Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

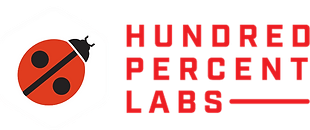

Hundred Percent Labs has shown a mixed performance across different product categories in Ohio. In the Concentrates category, the brand maintained a strong presence, ranking consistently within the top 6 throughout the last quarter of 2025. Notably, their sales in this category have shown a steady upward trend, reflecting a positive reception among consumers. In contrast, their performance in the Edible category was less impressive, as they did not make it into the top 30 brands in recent months, indicating a potential area for improvement. The Pre-Roll category saw a positive trajectory, with Hundred Percent Labs improving its rank from 19th to 18th in December, alongside a noticeable increase in sales, suggesting growing consumer interest.

On the other hand, the Flower and Vapor Pens categories presented challenges for Hundred Percent Labs in Ohio. In the Flower category, the brand struggled to break into the top 60, with rankings hovering in the mid-60s, which could indicate strong competition or a need for more targeted marketing strategies. The Vapor Pens category showed a declining trend, with the brand's rank dropping from 41st in September to 59th in December, accompanied by a notable decrease in sales. This decline suggests potential issues in either product appeal or market dynamics that may require strategic adjustments. Overall, while the brand has seen successes in certain areas, there are clear opportunities for growth and improvement in others.

Competitive Landscape

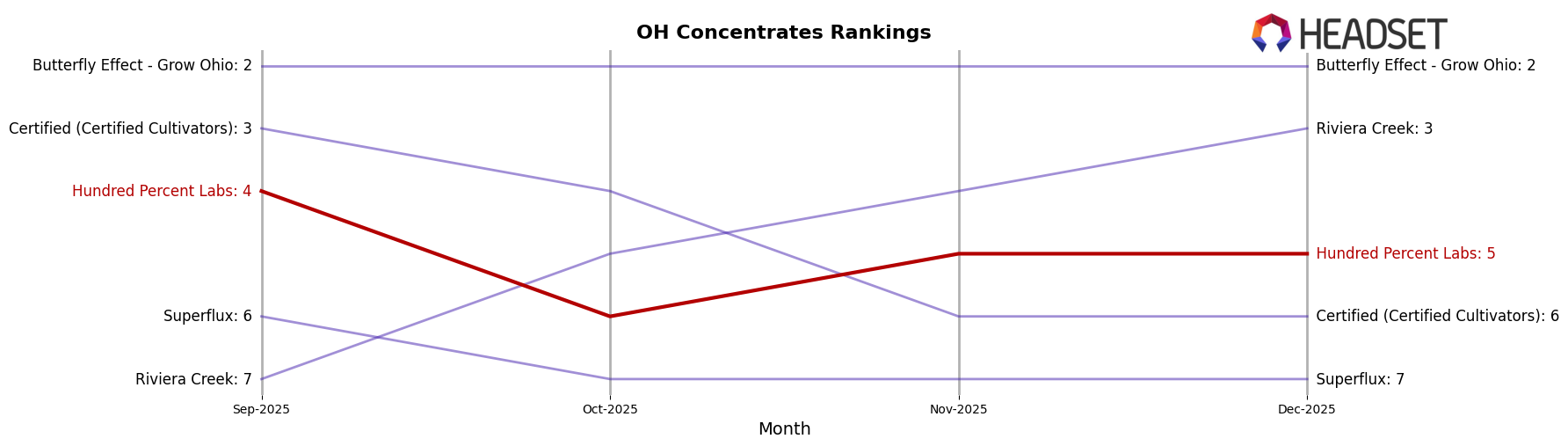

In the Ohio concentrates market, Hundred Percent Labs has experienced a dynamic competitive landscape over the last few months, impacting its rank and sales performance. Starting in September 2025, Hundred Percent Labs was ranked 4th but saw a drop to 6th in October. Despite this, the brand managed to climb back to 5th place by November and maintained this position through December. This fluctuation is notable as it reflects the brand's resilience amidst strong competition. For instance, Riviera Creek showed a remarkable upward trajectory, moving from 7th in September to 3rd by December, indicating a significant gain in market share. Meanwhile, Butterfly Effect - Grow Ohio consistently held the 2nd position, showcasing its stable dominance in the market. Certified (Certified Cultivators) experienced a decline, dropping from 3rd in September to 6th by November, which may have opened opportunities for Hundred Percent Labs to regain its footing. These shifts suggest that while Hundred Percent Labs faces robust competition, particularly from brands like Riviera Creek, its ability to recover rank indicates potential for growth and adaptation in the evolving Ohio concentrates market.

Notable Products

In December 2025, the top-performing product for Hundred Percent Labs was the Bananaconda Pre-Roll (1g) in the Pre-Roll category, which rose to the first position with sales reaching 855 units. Skunky Jack Shatter (1g) in the Concentrates category secured the second rank, marking its first appearance in the rankings. Frosted Kush Pre-Roll (1g) followed closely in third place, also making its debut in the rankings. Notably, Alaskan Thunder Fuck Shatter (1g) maintained a consistent presence at fifth place, showing a slight increase in sales from previous months. The Blue Blast Crumble (1g) also entered the rankings in fourth place, highlighting a strong performance in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.