Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

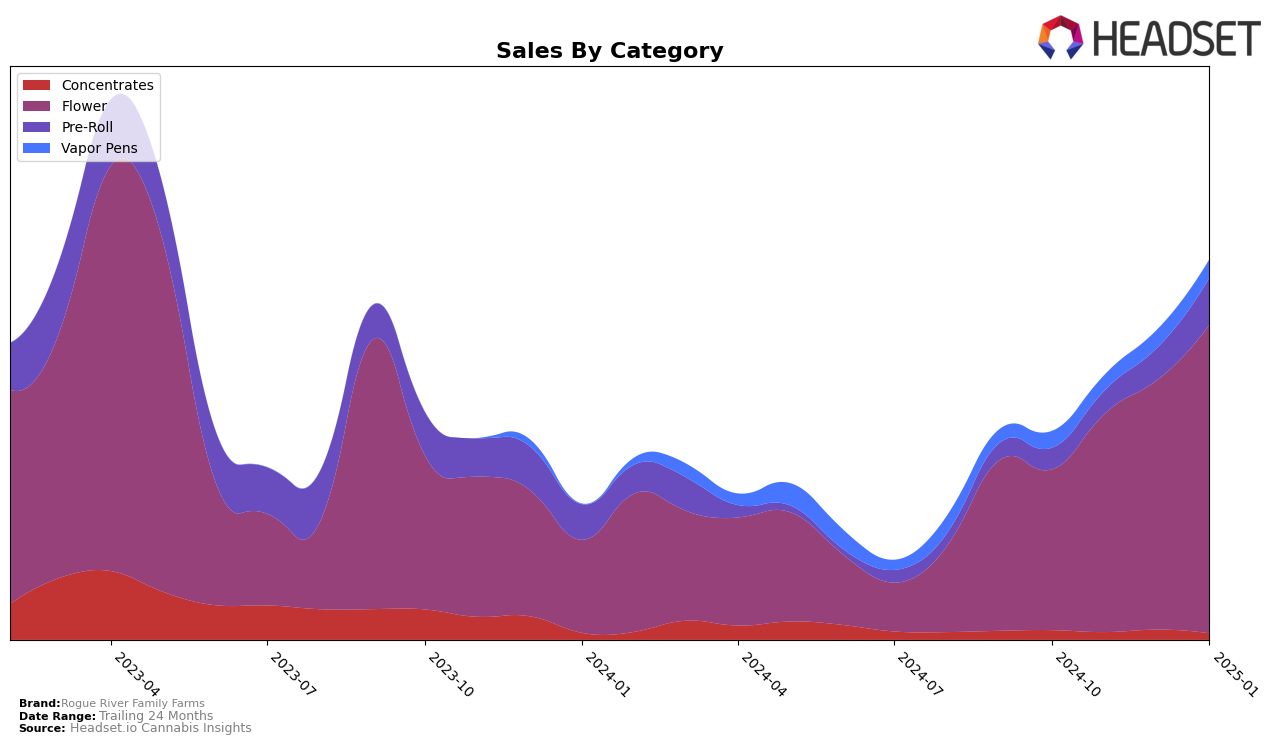

Rogue River Family Farms has shown a dynamic performance across various product categories in Oregon. Notably, their Flower category has experienced a significant upward trajectory, moving from 36th place in October 2024 to a remarkable 17th place by January 2025. This indicates a strong demand and growing consumer preference for their flower products. In contrast, the Concentrates category has seen inconsistent visibility, with the brand not making it into the top 30 rankings for November 2024 and January 2025, suggesting potential challenges in maintaining a competitive edge in this segment.

In the Pre-Roll category, Rogue River Family Farms has demonstrated steady progress, climbing from 78th position in October 2024 to 49th in January 2025. This improvement suggests a positive reception and increasing market penetration. Meanwhile, their performance in the Vapor Pens category has been relatively stable, with slight fluctuations in rankings, ending at 73rd place in January 2025. This consistency, albeit outside the top 30, indicates a steady but modest presence in this category. Overall, while some categories show promising growth, others highlight areas where the brand could focus on enhancing its market position.

Competitive Landscape

In the competitive landscape of Oregon's flower category, Rogue River Family Farms has shown a remarkable upward trajectory in recent months. Starting from a rank of 36 in October 2024, they have climbed to 17 by January 2025. This ascent is indicative of a strong growth trend, with sales increasing steadily over the same period. In contrast, The Heights Co. experienced fluctuating ranks, dropping to 30 in December 2024 before recovering slightly to 18 in January 2025, suggesting potential volatility in their market position. Meanwhile, Urban Canna maintained a relatively stable presence, although they slipped to 19 in January 2025. Bald Peak also demonstrated a significant improvement, moving from 35 in October to 16 in January, closely paralleling Rogue River Family Farms' progress. However, Kaprikorn, despite a drop to 15 in January, consistently outperformed in sales, highlighting their strong market presence. These dynamics suggest that Rogue River Family Farms is effectively capitalizing on market opportunities, positioning itself as a rising competitor in Oregon's flower sector.

Notable Products

In January 2025, Mule Fuel Pre-Roll (1g) emerged as the top-performing product for Rogue River Family Farms, achieving the number one rank with sales of 4983 units. Cherry Koff Dropz Pre-Roll (1g) followed closely in second place, showing a significant rise from its previous fifth rank in November 2024 and no ranking in December. Modified Grapes Pre-Roll (1g) climbed to third place, up from fifth in December 2024, indicating a growing popularity. Jungle Juice Pre-Roll (1g), which held the top spot in December, dropped to fourth position in January, reflecting a decrease in its sales momentum. Frosted Flakes Pre-Roll (1g) entered the rankings at fifth place, suggesting a new interest among consumers for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.