Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

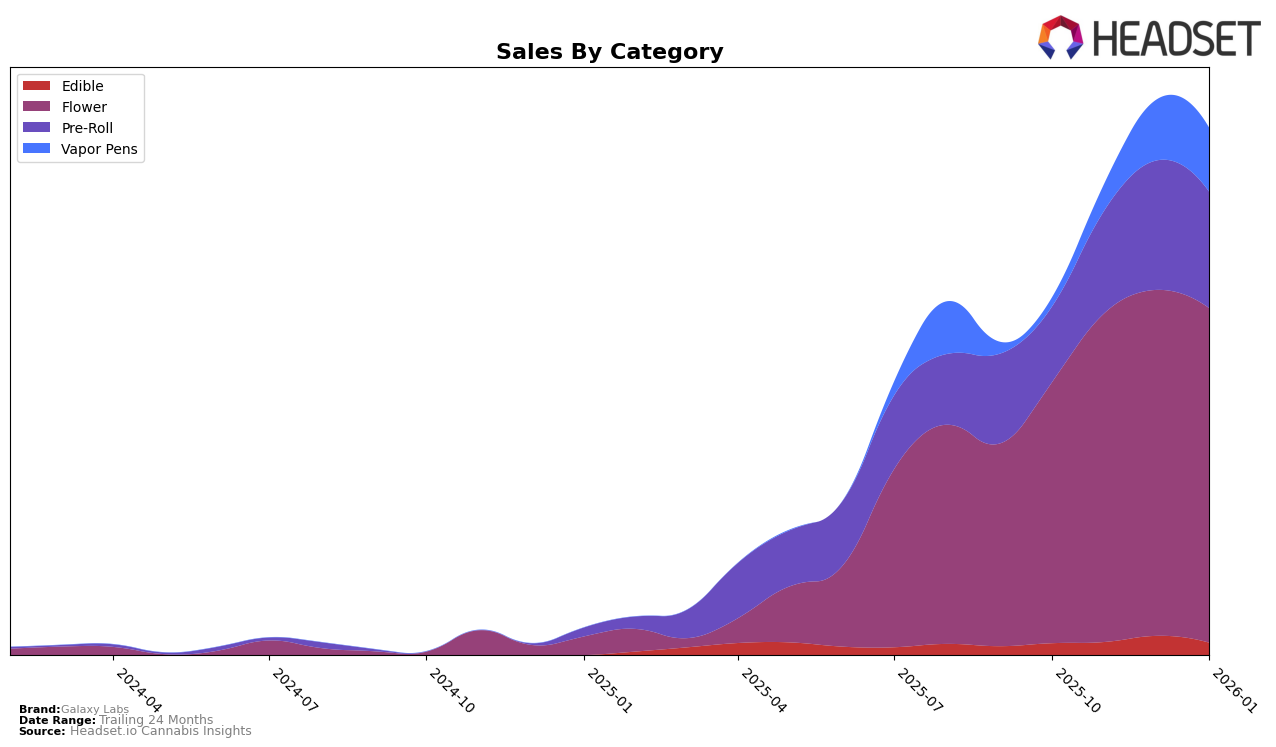

Galaxy Labs has shown varied performance across different product categories in Illinois. In the Edible category, the brand struggled to break into the top 50, with rankings hovering in the low 50s and even dropping to 55th in January 2026. This suggests a competitive market where Galaxy Labs might need to reassess its strategy. On the other hand, their Flower category has maintained a more stable presence, ranking in the mid-30s, which indicates a relatively strong position in a highly competitive segment. The consistency in rankings suggests a loyal customer base or effective distribution strategies.

In the Pre-Roll category, Galaxy Labs has shown a positive trajectory, climbing from 42nd in October 2025 to 26th by December 2025 and maintaining that position into January 2026. This upward movement highlights a growing consumer interest or successful product differentiation. Conversely, the Vapor Pens category presents a mixed picture; the brand was not in the top 30 in October 2025 but improved its rank to 55th by January 2026. This indicates potential growth opportunities, though the brand still faces stiff competition. Notably, the absence from the top rankings initially suggests a need for stronger market penetration strategies in this segment.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Galaxy Labs has demonstrated notable resilience and growth. Over the months from October 2025 to January 2026, Galaxy Labs improved its rank from 44th to 36th, indicating a positive trend in market presence. This upward movement is particularly significant when compared to competitors such as Interstate 420, which saw a decline from 26th to 38th, and Mini Budz, which fluctuated but ultimately improved from 42nd to 34th. Meanwhile, Seed & Strain Cannabis Co. maintained a relatively stable position, slightly declining from 31st to 35th. Despite these competitors, Galaxy Labs' consistent sales growth, particularly in December 2025 and January 2026, suggests a strengthening brand appeal and market strategy that could continue to elevate its position in the Illinois Flower market.

Notable Products

In January 2026, Galaxy Labs' top-performing product was Cap Junky (14g) in the Flower category, which climbed to the number one spot with sales of 741 units. Tahitian Flight (1g), also in the Flower category, rose to the second position from fifth in December 2025. The Cheddar Cheeze Pre-Roll 5-Pack (2.5g) entered the rankings for the first time, securing the third position. Truffle Cake (1g) experienced a drop from first place in December 2025 to fourth place in January 2026. Cap Junky (28g) made its debut in the rankings at fifth place, rounding out the top products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.