Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

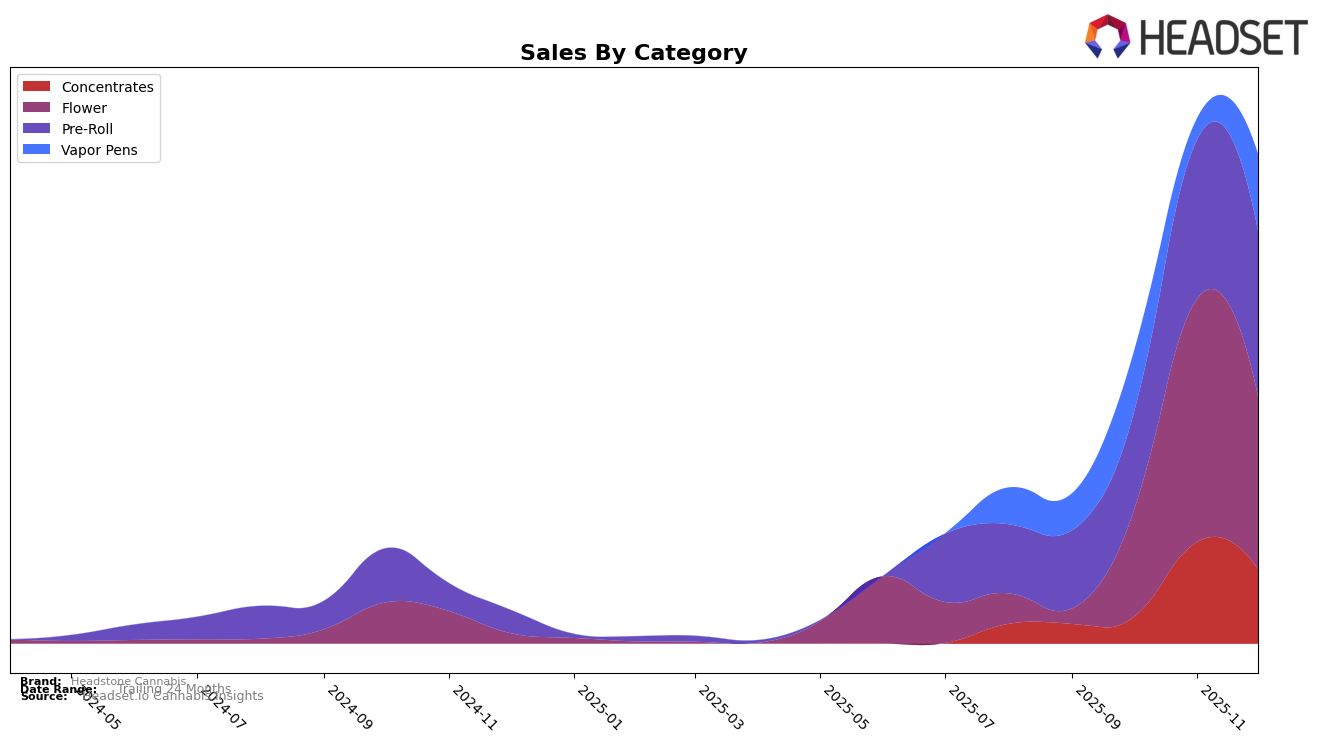

Headstone Cannabis has shown notable performance fluctuations across different product categories in Alberta. In the Concentrates category, the brand made a significant leap from a rank of 29 in September to 8 in November, before settling at 13 in December. This upward trend is indicative of increasing consumer interest and market penetration in this segment. Conversely, in the Vapor Pens category, Headstone Cannabis experienced a dip in November, falling to rank 62, before recovering to 37 in December. This volatility suggests potential challenges or shifts in consumer preferences that the brand may need to address.

In the Flower category, Headstone Cannabis experienced a dramatic rise from a rank of 99 in September to 19 in November, although it slipped to rank 30 by December. This improvement in ranking, despite the slight decline in December, highlights a strong market presence for their Flower products. However, the Pre-Roll category did not see such drastic changes, maintaining a relatively stable position, moving from rank 64 in September to 39 by December. The absence of Headstone Cannabis in the top 30 for certain months in some categories could signal areas needing strategic focus, especially as competition remains fierce. This analysis provides a glimpse into the brand's performance, illustrating both successes and opportunities for growth in the evolving cannabis market of Alberta.

Competitive Landscape

In the competitive landscape of the flower category in Alberta, Headstone Cannabis has experienced significant fluctuations in its market position from September to December 2025. Starting from a rank of 99 in September, Headstone Cannabis made a remarkable leap to 19 in November, before settling at 30 in December. This dramatic rise and subsequent drop indicate a volatile market presence, contrasting with competitors like Tribal, which maintained a relatively stable rank around the low 30s, and Partake, which hovered in the mid-20s. Notably, RIPPED and SUPER TOAST also showed fluctuations, but not as pronounced as Headstone Cannabis. The sales performance of Headstone Cannabis, with a peak in November, suggests a potential for high sales impact when ranked favorably, although maintaining this momentum remains a challenge amidst strong competition.

Notable Products

In December 2025, the top-performing product for Headstone Cannabis was the Black Mountain Morgue Pre-Roll 5-Pack (2.5g) in the Pre-Roll category, achieving the number one rank with sales of 4017 units. This product improved from its third-place ranking in November. The Demon Deep Sleep Pre-Roll (0.5g) followed closely, dropping to second place after leading in November. Ghoul Fuel Pre-Roll (0.5g) secured the third rank, showing a slight decline from its second-place finish in November. Meanwhile, the Black Mountain Morgue Cured Resin Cartridge (1g) saw a drop to fourth place in the Vapor Pens category, and Premium Select Quartz (7g) maintained a stable presence by ranking fifth in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.