Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

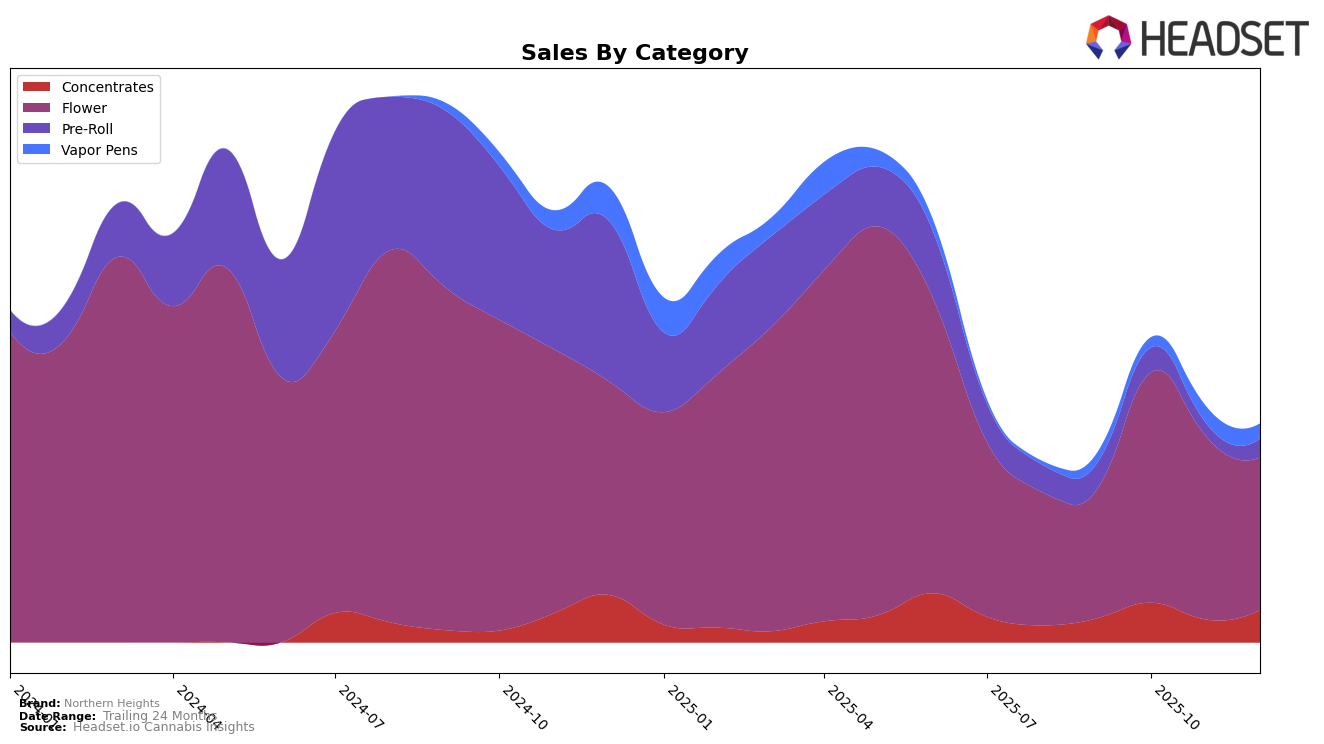

In Illinois, Northern Heights has shown varied performance across different product categories. Concentrates have seen some fluctuations, with a slight dip in November, dropping to a rank of 32 but recovering to 30 by December. This indicates a potential challenge in maintaining a stronghold in the top 30, which could be seen as an area for improvement. Meanwhile, their Flower category has consistently stayed outside the top 30, with rankings hovering in the 40s, suggesting a need for strategic adjustments to enhance visibility and market share in this segment. It's noteworthy that despite these challenges, the brand experienced a noticeable increase in sales from September to October in both Concentrates and Flower, hinting at underlying demand or successful promotional efforts during that period.

The Pre-Roll category for Northern Heights in Illinois presents a more volatile picture, with a significant drop in rankings in November to 72, before recovering slightly to 63 in December. This movement suggests potential issues with product consistency or shifts in consumer preferences that the brand may need to address. Vapor Pens, on the other hand, have not managed to break into the top 30, consistently ranking in the 70s and 80s, indicating a weaker performance in this category. The consistent sales figures, with a modest increase in November, suggest a loyal customer base, but the brand may need to innovate or increase marketing efforts to climb the ranks. Overall, Northern Heights exhibits potential in certain areas, but there are clear opportunities for growth and improvement across various categories in the Illinois market.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Northern Heights has experienced notable fluctuations in its rank over the last few months of 2025. Starting from a rank of 50 in September, Northern Heights improved to 42 in October, indicating a significant boost in sales performance. However, it slipped slightly to 45 in November and 48 in December. This trend suggests that while Northern Heights had a strong upward momentum in October, it faced challenges maintaining that trajectory in the following months. In comparison, In House consistently outperformed Northern Heights, maintaining a higher rank throughout the period, despite a dip in November. Meanwhile, Triple Seven (777) and Matter. remained lower in rank, indicating that Northern Heights is positioned competitively above these brands but still faces stiff competition from the likes of In House. The data underscores the dynamic nature of the market, where Northern Heights must strategize to reclaim and sustain its upward rank trajectory amidst fluctuating sales and competitive pressures.

Notable Products

In December 2025, Gogurtz (3.5g) emerged as the top-performing product for Northern Heights, securing the number one rank in sales. Bomb Sauce (3.5g) followed closely in second place, demonstrating a slight drop from its previous first-place ranking in November. Strawberry Gary (3.5g) maintained a strong presence at third place, slipping from its second-place position in the prior month. Red Delicious Pre-Roll 2-Pack (1g) and Kay Pre-Roll 2-Pack (1g) rounded out the top five, ranking fourth and fifth respectively. Notably, Gogurtz (3.5g) achieved impressive sales of 476 units, highlighting its popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.