Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

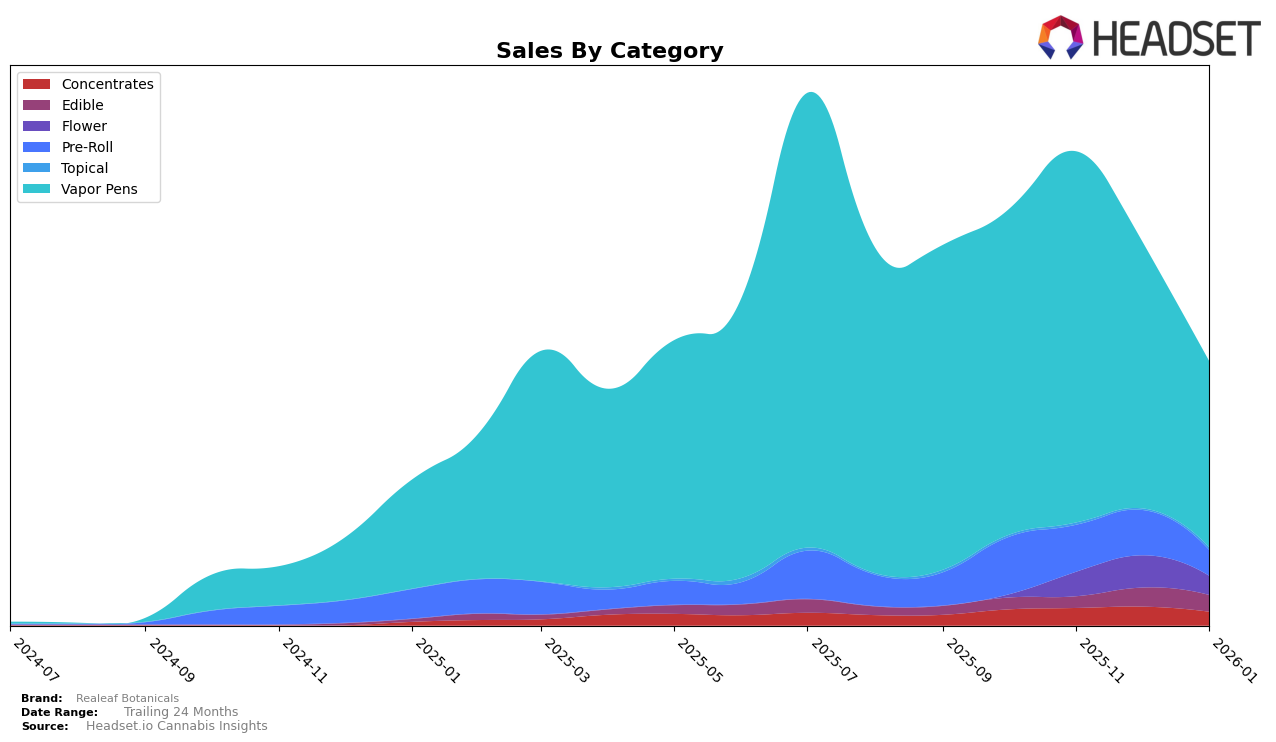

In the state of Illinois, Realeaf Botanicals has shown varying performance across different product categories. Their presence in the Concentrates category has been relatively stable, hovering around the mid-30s in rankings over the past few months. Despite this consistency, the brand has not managed to break into the top 30, indicating potential room for growth or a need for strategic adjustments. The Edible category shows a similar pattern, with rankings in the 50s, though a slight improvement was noted in December 2025. The Flower category is particularly noteworthy, as Realeaf Botanicals was not ranked in October 2025, suggesting a later entry or a significant sales push that helped them climb into the top 100 by November.

For Pre-Rolls, Realeaf Botanicals experienced a decline in rankings from October to January, moving from 46th to 56th, which might reflect increased competition or a shift in consumer preferences. The Vapor Pens category, however, presents a different story, as the brand consistently maintained a position within the top 30 through October and November before dropping to 32nd by January. This indicates a strong foothold in the category, despite a recent decline in sales. The sales figures for Vapor Pens, particularly in November, highlight a peak performance, making it a critical category for Realeaf Botanicals in Illinois. This mixed performance across categories underscores the dynamic nature of the cannabis market and the importance of strategic positioning for Realeaf Botanicals.

Competitive Landscape

In the competitive landscape of Vapor Pens in Illinois, Realeaf Botanicals has experienced notable fluctuations in rank and sales over the past few months. Starting strong in October 2025 with a rank of 23, Realeaf Botanicals climbed to 20 in November, showcasing a significant competitive edge. However, the brand's rank slipped to 28 in December and further to 32 in January 2026, indicating challenges in maintaining its position amidst competitors. Notably, Dabstract and Redbud Roots have shown consistent performance, with ranks hovering in the mid to high 20s, while Revolution Cannabis experienced a decline, mirroring Realeaf's downward trend. Meanwhile, Good Vibes has been on an upward trajectory, moving from rank 40 in October to 30 by January. These dynamics suggest that while Realeaf Botanicals initially captured a strong market share, sustaining growth amidst evolving consumer preferences and competitive pressures remains a challenge.

Notable Products

In January 2026, the top-performing product for Realeaf Botanicals was Skyy - Strawberry Fields Distillate Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales of 569 units. Following closely was the Mighty Rayne Drop - Watermelon Macro Gummy (100mg) from the Edible category, which held the second rank. Skyy - Super Lemon Haze Distillate Disposable (1g) took the third position, also in the Vapor Pens category. Notably, Skyy - Purple Urkle Distillate Cartridge (1g) and Skyy - Banana Candy Distillate Cartridge (1g) ranked fourth and fifth, respectively, both maintaining a strong presence in the Vapor Pens category. This lineup marks a new emergence for these products, as they were not ranked in the preceding months, indicating a significant rise in popularity and sales.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.