Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

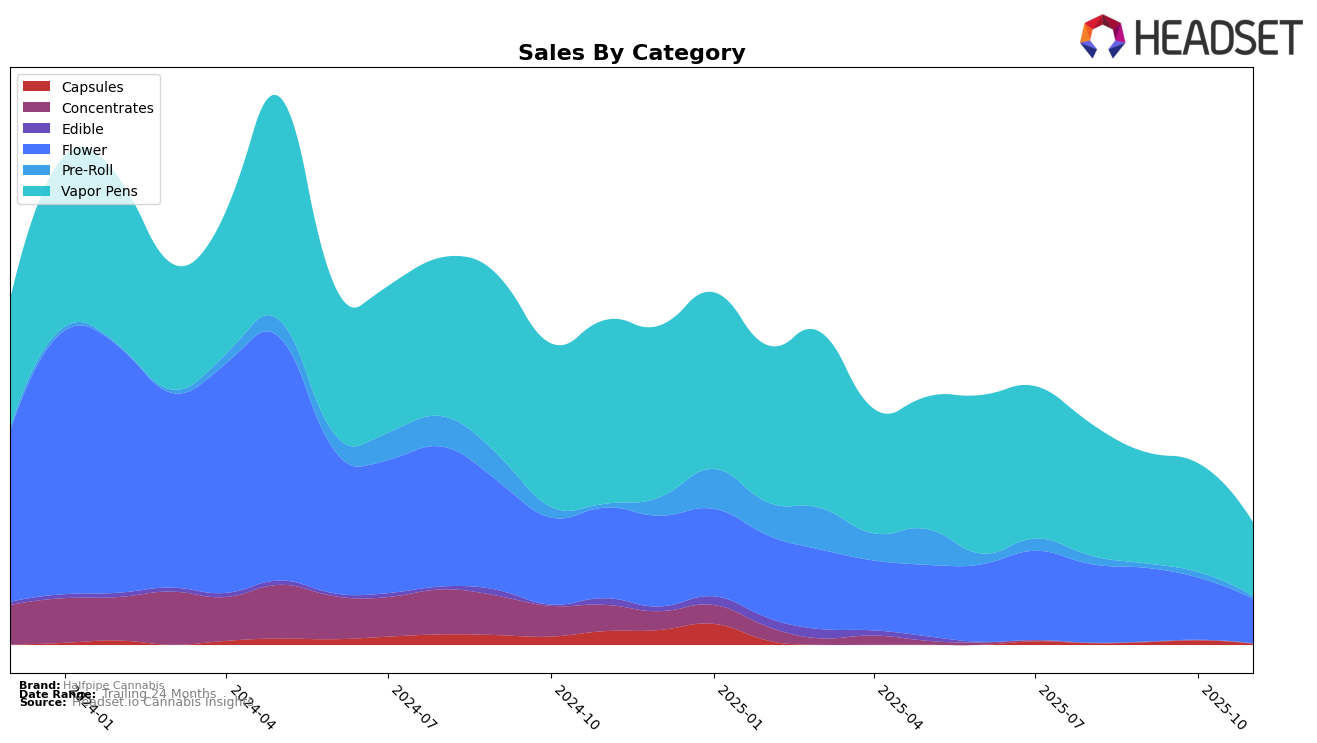

Halfpipe Cannabis has seen varied performance across different product categories and states. In California, their entry into the Capsules category in November 2025 with a rank of 15 indicates a positive movement, suggesting a successful market penetration. However, in the Flower category, Halfpipe Cannabis did not maintain a top-30 ranking from October onwards, which could be a cause for concern regarding their competitiveness in this segment. Meanwhile, the Vapor Pens category shows a downward trend, dropping from rank 42 in August to rank 53 by November, indicating a potential decline in consumer preference or increased competition.

The absence of Halfpipe Cannabis from the top 30 rankings in certain months and categories highlights areas where the brand could focus on improving its market presence. The consistent presence in the Vapor Pens category, despite the downward trend, suggests that it remains a significant part of their portfolio, albeit with challenges. The initial success in the Capsules category could serve as a strategic point for further growth. As the brand continues to navigate the competitive landscape, understanding these dynamics will be crucial for maintaining and enhancing their market position.

Competitive Landscape

In the competitive landscape of vapor pens in California, Halfpipe Cannabis has experienced a slight decline in its ranking, moving from 42nd in August 2025 to 53rd by November 2025. This shift is notable as it reflects a broader trend of decreasing sales, which have dropped consistently over the months. In contrast, brands like Hush have shown a positive trajectory, improving their rank from 60th in August to 51st in November, alongside a notable increase in sales during the same period. Similarly, Care By Design has also improved its rank from 65th to 55th, indicating a competitive edge over Halfpipe Cannabis. Meanwhile, 710 Labs and Maven Genetics have seen declines in both rank and sales, suggesting a more challenging market environment for these brands. These dynamics highlight the competitive pressures Halfpipe Cannabis faces, necessitating strategic adjustments to regain its market position.

Notable Products

In November 2025, Halfpipe Cannabis's top-performing product was the Maui Wowie Distillate Cartridge (1g) in the Vapor Pens category, climbing to the number one rank with sales of 2444 units. This product showed a significant improvement from its previous positions, moving from the fourth spot in both August and October 2025. The Purple Sherbert Distillate Cartridge (1g) debuted strongly in second place, followed by the Mango Milkshake Distillate Cartridge (1g) in third. Watermelon Ice and Lemon Cream Distillate Cartridges (1g) secured the fourth and fifth ranks, respectively, indicating a strong preference for flavored vapor pens. The introduction of new products in November led to a reshuffling of rankings, highlighting an evolving consumer interest in diverse flavors.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.