Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

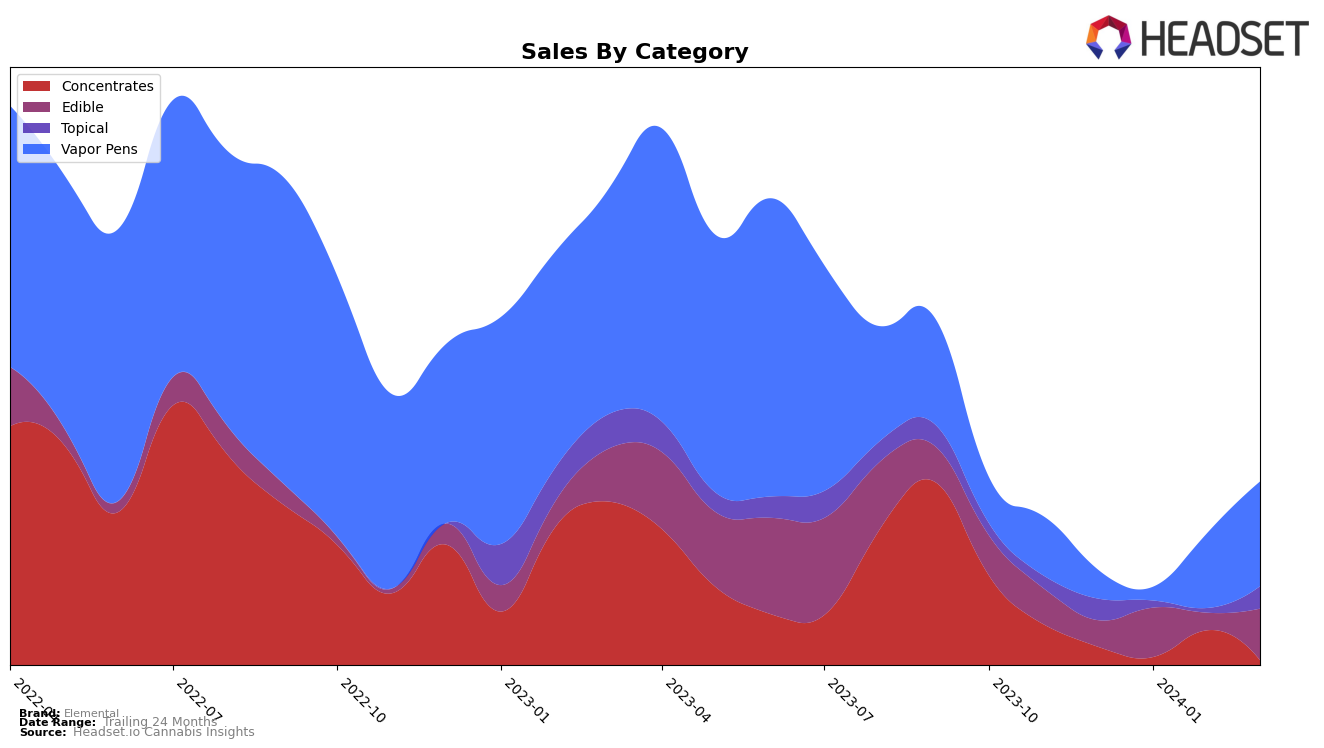

In the dynamic cannabis market of Nevada, Elemental has shown varied performance across different product categories, indicating a complex landscape of consumer preferences and market competition. Notably, in the Vapor Pens category, Elemental demonstrated a significant improvement, moving from a rank of 91 in December 2023 to 72 by March 2024, alongside a remarkable increase in sales from 540 units to 1948 units in the same period. This upward trend suggests a growing consumer preference for Elemental's offerings within this category. Conversely, the brand faced challenges in the Concentrates category, where it was ranked 63rd in December 2023 and did not make it into the top 30 by March 2024, reflecting either increased competition or shifting consumer interests away from their products in this segment.

Elemental's performance in the Edibles and Topicals categories in Nevada also provides interesting insights. The brand maintained a relatively stable presence in the Edibles category, with a slight improvement in ranking from 53rd in December 2023 to 46th in March 2024, coupled with a notable sales peak in January. This stability could indicate a loyal customer base or effective marketing strategies within this category. However, the brand's presence in the Topicals category showed volatility; it was ranked 21st in December 2023, experienced a drop in January 2024, and was not ranked in February 2024, only to rebound to 17th in March 2024. Such fluctuations could point to erratic consumer demand or inventory issues, underscoring the challenges Elemental faces in maintaining consistent market performance across its product range in Nevada.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Nevada, Elemental has shown a notable trajectory in terms of rank and sales from December 2023 to March 2024. Initially ranked 91st in December, Elemental experienced a slight dip to 93rd in January 2024, before making a significant leap to 75th in February and finally to 72nd in March. This upward trend in rank is mirrored in its sales performance, with a notable increase from 540 units in December to an impressive 1948 units by March. Competitors such as Harmony Extracts, despite a jump to 75th in March from being unranked in February, Pure Tonic Concentrates which slightly improved its position but saw a decrease in sales, and Tsunami Labs which experienced a significant drop in rank to 71st in March from 50th in February, highlight the volatile nature of this market. Bonanza Cannabis Company also saw fluctuations, ending up at 74th in March. Elemental's performance, especially in sales growth, positions it as a brand on the rise amidst a competitive field, indicating a growing consumer preference and market share within the Nevada vapor pens sector.

Notable Products

In March 2024, Elemental saw the Nuclear Distillate Cartridge (0.5g) from the Vapor Pens category rise to the top spot with remarkable sales of 77 units, marking a significant increase from its previous rankings and sales in the past months. Following closely was the NuClear Distillate Disposable (0.3g), also from the Vapor Pens category, securing the second position with a notable upward movement in its ranking, despite not being ranked in January 2024. The Lavender Salve Small (120mg THC, 2oz) from the Topical category made it to the third rank, showing a positive shift from its fifth position in February 2024. Interestingly, both the Cosmic Swirl Chocolate (100mg) and the Dark Chocolate 10-Pack (100mg) from the Edible category tied for the fourth rank, demonstrating the competitive nature of the Edible category despite varying sales figures in the preceding months. These rankings highlight a dynamic shift in consumer preferences within Elemental, with Vapor Pens gaining significant traction in March 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.