Nov-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

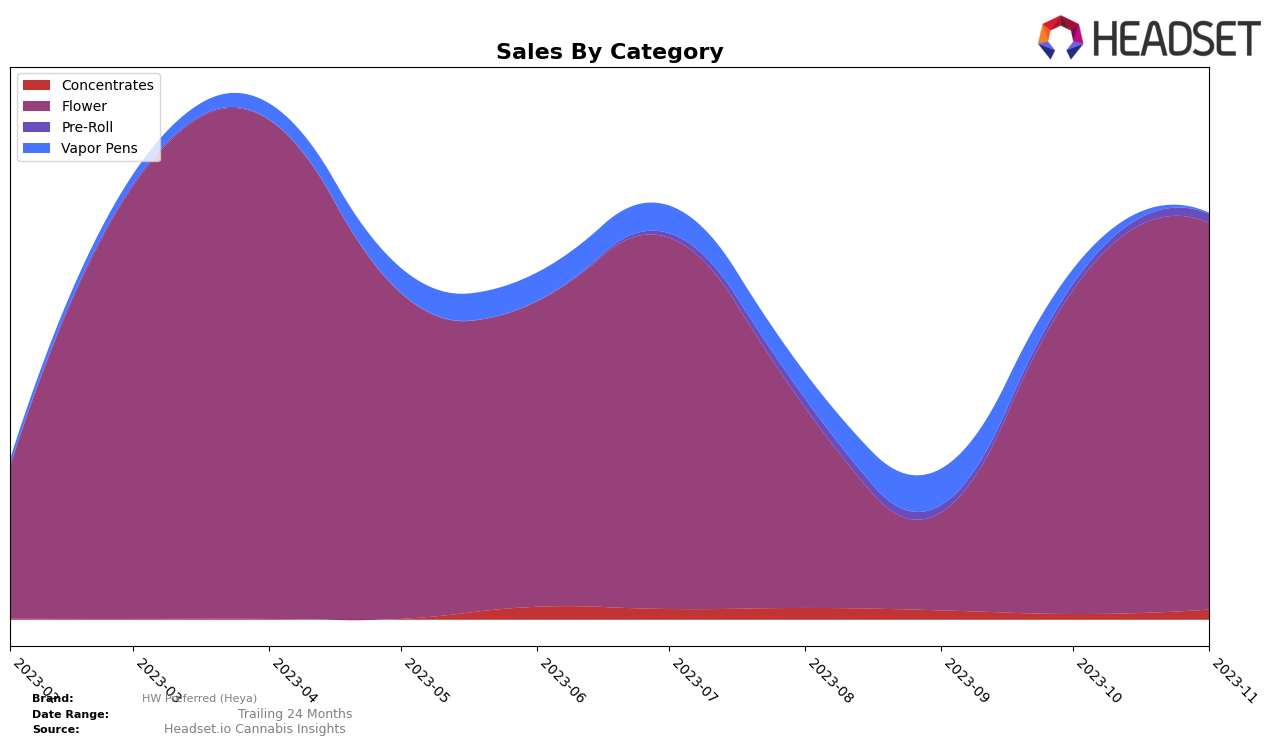

Looking at the performance of HW Preferred (Heya) in the Missouri market, we see some interesting trends across categories. In the Concentrates category, the brand's rank has been fluctuating in the 40s range from August to November 2023, indicating a somewhat stable performance. However, it's worth noting the sharp drop in sales from August to October, followed by a rebound in November. In the Flower category, HW Preferred (Heya) has made significant strides, moving from rank 34 in August to rank 20 in November, which is also reflected in the impressive increase in sales in this category.

On the other hand, the performance in the Pre-Roll category has been less encouraging. HW Preferred (Heya) has been consistently ranked in the 50s and 60s, and although there was a slight improvement in November, it was not enough to break into the top 50. The Vapor Pens category presents a more concerning picture, with the brand's rank falling drastically from 66 in October to 83 in November. This decline is mirrored in the sales figures, which saw a significant drop in the same period. These trends suggest areas where the brand could potentially focus its efforts for improvement.

Competitive Landscape

In the Flower category within the Missouri market, HW Preferred (Heya) has shown a notable upward trend in rank from August to November 2023, moving from outside the top 20 brands to the 20th position. This suggests a significant increase in market presence, despite a dip in September. In comparison, Cookies and In The Flow have also improved their ranks but remain outside the top 20. On the other hand, Robust and The Solid have seen a slight decrease in their ranks over the same period, but they remain within the top 20. It's worth noting that while HW Preferred (Heya) has seen a significant increase in sales from September to November, it still trails behind these competitors in terms of sales volume.

Notable Products

In November 2023, the top-performing product from HW Preferred (Heya) was Lemon Cherry Gelato (3.5g) in the Flower category, with sales reaching a remarkable 2068 units. Following closely, Katsu Bubba Kush (3.5g) and Mimosa (3.5g), also in the Flower category, ranked second and third, selling 2021 and 1909 units respectively. The fourth spot was secured by Duct Tape (3.5g), which had previously held the second position in August and September. Finally, Grease Monkey (28g) entered the top five for the first time in November, indicating a potential upward trend for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.