Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

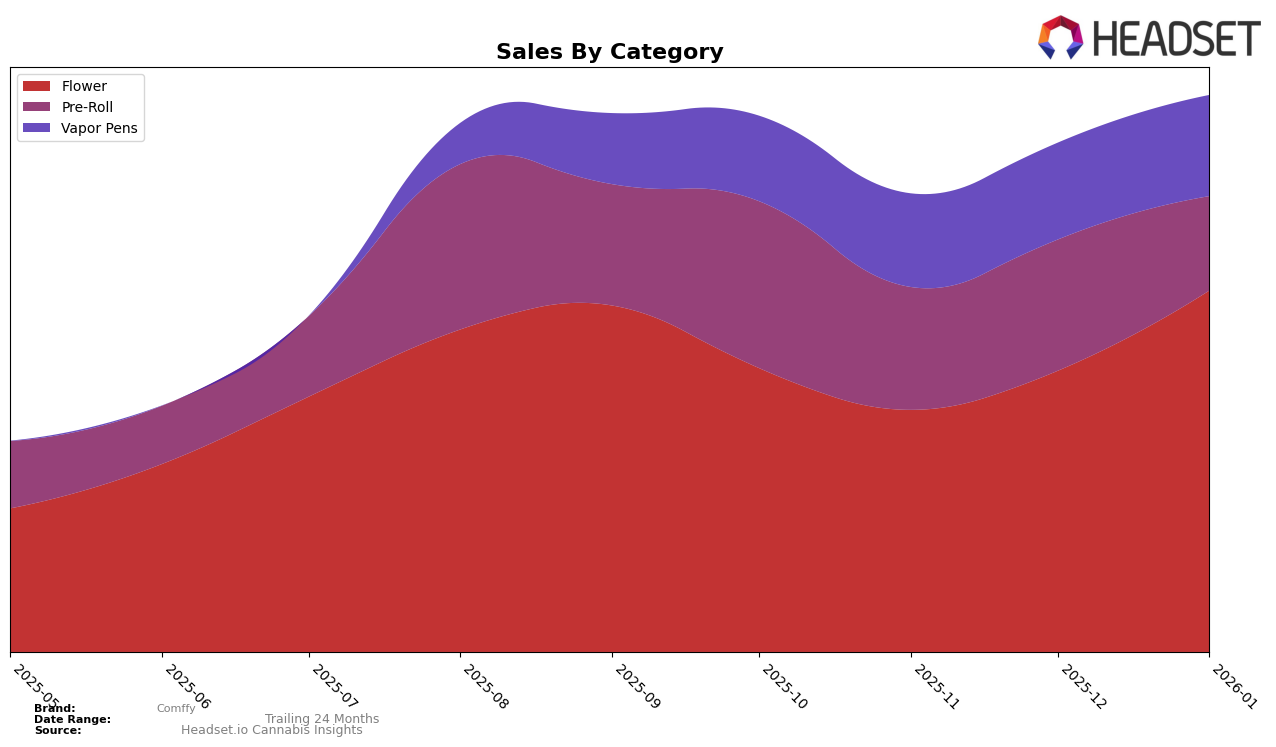

In the state of Connecticut, Comffy has shown notable performance in the Flower category, consistently holding the 8th position from October to December 2025 before climbing to the 6th position in January 2026. This upward movement in rankings is accompanied by a significant increase in sales, with January 2026 sales reaching $632,987. In contrast, the Vapor Pens category has seen Comffy maintaining a steady rank, albeit outside the top 10, indicating a need for strategic focus if they aim to break into higher rankings. The consistency in their Flower category performance highlights a strong market presence, but the variance in rankings across categories suggests potential areas for growth and improvement.

For Pre-Rolls, Comffy experienced fluctuations in their rankings, starting at 6th in October 2025 and dropping to 8th by January 2026. The sales trend for Pre-Rolls mirrors this movement, with a notable decrease in January 2026. This decline could be indicative of increased competition or changing consumer preferences in Connecticut. The absence of Comffy in the top 30 for certain categories in other states or provinces could either highlight a lack of market penetration or an opportunity for expansion. These insights suggest that while Comffy has a solid footing in some categories, there is room to enhance their market strategy across others.

Competitive Landscape

In the competitive landscape of the Connecticut flower category, Comffy has shown a promising upward trajectory in recent months. Starting from the 8th position in October 2025, Comffy maintained this rank through December, before climbing to 6th place by January 2026. This improvement in rank coincides with a notable increase in sales, particularly in January, where Comffy outperformed its previous months. In contrast, Curaleaf, initially the top brand, experienced a decline, dropping to 4th place by January 2026, with a significant decrease in sales over the same period. Meanwhile, Theraplant consistently held a strong position, peaking at 3rd in November, while Affinity Grow saw a downward trend, moving from 4th to 8th place. All:Hours showed steady improvement, maintaining 7th place from December to January. These dynamics indicate that Comffy is gaining momentum, potentially capitalizing on the declining sales of some top competitors, and positioning itself as a rising contender in the Connecticut flower market.

Notable Products

In January 2026, Comffy's top-performing product was Brass Bonanza (3.5g) from the Flower category, which reclaimed the number one spot with impressive sales of 7057 units. This product showed a significant increase from its second-place ranking in December 2025. Boomer OG (3.5g), also in the Flower category, debuted strongly at second place. Fritterz Pre-Roll (1g) entered the rankings at third place, while Brass Bonanza Pre-Roll (1g), which was the top Pre-Roll in December, fell to fourth place. Pillow Talk Pre-Roll (1g) made its first appearance in the rankings at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.