Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

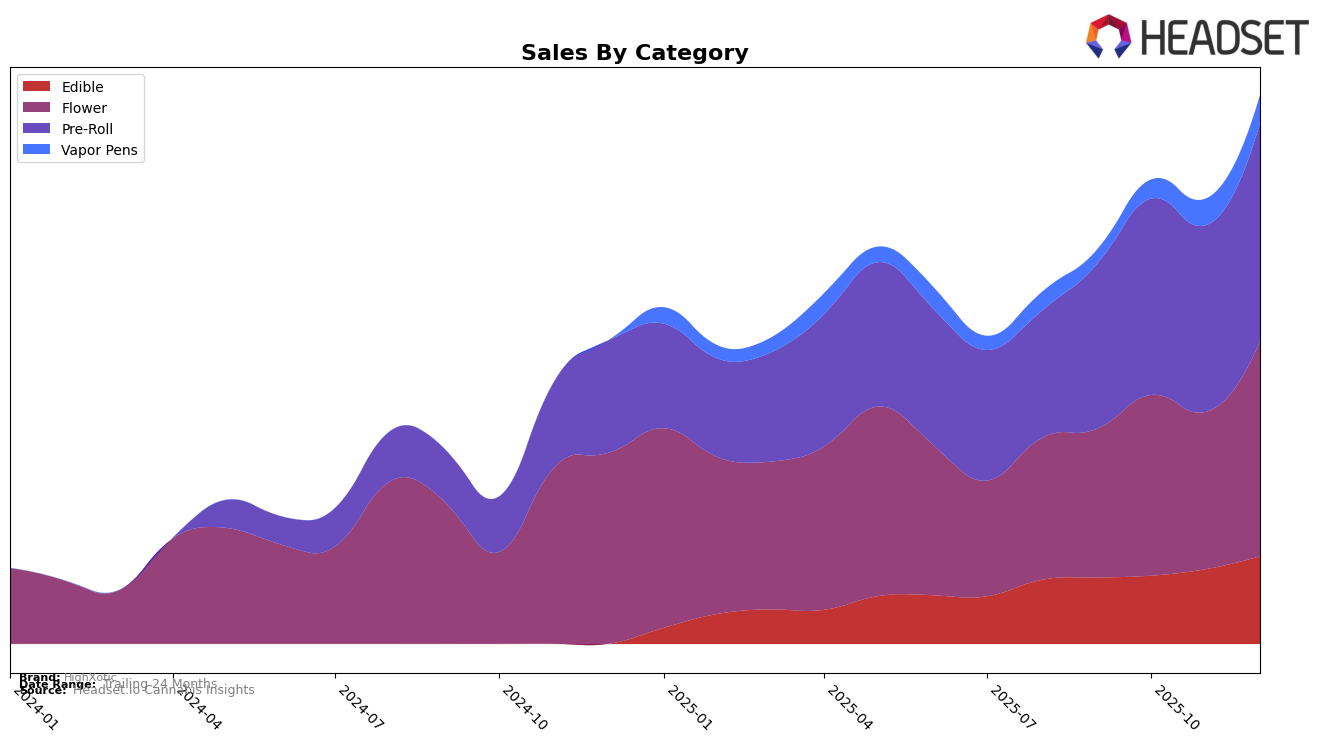

HighXotic's performance in the Alberta market has seen a consistent decline in the Flower category, where it failed to make it into the top 30 brands from September to December 2025. This downward trend suggests challenges in maintaining market share or consumer interest within this category, as evidenced by a significant drop in sales from CAD 47,060 in September to CAD 22,205 in December. In contrast, HighXotic's presence in the Ontario market is more varied across categories, with notable stability in the Edible category where it consistently held the 13th rank from October to December. Such consistency indicates a strong foothold and consumer loyalty in this segment.

In Ontario, HighXotic demonstrated upward mobility in the Flower and Pre-Roll categories. The Flower category saw a rise from 42nd place in September to 30th by December, indicating strategic improvements or successful product offerings that resonated with consumers. Similarly, the Pre-Roll category showed an impressive leap from 48th to 32nd place over the same period. However, the Vapor Pens category presented a mixed picture, with rankings fluctuating but eventually stabilizing at 63rd in December. This suggests potential areas for growth or reevaluation in marketing strategies to capture a larger market share. The details of how these shifts were achieved remain an area of interest for further exploration.

Competitive Landscape

In the competitive landscape of the Ontario pre-roll category, HighXotic has demonstrated significant upward momentum in the latter months of 2025. Starting from a rank of 48 in September, HighXotic climbed to 32 by December, showcasing a robust improvement in market positioning. This upward trajectory is particularly notable when compared to competitors such as Simply Bare, which maintained a steadier but less dynamic rise from rank 36 to 29 over the same period. Meanwhile, MTL Cannabis experienced a decline, dropping from rank 23 in September to 30 in December, indicating potential challenges in maintaining its market share. Pistol and Paris also saw fluctuations, reaching a peak rank of 30 in November before slipping to 34 in December. HighXotic's growth in rank correlates with an increase in sales, suggesting effective strategies in capturing consumer interest and expanding its footprint in the Ontario market.

Notable Products

In December 2025, HighXotic's top-performing product was the TenTen Caribbean Chill Live Rosin Gummy (10mg) in the Edible category, maintaining its number one rank for four consecutive months with a notable sales figure of 64,383. The G.S.P (Gas S'il vous Plaît) Ice Water Hash Infused Pre-Roll (1g) held steady in the second position across the same period, despite a decline in sales. The Royal Ace#4 Pre-Roll 3-Pack (1.5g) improved its ranking from fifth in November to third in December, while the Royal Journey Pre-Roll 3-Pack (1.5g) re-entered the rankings in fourth place. The Royal Ace #5 : Purple Zombie Pre-Roll 3-Pack (1.5g) experienced a drop from third in November to fifth in December, indicating a shift in consumer preferences within the Pre-Roll category. Overall, the December rankings reflect a consistent demand for HighXotic's Edibles and Pre-Rolls, with slight fluctuations in the latter's specific product performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.