Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

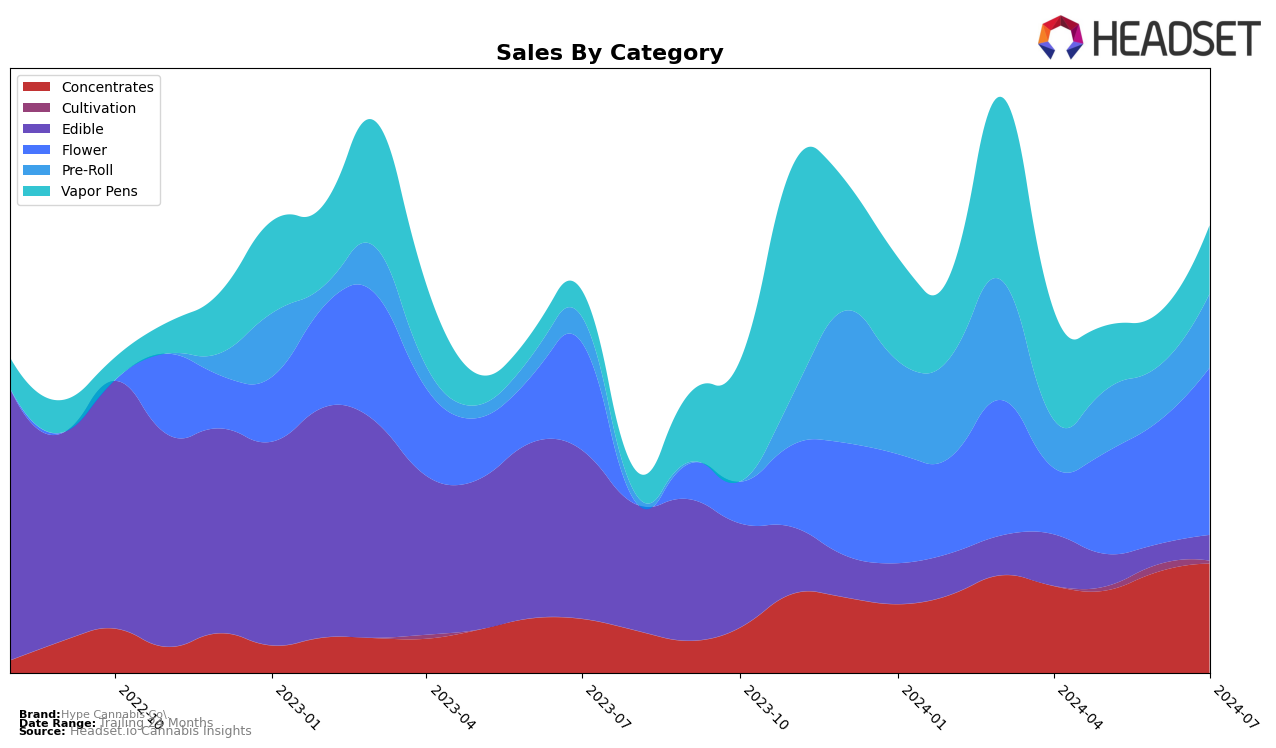

Hype Cannabis Co. has shown a varied performance across different categories and states. In California, the brand has experienced significant fluctuations in the Concentrates category, moving from 34th place in April to 40th in May, then rising to 28th by July. This upward trend in the Concentrates category is promising, especially given the increase in sales from $98,940 in May to $149,952 in July. However, their performance in the Pre-Roll category has been inconsistent, with the brand not making it into the top 30 in April and June, but ranking 82nd in July, indicating potential volatility in this segment. Despite these fluctuations, the overall sales trend in California appears positive, particularly in the Concentrates category.

In contrast, Hype Cannabis Co.'s performance in Michigan has been less stable. In the Edible category, the brand has seen a downward trend, dropping from 64th place in April to 92nd in July, with sales decreasing significantly from $52,195 in April to $15,783 in July. This decline suggests challenges in maintaining market share in Michigan's Edible segment. Additionally, the brand did not maintain a consistent ranking in the Vapor Pens category, only appearing in the top 30 in April at 70th place. The lack of presence in the top 30 in subsequent months indicates difficulties in sustaining competitive performance in this category. These trends highlight the need for Hype Cannabis Co. to strategize more effectively to improve and stabilize their market position in Michigan.

Competitive Landscape

In the competitive landscape of the California concentrates market, Hype Cannabis Co. has experienced notable fluctuations in its rank and sales over recent months. While Hype Cannabis Co. saw a dip in its rank from 34th in April 2024 to 40th in May 2024, it managed to recover to 28th by July 2024. This recovery is significant, especially when compared to competitors like Buddies, which also saw a rise from 35th in April to 29th in July, and Cream Of The Crop (COTC), which maintained a relatively stable position around the mid-20s. Meanwhile, West Coast Trading Co. experienced a decline from 17th in April to 30th in July, indicating a potential shift in consumer preferences. Additionally, Humboldt Terp Council showed a more stable performance, fluctuating between 22nd and 30th. These dynamics suggest that while Hype Cannabis Co. faces stiff competition, its recent upward trend in rank and sales positions it as a resilient player in the market, potentially poised for further growth.

Notable Products

In July 2024, the top-performing product for Hype Cannabis Co. was Pineapple Prodigy Gummies 5-Pack (100mg) in the Edible category, which maintained its number one ranking from May 2024 with sales reaching 5160 units. Black Cherry Bliss Gummies 5-Pack (100mg), also in the Edible category, secured the second position, a consistent ranking from June 2024, with notable sales of 4112 units. French Toast and Jam Sauce (1g) in the Concentrates category made a significant entry at the third spot. Glitter Bomb (3.5g) in the Flower category dropped to fourth place from its top position in June 2024. Lastly, Grapes and Cream Sugar (1g) in the Concentrates category held the fifth position, showing steady performance since its debut.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.