Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

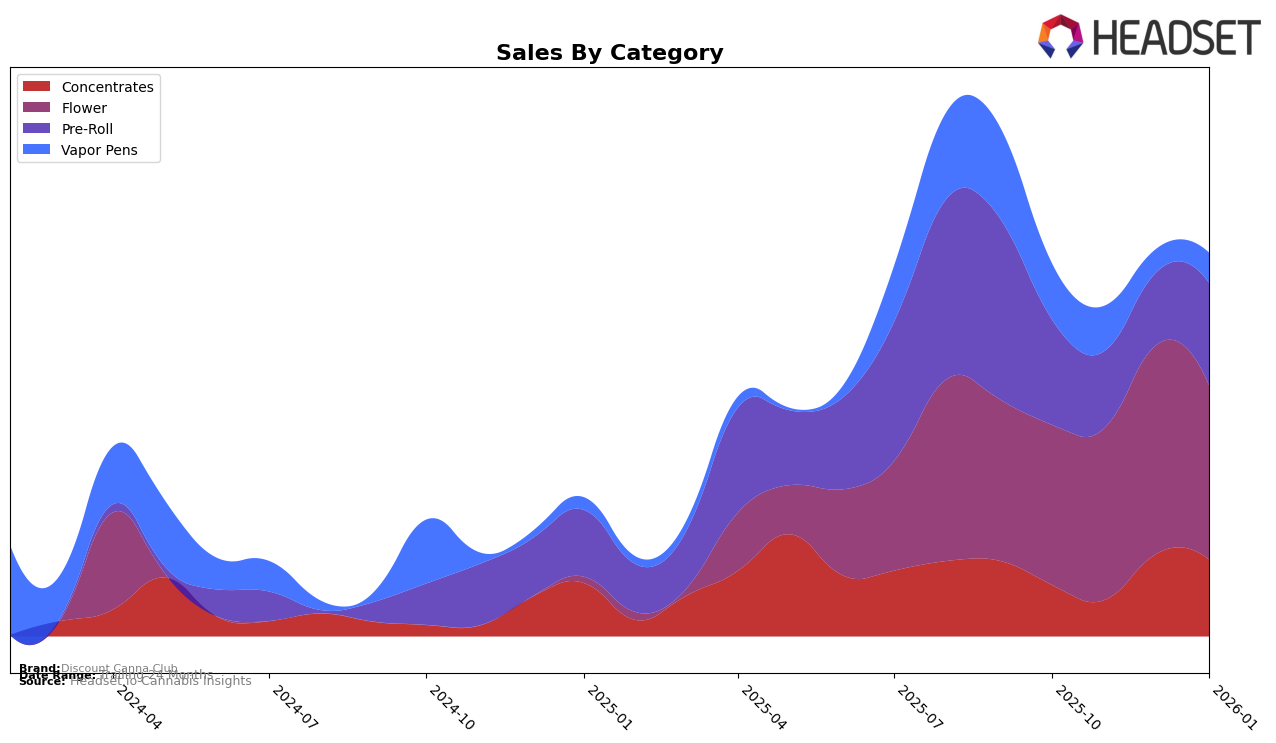

Discount Canna Club has shown varying performance across different product categories in Massachusetts. In the Concentrates category, the brand saw a significant improvement in its ranking, moving from 41st in November 2025 to 24th in December 2025, before slightly declining to 26th by January 2026. This upward trend in December was accompanied by a notable increase in sales, highlighting a successful period for the brand in this category. However, in the Flower category, Discount Canna Club struggled to break into the top 90 rankings, indicating a potential area where the brand could focus on improving its market presence. The Pre-Roll category saw the brand enter the rankings at 92nd in January 2026, suggesting a new or renewed interest in this product line.

In the Vapor Pens category, Discount Canna Club's performance was inconsistent, with rankings fluctuating from 88th in October 2025 to 95th in January 2026. This variability might suggest challenges in maintaining a stable market position or changes in consumer preferences. The absence of a ranking in December 2025 indicates that the brand did not make it into the top 30, which could be a point of concern for maintaining competitiveness in this category. Overall, while Discount Canna Club exhibits strengths in certain areas like Concentrates, there are clear opportunities for growth and increased market penetration in others, particularly in Flower and Vapor Pens.

Competitive Landscape

In the Massachusetts flower category, Discount Canna Club has shown a fluctuating yet promising trajectory in recent months. While it was not ranked in the top 20 brands in October 2025, it made a notable entry at rank 93 in November and maintained a relatively stable position through January 2026, ending at rank 95. This upward movement suggests a growing presence in the market, despite facing stiff competition. For instance, Natural Selections and Anthologie have experienced a decline in sales over the same period, with Natural Selections dropping from rank 79 to 86, and Anthologie falling from 67 to 88. Meanwhile, Kynd Cannabis Company and Simpler Daze have also shown volatility, with Kynd Cannabis Company not maintaining a consistent rank past November. This competitive landscape indicates that Discount Canna Club is gaining traction, potentially capitalizing on the challenges faced by its competitors, and positioning itself as a brand to watch in the Massachusetts flower market.

Notable Products

In January 2026, the top-performing product for Discount Canna Club was Frosted Sugar Plum Diamond Infused Pre-Roll 2-Pack (1g), which climbed to the number one rank with sales reaching 512 units. Huckleberry Haze Diamond Infused Pre-Roll 2-Pack (1g) secured the second spot, followed by Durban Poison Diamond Infused Pre-Roll 2-Pack (1g) in third place. SFV OG Diamond Infused Pre-Roll 2-Pack (1g) and Limoncello Diamond Infused Pre-Roll 2-Pack (1g) took the fourth and fifth positions, respectively. Notably, Frosted Sugar Plum experienced a significant rise from fourth place in December 2025, highlighting its growing popularity. This shift in rankings suggests a strong consumer preference for Frosted Sugar Plum, possibly due to its unique flavor profile or promotional efforts.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.