Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

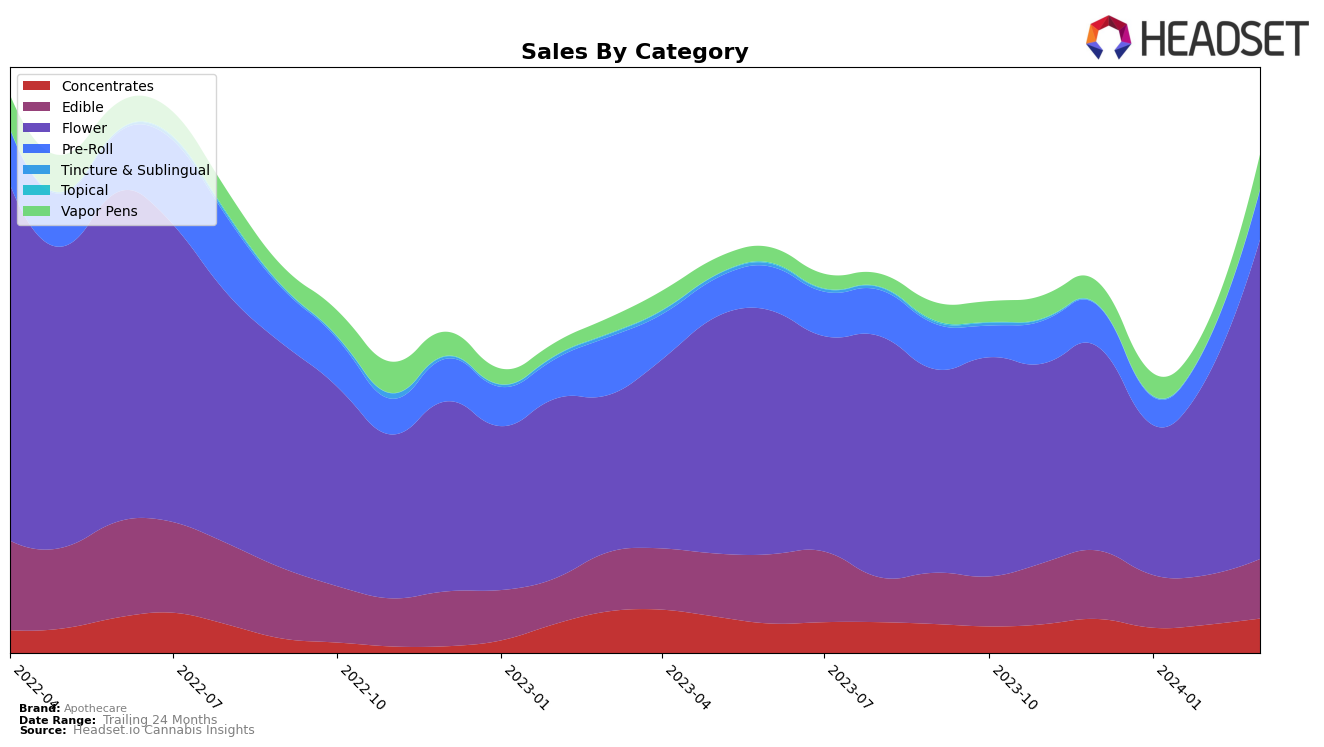

In Michigan, Apothecare has shown a diverse presence across multiple cannabis product categories, indicating a broad market strategy. Particularly noteworthy is their performance in the Flower category, where they made a significant leap from a ranking of 74 in January 2024 to 38 in March 2024, suggesting a strong recovery and growing consumer preference. This movement is underscored by a substantial increase in sales from 338,359 in January to 721,402 in March. Conversely, the brand has struggled to maintain a consistent ranking in the Pre-Roll category, with rankings fluctuating and ending at 73 in March 2024, which although is an improvement from January's 94th rank, indicates room for growth and stabilization. The Tincture & Sublingual category shows a steady performance with a slight improvement, moving from 22nd rank in December 2023 to 18th in March 2024, hinting at a solid niche market presence.

Despite the fluctuations in certain categories, Apothecare's overall trajectory in Michigan seems positive, with notable improvements in rankings and sales in key categories such as Flower and Tincture & Sublingual. However, the brand's performance in the Vapor Pens category illustrates a challenge, with rankings dipping as low as 96 in February 2024 before slightly recovering to 83 in March 2024. This volatility suggests a competitive market segment where Apothecare is struggling to hold its ground. The absence of Apothecare in the Topicals category rankings after December 2023 also raises questions about its performance or strategic focus in this segment. As the brand navigates Michigan's dynamic market, these insights into category performance and state rankings offer a glimpse into Apothecare's strengths and areas for potential growth.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Michigan, Apothecare has shown a notable improvement in its ranking over the recent months, moving from 58th in December 2023 to 38th by March 2024. This upward trajectory in rank is mirrored by a significant increase in sales, suggesting a growing consumer preference or expanded distribution. Competitors such as Cloud Cover (C3) and Redbud Roots have experienced fluctuations in their rankings, with Cloud Cover seeing a decline from 24th to 43rd and Redbud Roots moving from 25th to 41st in the same period. Notably, Rkive Cannabis and Glorious Cannabis Co. have also seen changes, with Rkive climbing to 33rd and Glorious slightly decreasing to 34th by March 2024. These movements highlight the dynamic nature of the market and the importance of maintaining quality and consumer engagement to stay competitive. Apothecare's recent performance, particularly its sales growth and improved ranking, positions it as a brand on the rise amidst stiff competition in the Michigan cannabis flower market.

Notable Products

In March 2024, Apothecare's top-selling product was the Certified Organic - Lemon Alderaan Pre-Roll (1g) from the Pre-Roll category, securing the first rank with sales reaching 2210 units. Following closely was the CBD/THC/CBN 2:2:1 Zen Berry Gummies 20-Pack (200mg CBD, 200mg THC, 100mg CBN) from the Edible category, which held the second position, a slight drop from its previous top positions in January and February. The Lemon Alderaan (3.5g) from the Flower category made an impressive debut in March, landing directly in the third rank with sales figures of 1819 units. The THC:THCV 10:3 Citrus Lift Gummies 20-Pack (200mg THC, 60mg THCV), also an Edible, fell to the fourth rank after previously holding higher positions in the earlier months. This shift in rankings and the entry of new products in March highlight dynamic consumer preferences and the competitive nature of Apothecare's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.