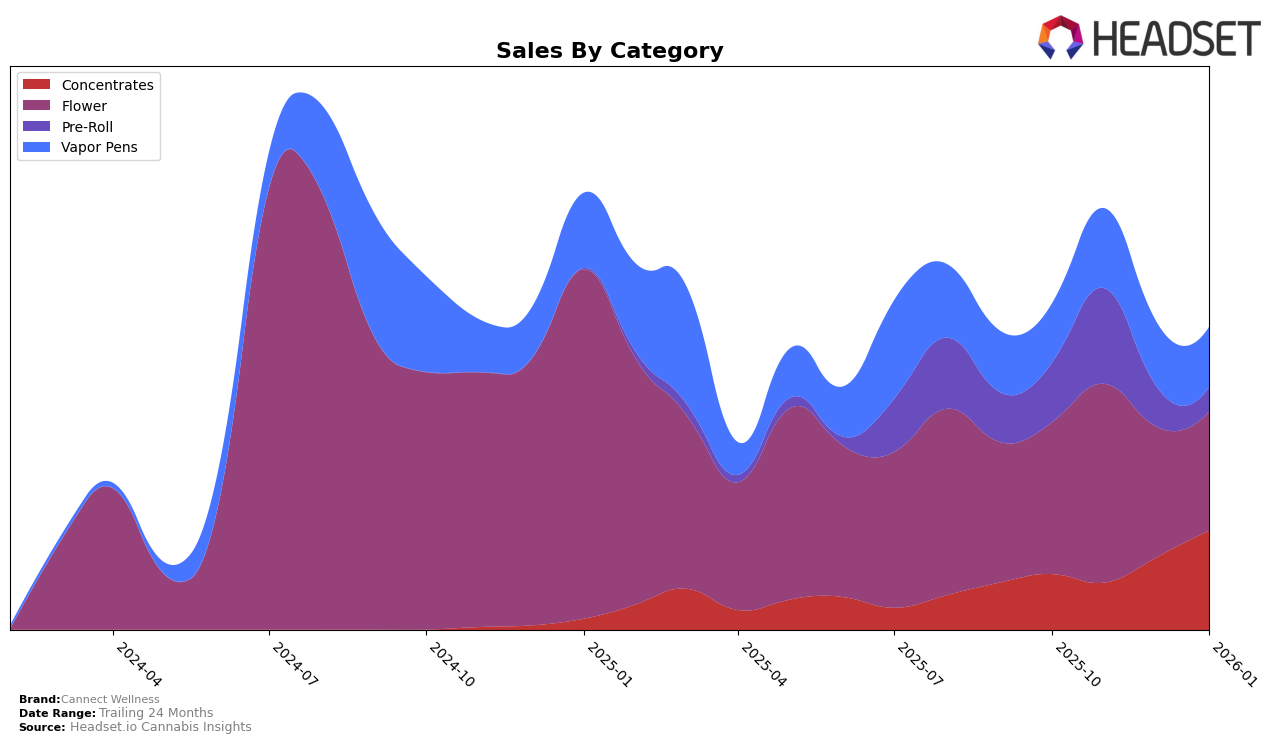

In Illinois, Cannect Wellness has shown noteworthy performance in the Concentrates category. Over the span from October 2025 to January 2026, the brand improved its ranking from 29th to 20th, highlighting a significant upward trajectory. This improvement was accompanied by a steady increase in sales, culminating in a notable jump to $65,895 in January 2026. The Flower category, however, paints a different picture, with Cannect Wellness consistently ranking around the 59th position, indicating a stable yet unremarkable presence in this segment. Despite fluctuations in sales, the brand has not broken into the top 30, suggesting potential areas for growth and strategic focus.

Meanwhile, the Pre-Roll category in Illinois reflects a decline in Cannect Wellness's market presence, with its ranking slipping from 44th in November 2025 to 65th by January 2026. This downward trend is mirrored in the sales figures, which saw a reduction from $63,321 in November to $16,043 in January, pointing to challenges in maintaining consumer interest. Similarly, the Vapor Pens category has seen Cannect Wellness hovering around the 66th position, showing little change over the months. Although there was a peak in sales in November, the brand has not managed to break into the top 30, which could be indicative of stiff competition or a need for innovation in this product line.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Cannect Wellness has experienced a relatively stable yet challenging position from October 2025 to January 2026. Cannect Wellness maintained its rank around the mid-50s, with a slight dip in December 2025, indicating a potential area for strategic improvement. In contrast, Crops showed a more volatile rank, dropping from 38th in October to 56th by January, which could suggest a decline in consumer preference or market share. Meanwhile, Matter. demonstrated a fluctuating performance, peaking at 51st in December before falling to 62nd in January, highlighting potential instability in their market strategy. Interestingly, Superflux entered the top 20 in December and improved its rank by January, suggesting a growing presence that Cannect Wellness should monitor closely. Despite these competitive shifts, Cannect Wellness's consistent ranking suggests a loyal customer base, but there is room for growth to climb higher in the rankings and increase sales.

Notable Products

In January 2026, the top-performing product for Cannect Wellness was Acai Gelato x Sherb Live Resin Cartridge (0.5g) in the Vapor Pens category, maintaining its first place ranking from December 2025 with notable sales of $415. Cakelato (3.5g) in the Flower category emerged as the second-best product, followed by Juicee J (3.5g) and Banaconda (3.5g), both also in the Flower category. Bananaconda Live Resin Badder (1g) in Concentrates rounded out the top five. These rankings highlight a stable performance for Acai Gelato x Sherb Live Resin Cartridge, while Cakelato and Juicee J made significant entries, showing a dynamic shift in consumer preferences towards Flower products compared to previous months. Overall, the rankings reflect a strong demand for both Vapor Pens and Flower categories in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.