Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

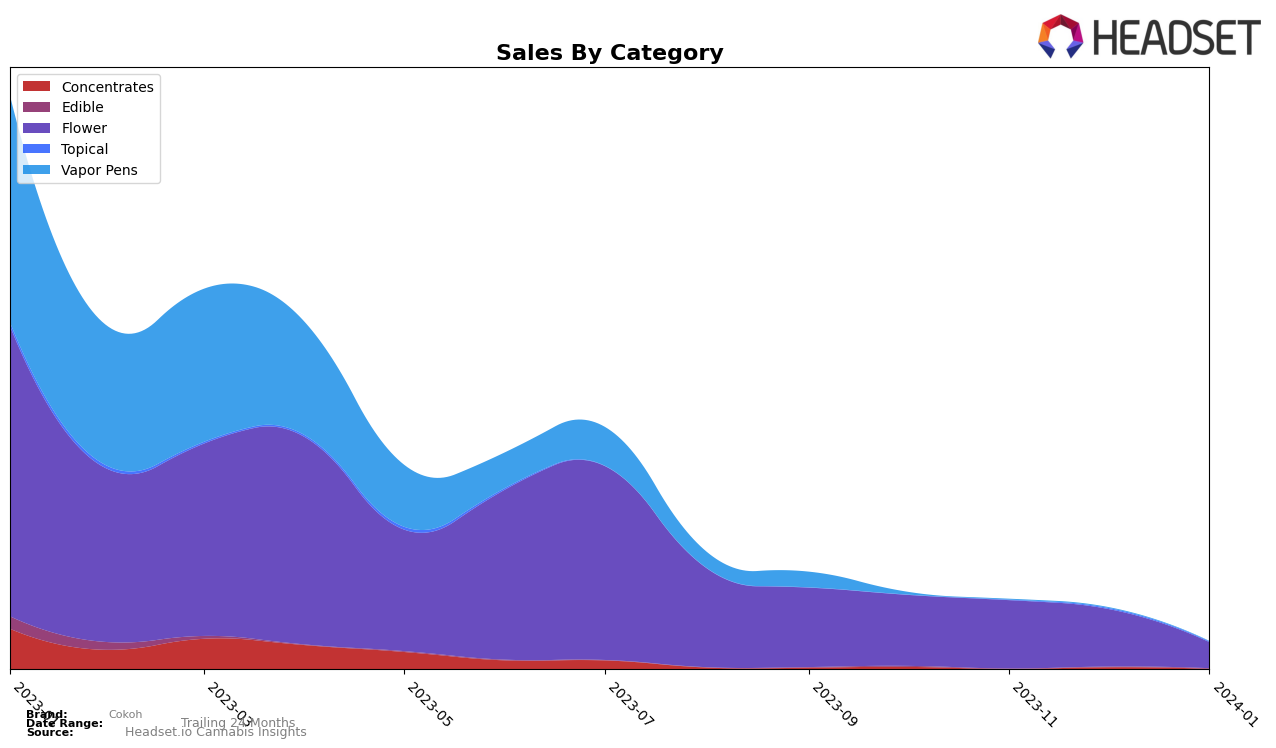

In Ohio, Cokoh has demonstrated varied performance across its product categories, with notable movements in both rankings and sales. For instance, in the Flower category, Cokoh experienced a decrease in ranking from October 2023 to January 2024, moving from 30th to 39th position, accompanied by a significant drop in sales from 164,313 in October to 59,910 in January. This trend suggests a challenge in maintaining its market position in this category. Conversely, in the Topicals category, Cokoh showed improvement, entering the rankings in November 2023 at 14th and climbing to 12th by January 2024, with sales peaking at 1,818 in December. This indicates a growing consumer interest and potentially a successful strategic focus for Cokoh in this segment.

However, Cokoh's performance was not as promising in other categories such as Concentrates and Vapor Pens, where it failed to secure a spot in the top 20 brands for some months, indicating a lack of strong market presence in these areas. Specifically, in the Concentrates category, Cokoh was absent from the rankings in November 2023 and saw a decrease in sales from 4,544 in October to 3,762 in December. The Vapor Pens category also saw a decline, with rankings dropping from 60th in October 2023 to 67th in January 2024, alongside a significant decrease in sales, highlighting potential areas for improvement or reevaluation of market strategies. Despite these challenges, the Edibles category showed some resilience, with a slight improvement in ranking from 59th in November and December to 53rd in January 2024, suggesting a potential area of opportunity for Cokoh to capitalize on.

Competitive Landscape

In the competitive landscape of the flower category within Ohio's cannabis market, Cokoh has experienced a slight decline in its ranking over the recent months, moving from 30th in October 2023 to 39th by January 2024. This shift indicates a challenging environment for Cokoh, especially when considering the performance of its competitors. For instance, Moxie, despite not ranking in December, made a significant leap to 37th place by January, showcasing a remarkable recovery and potential threat to Cokoh's market position. Similarly, The Solid has shown resilience, improving from 40th to 38th in the same period, overtaking Cokoh. On the other hand, Matter. and Cresco Labs have seen fluctuations but remain competitive, with Matter. closely trailing Cokoh by January. The directional trends suggest a tightening competition, where Cokoh's slight rank decline amidst competitors' varied performances could impact its market share and sales, emphasizing the need for strategic adjustments to maintain or improve its standing in Ohio's cannabis flower market.

Notable Products

In Jan-2024, Cokoh's top-performing product was GG4 Smalls (14.15g) within the Flower category, showcasing notable sales figures of 491 units. Following closely was the GG4 (2.83g), which consistently held the top rank in the previous three months but fell to second place in January. The third-ranked product was GG4 Shake (14.15g), indicating a preference for GG4 strain variations among Cokoh's offerings. Sticky Buns (2.83g) moved up to the fourth position from its third-place ranking in December, demonstrating a slight shift in consumer preferences. Lastly, Afghani Shake (28.3g) entered the rankings at fifth place, rounding out the top five products for the month, without a previous ranking to compare.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.