Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

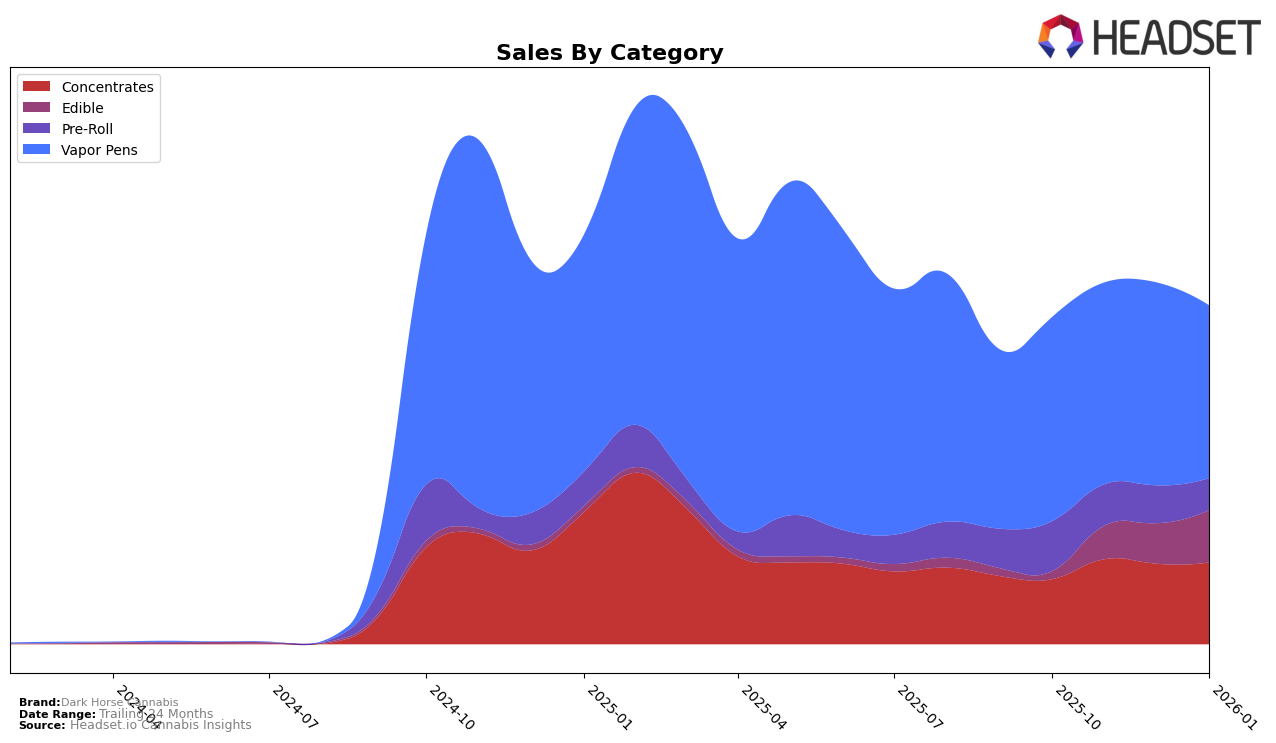

Dark Horse Cannabis has shown varied performance across different product categories in Missouri. In the Concentrates category, the brand has maintained a consistent presence within the top 30, fluctuating slightly from a rank of 21 in October 2025 to 20 by January 2026. This consistency indicates a stable demand in the market, with sales peaking in November 2025. Meanwhile, in the Edible category, Dark Horse Cannabis was absent from the top 30 in October 2025, but made significant strides to reach rank 37 by January 2026. This upward trajectory suggests growing popularity or effective marketing strategies in this segment.

In contrast, the Pre-Roll category has seen a decline in rankings, with Dark Horse Cannabis dropping from rank 50 in October 2025 to 55 by January 2026. This downward trend might point to increased competition or shifting consumer preferences. Additionally, the brand's performance in the Vapor Pens category remained steady at rank 35 for three consecutive months before slipping to 36 in January 2026. Despite the slight drop, this stability highlights a consistent consumer base, although the decrease in sales from December to January could be an area of concern. Overall, while Dark Horse Cannabis shows promise in some categories, there are areas that may require strategic adjustments to enhance market performance.

Competitive Landscape

In the Missouri Vapor Pens category, Dark Horse Cannabis has experienced a slight decline in its competitive positioning from October 2025 to January 2026, moving from 35th to 36th rank. This change is particularly notable given the performance of other brands in the same period. For instance, Plume Cannabis (MO) consistently outperformed Dark Horse Cannabis, maintaining a higher rank and showing resilience despite a slight drop from 31st to 34th. Meanwhile, Greenlight exhibited fluctuations but remained ahead, with ranks ranging from 32nd to 36th. Interestingly, Acute showed a volatile trajectory, dropping significantly in November 2025 but recovering to 37th by January 2026, still trailing behind Dark Horse Cannabis. The competitive landscape indicates that while Dark Horse Cannabis maintains a stable presence, it faces challenges from brands like Plume Cannabis (MO) and Greenlight, which have shown stronger sales performance and rank stability.

Notable Products

In January 2026, the top-performing product for Dark Horse Cannabis was the Hawaiian Haze Live Resin Distillate Cartridge in the Vapor Pens category, maintaining its number one rank from December 2025, with sales reaching 385 units. The Sweet Island Skunk Infused Pre-Roll climbed back to the second position, having previously been unranked in December, indicating a resurgence in popularity. The Jack Herer Live Resin Terpene Distillate Disposable made its debut in the rankings at the third position, suggesting strong initial consumer interest. The Granddaddy Purple Live Resin Terps Distillate Cartridge dropped to fourth place from its previous second spot, reflecting a slight decline in sales momentum. Lastly, the Hybrid FECO Syringe entered the rankings at fifth place, highlighting a growing interest in concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.